Oil industry battle: ‘New fracking technologies VS traditional extraction methods’

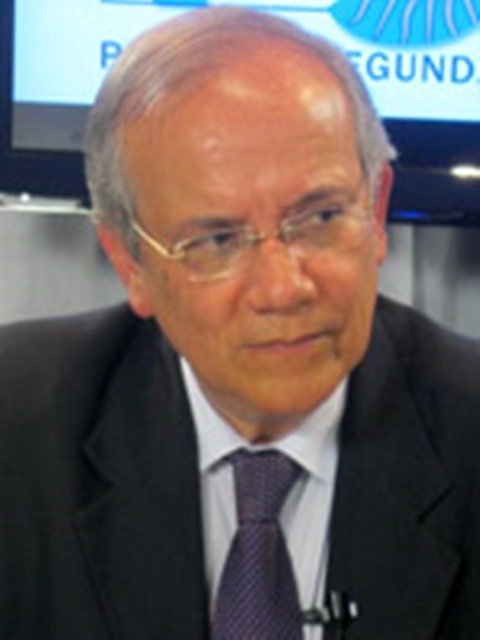

OPEC is not a monolithic organization and it fails to agree on common policy, so it’s unlikely that the upcoming Vienna meeting will become a deciding factor on oil prices, Adrian Salbuchi, International consultant, told RT.

The OPEC meeting will be take place in Vienna on November 27. Ahead of the gathering, a group of major oil exporters and OPEC members, Russia, Mexico, Venezuela, Saudi Arabia, held their own meeting. The countries together produce a third of the world’s oil.

RT:How much of a concern is the low crude price for the economies of oil exporters, like Russia and Venezuela?

Adrian Salbuchi: From the point of view of oil exporters it is definitely a concern but I think that we have to look beyond the merely economic factor of the actual price itself. I think that we are seeing the geopolitics of oil coming out in full swing. One the hand we have countries that are exporting oil from traditional extraction methods such as Saudi Arabia and the Middle East oil giants. And then you have the US which is working very strong on the new technologies involving fracking, which is much more expensive or substantially more expensive. But it does give the countries like the US much greater autonomy so they do not depend so much on foreign oil. So we are seeing two technologies within the oil industry fighting against each other, because fracking is only viable as long as oil prices are somewhere at the $80-90 per barrel region. If it falls too low it will be cheaper to import oil. So I think that we are having a bit of market supplying demands on the one hand, and we are also having the technology protectors on the other hand. And that is creating a bit of turmoil even within the countries themselves.

RT:Four major oil exporters met today in Vienna, but failed to agree on cuts in production. Do you think such a decision will be reached at the upcoming OPEC meeting, and will it be enough to hold this light in prices?

AS: One thing is - OPEC is not really a monolithic organization: its countries have varying interests, have varying histories; some of them don’t even talk to each other. I think we will be seeing that there is definitely an interest in reducing production so that prices will rise which is in the interest of countries like Venezuela, even Saudi Arabia or certain sectors within Saudi Arabia and Russia. But we also have to look…to the oil companies themselves. They also have their own interest in recirculating money to develop technologies, to develop new areas, to even support the militarization of oil. Let’s not forget that oil companies work very closely with the armed forces of NATO counties, the US notably and Britain. They buy oil routes, and oil fields have been militarized. Even in the South Atlantic. I’m speaking right now from Argentina. And there definitely is an ongoing militarization of oil reserves, in the Falkland Islands for example down in the South Atlantic, and even Brazil. So we have to put all these factors: geopolitical, economic, public, and private on the scale to understand why some people, some countries, some interests want oil prices to rise and others want them to continue falling. Especially those that want them to continue falling is to stop the fracking industry which is going full-fledged in America and would strengthen America. I think it will be a very complex situation where I do not believe that OPEC will be the deciding factor because they cannot agree on a common policy. But it will be very interesting to see what does happen at Vienna’s meeting because it will give us an indication where things are going, and it has a lot to do with keeping an eye on the oil companies themselves or oil suppliers like Halliburton, for example, and not just on the countries themselves.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.