The real black box: American Airlines share buybacks are a scam to enrich execs – and the Covid-19 bailouts will fuel more of them

To anyone doubting the Covid-19 bailouts will line executives’ pockets, American Airlines CEO Doug Parker says he’ll “find a way around” the rules against it. This after making $150 million while AAL’s stock plummeted 70%.

Stock buybacks are the ultimate vehicle of self-enrichment. Consider the following as a ‘case study’ of Wall Street’s legal fraud. Under CEO Doug Parker’s leadership from 2013-2020, American Airlines (AAL) has seen its stock plummet 70%. When one looks at Parker's pay awarded vs the company’s three-year average economic profits, his pay-for-performance metrics are abominable. The media worships Parker for his stewardship of AAL during this crisis and reports that, for the past three years, Parker’s salary and bonus were zero.

However, they fail to mention that AAL's legal Ponzi stock-buyback scheme saw Parker's 2016-2018 take-home pay rocket to $70.2 million. (According to the Financial Times, Parker’s total award from selling stock since 2013 is $150 million). It’s not bad for Parker, but it’s horrendous for AAL employees, shareholders and American taxpayers who will be stuffed with a $20 billion bailout. Fair? Not on your life.

Debt-fuelled stock buybacks and dividend payments are engineered to artificially increase stock prices so that self-interested CEOs like Parker can “earn” higher compensation. Increasing debt creates an illusion of better earnings. However, buybacks cannibalize corporate balance sheets, leaving taxpayers exposed to unlimited “bailouts” when these leveraged bets go wrong.

What’s the difference between rogue hedge fund managers and airline CEOs? Not much, except some airline CEOs have been given golden parachutes to the tune of nearly $17.5 million.

So who is enabling these CEOs to line their pockets with taxpayer money?

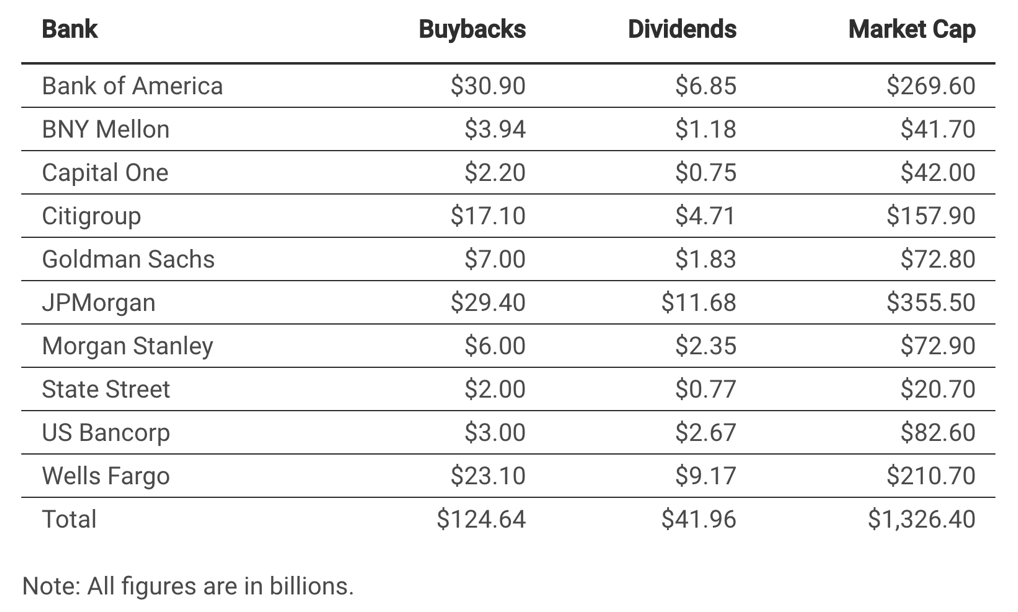

Last summer, the US Federal Reserve released the results of its annual Comprehensive Capital Analysis and Review (CCAR). The CCAR is a bank stress test, which all the banks passed, and after passing the stress test, the Federal Reserve approved $125 billion in share buybacks!

