Plebs pay 37% on credit card debt as elites enjoy a Covid-19 payday

As the Covid-19 pandemic destroys incomes, the middle class is forced to pay exorbitant credit card rates. How much longer are the debt-serfs willing to get fleeced by bankers and politicians brain-frozen on designer ice cream?

The repeated rinsing of taxpayers has hollowed out the UK and US middle class, and continued polarization will surely end in civil unrest.

Covid-19 has revealed how 30 years of neoliberal politics by the ruling elite have failed. This global pandemic, which has killed nearly 200,000 people and infected more than 2.5 million, has set off a chain reaction causing simultaneous worldwide supply-and-demand shock waves.

And what are the UK and the US governments doing to help ordinary folk during this crisis?

Not much.

Also on rt.com ‘Open the economy – I need to feed my family!’ Will lockdown fatigue spiral into destructive mass protests?While too-big-to-fails, airlines and other institutions with a history of abusive and reckless governance receive taxpayer-subsidized bailouts, low-interest rate loans and/or zero-interest rate loans, ordinary people are forced to pay an exorbitant amount to borrow money on a credit card.

For example, RBS’s Reward Black card charges average customers an annual fee of £84 and a whopping 37.1 percent APR. Sir Richard Branson’s Virgin-branded Money balance-transfer card charges 27.9 percent APR after 24 months.

And what could be worse than this?

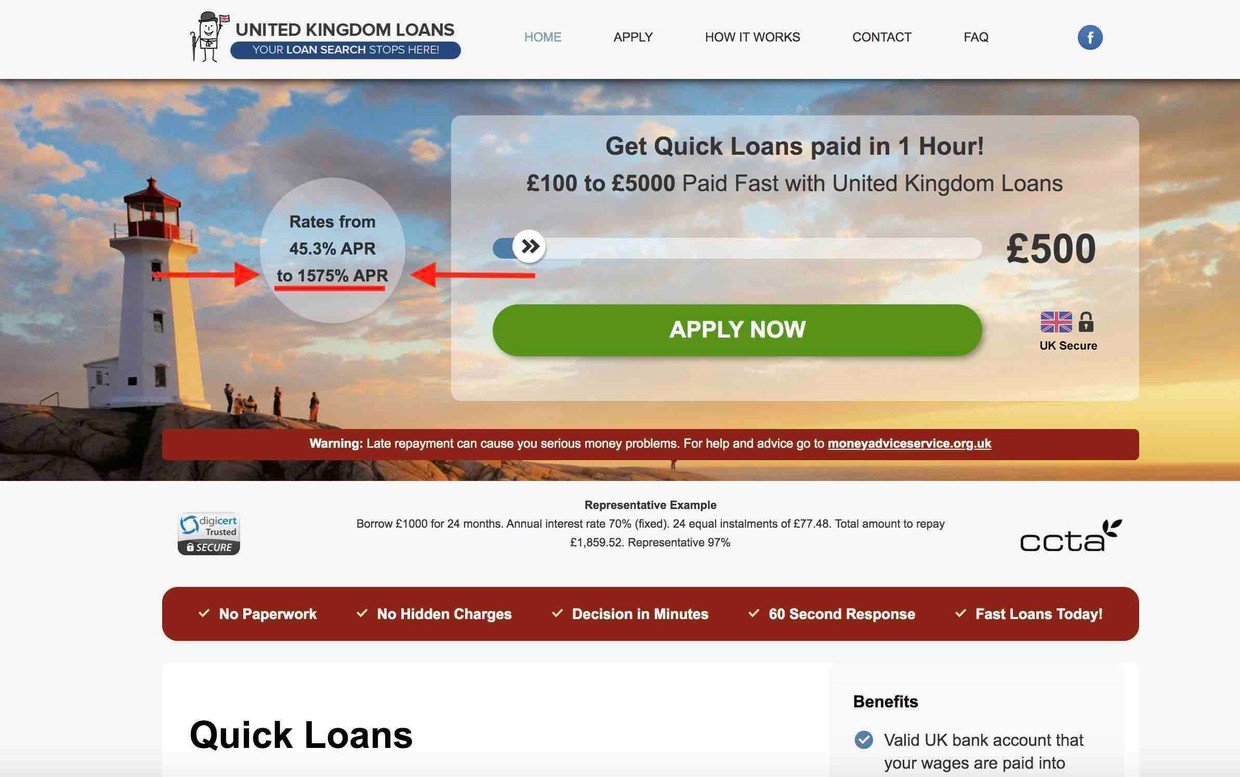

Allowing money lenders to prey on society’s most vulnerable. In the midst of record unemployment, money lenders are charging 1,575 percent APR or more on short-term high-cost loans.

It seems the changes made by the Financial Conduct Authority (FCA) in 2015, as well as the enforcement of those changes, are pathetically inadequate. If this government wants to create jobs, it should create a department to manage loans for those who need them the most.

Boris Johnson? Rishi Sunak? The next Tory PM? Can any of you hear me? The UK government must ban usury, and ban it now!

Bailouts for billionaires, buybacks and bankers

In recession after recession, the Federal Reserve, the European Central Bank and the Bank of England continue to bail out banks and institutions that made reckless lending decisions. And knowing that the central banks will be there to catch them, these institutions continue to behave recklessly.

