American default already happened anyway

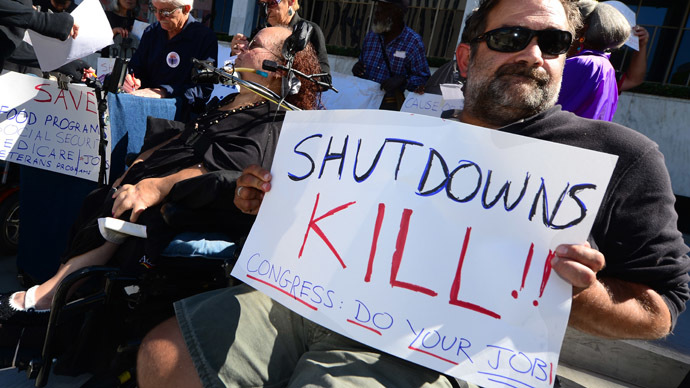

The US cannot afford to pay off its debt, and after weeks of government shutdown it has lost face, both domestically and globally. We are seeing the US defaulting both domestically and internationally, according to a group of experts interviewed by RT.

Americans rejoiced on Thursday as the Senate reached an

eleventh-hour compromise on raising the debt ceiling narrowly

averting a government default. However, a number of experts argue

that the country is already experiencing the beginning of one.

This sad forecast seems logical in the light of several factors

that include the dwindling public trust for the country and the

currency at home and abroad; the decline in foreign assets being

kept in US dollars; and America’s inability to pay off $17

trillion in debt, to name but a few reasons. One thing is for

sure – many have expressed a desire for the United States to

start living according to its means and get out of debt.

These facts consequently lead people on the international arena

to behave differently toward the United States and its currency.

This is something a panel of financial experts agreed on.

Lew Rockwell, chairman of the Ludwig von Mises Institute, said

the credit ceiling should not have been raised at all.

“I'd like to see a default, so that we have a balanced budget

that forces the government to live on its income and stop

borrowing. There's far too much borrowing by the American

government. Really everybody in the American society is too much

in debt. We need less debt, and if we want less debt the only way

we want to get these birds to do in Washington is just don't

raise the debt ceiling,” he told RT.

He argued that it’s “Keynesianism” to believe that

“more government, more spending, more debt perpetually”

are necessary to ensure everyone’s wealth. “No, it doesn’t. It

helps the banksters, it helps the government, the

military-industrial complex and all the big companies associated

with the government. It hurts the regular people, so we want an

end to the debt and… much less spending.”

“The US in fact has already defaulted, because it can’t give

back that money,” Chris Clarke, a hedge fund manager, told

RT. “We are all going to face the US default at some point in

future – in three months or in three years – but it's going to

come. If you have a heroin addict he has two choices, he can

either go through a lot of pain and sober up, or he can keel over

and die. All the US is doing is delaying the day when the pain

will come. If they don't stop pushing up the debt ceiling,

there'll be massively more pain in the future.”

While the experts disagreed on some points, they were united in

thinking that the US economy is well along the road to

defaulting. Richard Hainsworth, CEO of External Credit Ratings

Group, led the charge, saying that the dreaded default had

already happened. The US, while fulfilling its external

obligations, would not fulfill its obligations to its own

workers, Hainsworth said, adding that the US also defaulted when

“it set up certain programs that needed to be funded, and the

sequestration actually didn’t fund those laws.”

Ben Aris, editor-in-chief of Business New Europe, explained that

it doesn’t really matter what the current situation is called, as

the harm to the US’s economic stature has already been done.

“The money is a promise… itself valueless. But what America’s

done is it didn’t default insomuch as it’s going to pay its

bills. Nevertheless, it’s undermined that trust, that promise,

that they will pay… in the short term it costs nothing, because

they’re going to pay up, like they should do. But in the longer

term, they’re undermining their reputation of reliability – and

that’s going to hurt them.”

There is no enthusiasm that there will be any solution reached in

anytime soon, the experts agreed.

Clarke believes that the US will get back to the same stalemate

by February 7, the deadline by which the US will need to approve

its next hike in the debt ceiling. “The only difference will

be that the US debt will be bigger,” he said. “They'll

always get a deal; they’ll always keep kicking the can down the

road. The thing that will stop them is when people who buy US

government's debt will say ‘You know, we can see what's

going on here, we know what's going to happen,’ and they start

selling that government debt, then we'll have a problem.”

Curtis Ellis, executive director of American Jobs Alliance, told

RT: “We haven't been able to come up with a solution for two

years, so we are not going to see it in three months.”

Decline of ‘Brand America’

The fact remains that just over 60 percent of the world’s

currency exchange reserves are currently held in US dollars. But

the US debt stalemate has brought about forecasts that there’ll

be a move away from the dollar due to dwindling trust abroad.

Keith Boyfield, who is the research fellow for CBS, believes

there'll be a review of how countries worldwide hold their

assets. Larger investment will flow away from the US dollar into

other countries, namely into the UK, as investors increasingly

learn not to hold all their assets in one place. He also sees

gold and the commercial and residential sectors as prospective

targets for investment as they are a “hedge” against

uncertainty – “and markets hate uncertainty.”

“The world cannot depend on America anymore,” Francis Lun,

CEO of GEO Securities Limited, agreed.

In their panic the Chinese “are setting up currency swaps with

other countries, they’re looking for other assets in which they

can invest, they want to get rid of their dollars; they would

prefer to move to the euro,” Hainsworth told RT.

But the problem is that there's no other reserve currency except

US dollar, so the US is still in a better position, Celente said.

And so far China and other countries will be cornered with

trillions of dollars of US debt.

According to Lun, any harsh movement from the US dollar will

disrupt global markets, as at the moment there are not enough

alternatives to make it without catastrophic consequences.

However, he argues, it is time to diminish the meaning of US

dollar in global finances.

Parsons calls it the decline of “Brand America.” But in

terms of the de-Americanization that analysts seem to forecast,

he is not worried. This so-called process has been happening for

15 years, Parsons said. And while he believes that the process

“is taking place and will continue to take place,” the

next 20 years do not seem like such a bad deal for the US to stop

being majority holder of currency in the world.

Clarke said that the world was now going down the road along with

the US. “The US is not the only game in town here,” he

said.

“Japan is in an even worse situation. China is beginning to

put itself in the same situation. Europe is in that situation.

It's about time that somebody out there started to realize that

the economic model which has been the Western economic model for

the last 70 years is truly broken, and pursuing economic growth

and full employment at all costs is not a sustainable

[goal],” Clarke told RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.