Yet, even though the banks all passed the stress test, the Financial Times recently reported that the president and chief executive of the Federal Reserve Bank of Minneapolis (who oversaw TARP during the GFC of 2008) is recommending big US banks raise $200 billion in capital now to act as a buffer against economic shock from the “coronavirus pandemic.” This is a bit like putting on your seatbelt after your airbag has already deployed.

The Federal Reserve's legislated dual mandate is price stability and full employment. But last week, the Fed manipulated interest rates by buying back bonds, permanently destroying the capital market's ability to function and surrendering every pretence that markets are fair and that the United States is a democracy.

It is completely contrary to the mandate of the Fed to implement policies that not only create record-high wealth inequality but also enable record-high amounts of corporate debt and risky leveraged loans (used for stock buybacks). These policies wildly distort valuations by inflating temporary bubbles in the stock, bond, property and credit markets. They also destroy every market’s natural ‘price discovery’ mechanism, enable Wall Street to conspire with Washington to commit the biggest corporate plunder in history, and turn a blind eye to a grand Ponzi scheme that will destroy the myth of capitalism.

The Fed’s perverse policies have enabled Wall Street fraud and created an oligarchy to serve oligarchs. It is clear that Congress should close the Federal Reserve and investigate the use of leverage for share buybacks.

During the past decade, Bloomberg reported that US airlines spent 96 percent of their free cash flow buying back shares. American Airlines was the leader, squandering at least $12.5 billion on share repurchases. Despite having negative cumulative free cash flow during the decade, AAL engaged in high-risk, balance-sheet-weakening buybacks. If this money had not been wasted on share buybacks, earnings would be much lower – but so would AAL’s debt.

However, rather than building capital buffers and paying off debt to ensure a strong balance sheet, the airline industry leveraged up, knowing that governments would bail out their fiscal profligacy. The executives made millions and laughed all the way to the bank, leaving taxpayers on the hook.

Unfortunately, this is nothing new.

Remember the 2008 bailouts? When Citibank exploded, kicking off the Great Financial Crisis, and needed trillions in bailouts? At Citi's helm was Bill Clinton's ex-Treasury Secretary Robert Rubin. Rubin denied having any knowledge of the bank's “risks” while “running the bank,” claiming he had “no idea what was going on.” Rubin resigned in shame but kept around $150 million for “running Citibank.”

Which brings us back to Doug Parker and his recent interview with CNBC, during which he came out with a line at which nobody so much as blinked.

Interviewer: “Doug, they say that beggars can’t be choosers, but restrictions on buybacks, dividends, executive comp, government warrants… do you see those as limiting your flexibility operationally, financially in the year to come?”

Doug Parker: “There are conditions we are happy to accept. If you find yourself in need of government assistance, I think it’s fair to say that until you’ve paid off the loans, for example if you choose to take loans that you don’t have stock buybacks, you don’t do dividends, that the money doesn’t flow to your executives, so that you have restrictions on executive compensation – we’re going to need to figure out ways around those. But those were fair things we were asked to do, but we are certainly not complaining about them.”

Here’s that bit on video – priceless!

Is it possible that a CEO like AAL’s Doug Parker, who receives 100% of his take-home pay in the form of equity through the sale of his shares of his own company, would not have a conflict of interest? Many would say that avoidance of a conflict is highly unlikely, if not impossible. The miracle of the stock market earnings-per-share growth over the past decade was driven, in no small degree, by extreme greed, conflicts of interest and trillions of dollars in corporate stock buybacks.

What is the solution? End the Federal Reserve, prohibit all share buybacks, do not bail out these companies and audit the fiduciary abuse of executives like Doug Parker and hold them responsible. If you are a CEO and your bank, airline or company needs a rescue, 95% of your take-home pay over the past ten years should be clawed back. In Parker's case, he would still likely have over $7.5 million after the clawback. Who couldn't live off $7.5 million? The time has come to put an end to all stock buybacks and bailouts. Will Congress ever take their hands out of their cash-filled pockets and wake up?

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.