‘Hard to make ends meet on Main Street? Some bureaucrat is eating your lunch’

The economic system managed by the US government is going to collapse, Euro Pacific Capital President Peter Schiff told RT. All of this is because of Washington’s ‘too big to fail’ policy, Schiff argues.

RT: It is the second-best year for the big banks, great for Wall Street, but is it great for the economy as a whole?

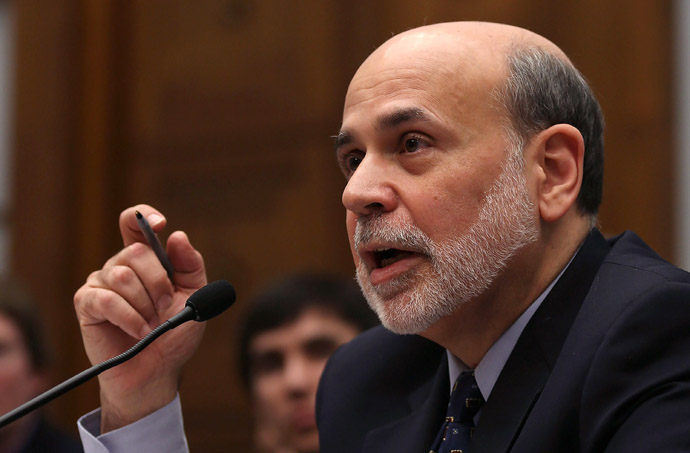

Peter Schiff: Well, it is good to be a banker, especially if you have Ben Bernanke at the Federal Reserve. The Fed’s policy is to try to revive the economy by inflating the markets. It is great if you are a banker, because you benefit on several fronts. The markets are more vibrant, so you can make more money speculating, but also it is cheaper to borrow and that is a lot of the source of this speculation. So the banks are doing really well under this environment but the US economy is not doing well at all. In fact, people think that there is a recovery going on. It is not. The economy is actually getting sicker as a result of the current Fed policy.

RT: The financial industry takes home a third of corporate profits. What does it mean for the average citizen? How dangerous is it for the economy to be in the hands of banks?

PS: It is very dangerous that the government,

through monetary and fiscal policy, is funneling such a large

percent of our resources into the financial sector. And it is not

just the financial sector, but look at government. It pays to be in

government. Look at the salaries of the bureaucrats and the

lobbyists in Washington, DC. So the bureaucrats and bankers are

thriving under this phony economy but the average American working

– or not working, because they can’t get jobs because the resources

necessary to employ them are in Washington, DC, and in New York

City – is not doing well.

And eventually this whole phony economy that the Fed has created is

going to come collapsing down, and in the long run the bankers are

going to lose money. Hopefully we won’t have another round of

bailouts, but in the meantime they are getting rich as the economy

suffers.

RT:$20 billion in bonuses at a time when the economy

is shrinking – how does that add up?

PS: It does not add up. And I think that Wall Street gain is

Main Street pain. And people think the economy is expanding. Look

we just got the GDP numbers, they revised the fourth quarter and it

showed a slight expansion, one-tenth of 1 percent, but that is only

because the government assumes that there is no inflation. They

want us to believe that inflation is around 1.5 percent. Inflation

in my opinion is at least five percent, and quite a bit more. But

even if inflation is only 3 percent, that means the US economy is

contracting, which makes a lot of sense to me.

The reason why it does not feel like a recovery for most people, is

because it is not, it is a recession. But it is certainly good

times for the banks and good times in Washington, DC, because that

is where our money is going. If you’re wondering why it is so hard

to make ends meet on Main Street, it’s because some bureaucrat is

eating your lunch.

RT:We reported yesterday how Massachusetts Senator

Elizabeth Warren grilled Ben Bernanke over the ‘too big to fail’

policy, pointing out that big banks get $83 billion a year in

taxpayer subsides, so could the big banks survive without taxpayers

pumping them up?

PS: Many of them would have already failed, but the answer

is no. But Ben Bernanke was not even honest with Senator Warren,

because he is not honest with anybody, but on that particular

issue, he was disingenuous at best. Because was she was talking

about that subsidy and it is hard to qualify exactly what it is,

but Ben Bernanke acted as if subsidy was there for the stockholders

and the banks. It is not. The subsidy makes it easier for the banks

to borrow money, it makes it easier for the banks to attract

depositors, who want to put their money in an institution that is

‘too big to fail.’

If you’ve got more money than the FDIC maximums, you want to make

sure you’re at the bank that is going to get bailed out, you don’t

want to take chances on the smaller bank. So that does give big

banks an unfair advantage to attract customers and borrow money.

And even if the banks fail, the depositors are still going to get

bailed out. The secure creditors are still going to get bailed out

and Ben Bernanke was oblivious to that. He focused on the

stockholders but it is not where the subsidy is most important. It

is attracting capital through lenders and through depositors and it

is an unfair advantage.

Personally, I keep a lot of my money at Bank of America even though

I believe they are too insolvent. And if it was not for this ‘too

big to fail,’ I would not have a dime of my money there. But now

the problem is that a much sounder, smaller institution does not

get my business and now if Bank of America potentially fails, the

taxpayers are going to have to bail me out, whereas if the

government would not have that guarantee, I’d never put my money in

harm’s way in the first place.

RT: The argument that you do hear, is that shutting down these banks would be disastrous for the economy and that big bonuses are justified?

PS: That was spoken like a banker. Of course it is going to be bad for the people involved. And yes, in the short run, we’re going to have to swallow our medicine, we’re going to have to admit to a lot of serious problems that right now we are papering over but it is not like what is good for Wall Street banks is good for America. That is not the case. Actually, what is good for the banks in the short run is actually quite bad for America, because we’re diverting resources that are badly needed in other parts of the economy and we’re sending them to Wall Street. What we need are more factories in this country, not more banks. We need to produce more, we need to export more. We need to save more, and unfortunately none of this is taking place.

RT:They are getting a third of the profits, but what are they producing, what are they contributing to the society? Is there any incentive to change the situation?

PS: The people in power, the people that are benefiting

from the status quo, they have no incentive to change it and

politicians, of course, don’t want to rock the boat. They do not

want to do anything that would bring out short term pain, even if

it produces long term gain. They are not in it for the country.

They are there to line their own pockets. They want to make as much

money for themselves. They want to get re-elected and if that means

they have to sacrifice the country in the process, well that is the

sacrifice they’re willing to make. I think the only thing that is

going to change this, is a crash, a crisis which is going to come

in the US currency and the US bonds market. We’re only going to

change, when we have no alternative when the circumstances force us

to change. Unfortunately by then, the problems would have gotten so

much bigger, and the pain associated with correcting them would be

so much greater.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.