‘Only way to increase oil prices - reduce production’

Future oil prices depend on increased demand from the Asian economies and whether or not OPEC decides to reduce supply, says Ed Hirs from the independent oil and gas company Hillhouse Resources.

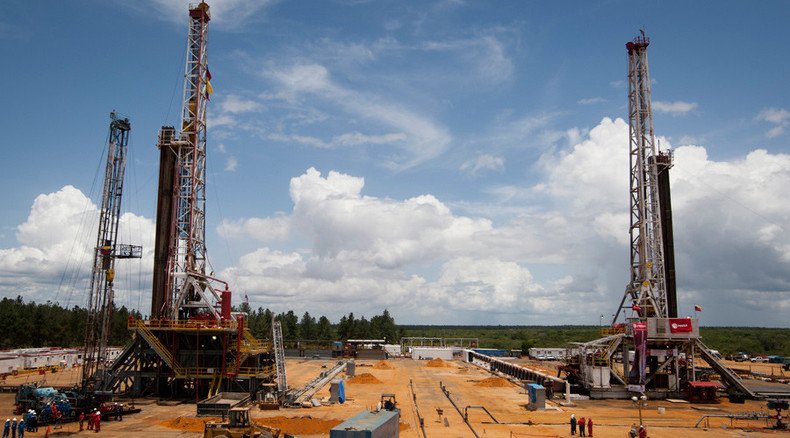

Ecuador is the first OPEC country which has been forced to sell crude for less than the cost of production. On average it costs the country $39 to extract one barrel of oil while its market price has now plummeted to $30. The situation has prompted several OPEC countries to urge Saudi Arabia - the de-facto leader of the oil exporters’ bloc - to hold an emergency meeting.

RT: Why is OPEC refusing to cut oil exports if major sellers are taking a hit?

Ed Hirs: This has been the case with OPEC since the fall when OPEC made the decision to maintain production and increase production. This is very difficult for some of the members that have very high lifting cost such as Ecuador. And Ecuador is not alone in this; other countries are using their foreign reserves at a rapid rate. In fact Saudi Arabia is using its foreign reserves at a pace of about five percent very two months, meaning if they are able to continue they will be out of foreign reserves within two years.

RT: There also social ramifications here, aren’t there? There is also a lot of disquiet in Venezuela. How much are OPEC states ready to sacrifice then?

EH: That’s absolutely right. But the challenge is they are not large enough to enforce a change across OPEC, it’s a matter of collective action by the organization itself. They all have to combine together and work together to come to a solution either to reduce production or they can continue in this way and keep production levels high and maintain a low price. It’s still a 94 million barrel a day market just as it was last year. But instead of it being worth nine billion dollars a day it’s now worth about 3.5 billion dollars a day.

RT: Is there a danger that OPEC might lose members here?

EH: It won’t change the outcome. If they leave OPEC - what are their alternatives? The only way to increase oil prices - to reduce production. …Leaving OPEC and increasing production is not an option for Ecuador or any of the other small players in the organization. If they stay within OPEC or if they leave - the only solution at the moment until demand picks up is to cut production.

RT: And from Saudi Arabia’s point of view, how much sway could they have, how sympathetic will they be to Ecuador’s or Venezuela’s concerns?

EH: I don’t know. When OPEC works collectively together they have great relations, but there has been a history since OPEC was founded in 1960 of individual member countries pursuing their own interest apart from the mutual interest they have in OPEC.

RT: Do you think we will see countries deciding to cut production on their own?

EH: Certainly there could be a unilateral move by one of the producers within OPEC to just cut production, but that can also happen let’s say from Russia. It is happening in the US shale space, production is beginning to tail off in shale. These are the high cost producers of oil across the world and so we would expect these wells to be shut and new drilling activity reduced. And that’s what we are seeing here in the US.

RT: What is going to happen with the oil prices in the future?

EH: It really depends on an increase in demand coming from the Asian economies and whether or not OPEC decides to reduce supply. That’s what is facing the world for the next 12 to 18 months. Any reduction in supply that’s substantial, say a million barrels a day, and prices will begin to rebound very quickly.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.