Remember 2009? UK taxpayers were forced to bail out the Royal Bank of Scotland (RBS). RBS had been run by Fred ‘the Shred’ Goodwin, who oversaw foolhardy share buybacks and buyouts, was dubbed the “most arrogant man in the city of London” and was knighted in 2004 for “services to banking.” Although the Queen annulled his honours in 2012 as a result of this disaster, the Shred still departed a wealthy man after the credit crisis, while taxpayers lost billions, and remain on the hook for RBS. As of 2018, the ‘government’ – aka taxpayers – still owned 62 percent of RBS’s shares. Poor Shred.

Across the pond, American Airlines, under CEO Doug Parker, spent nearly US$13 billion on share buybacks instead of strengthening its balance sheet. Parker’s horrible corporate governance saw him pocket US$150 million. And yet, in 2020, the airline is seeking an estimated US$10 billion in taxpayer-backed bailouts (after already having received a US$4.1 billion grant and, last week, a low-interest rate loan of US$1.7 billion). Poor Doug.

Poverty, payday, pasta and politicians

And then there’s the speaker of the US House of Representatives, who is the poster child for tone-deaf politicians. Pelosi withheld billions of dollars of aid from small businesses across America and the CARES Act trillion-dollar bailouts she championed have not benefitted the masses below the poverty line.

But what does Pelosi care? While her constituents suffer – poverty, crime, homelessness, and unemployment levels have all skyrocketed in her Congressional district – Pelosi shows off the extensive designer ice-cream collection stored in her US$30,000 Sub-Zero refrigerator at her multi-million dollar mansion in one of Northern California’s fanciest gated communities.

But don’t worry, Pelosi still has her eyes on the prize – she is backing 0 percent interest loans and bailouts that will help billionaire donors and bankers.

Unfortunately, she seems to have forgotten about the average taxpayer. Pelosi’s policies allow Citibank’s American Airlines credit card to charge the same taxpayers who were forced to fund bailouts of both Citibank and American Airlines up to 30 percent APR.

Where are the bailouts for the average citizen, Nancy?

A US$1,200 one-off payment? Crumbs. Go back to your designer ice cream and vodka.

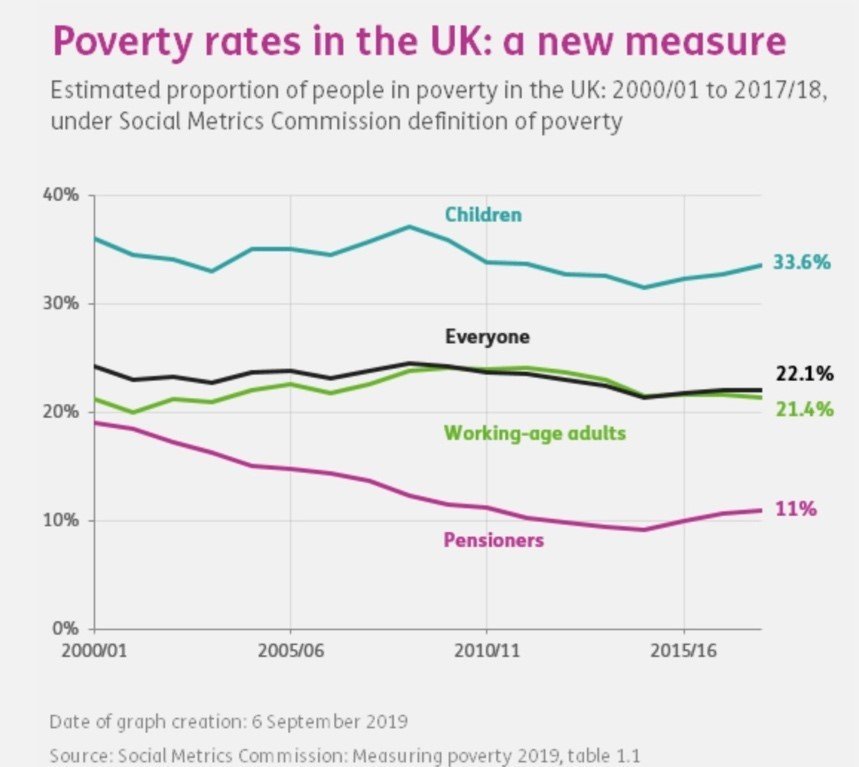

And it’s no different in the UK. The Bank of England, the Treasury and the politicians have done nothing to help bring down high poverty levels, which are estimated to impact 15 million people.

The UK is a developed nation and, in many ways, a model country that I’m proud to call my home. However, our government can and must get its priorities straight. Rather than using taxpayer funds to bail out banks run by scum like the Shred, politicians should strengthen the weak restrictions on payday-loan interest rates and actually enforce those restrictions. It is completely shameful that our government has done nothing to protect us from companies advertising loans charging interest of 1,575 percent APR to people who are struggling to feed their children and heat their homes. How is this allowed in 2020?

While Pelosi pigs out on her designer ice cream (as does the Shred, although he at least has the decency to do so in private), the poor souls in poverty eat 70p pasta and rack up insurmountable debt on their 1,575 percent payday loans. As the empire fades, one recalls the “let them eat cake” moment.

That comment did not work out very well for Marie Antoinette.

Like this story? Share it with a friend!

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.