Oil: Lubricating chaos around the world

The much-coveted viscous liquid remains volatile & highly susceptible to destructive blasts - but now oil's combustible properties could stretch to immolating whole governments.

While oil remains typically inert until sparked into life by our daily commute, on the macro scale the oil market has gained the power to inflict colossal damage.

Like all sophisticated markets it takes multiple factors to meaningfully affect the price of primary energy for the world’s 7.3 billion increasingly economically interconnected citizens. However, a perfect storm has now developed which can be rationalized easily in that old economic classroom staple: the supply & demand curve. That delightful old diagrammatical chestnut visualizes a simple theory: too much demand drives prices up while excess supply pushes prices down.

Oil has endured a giddy slide from $110 a barrel in June 2014 to $30 today. Panic is setting in. The root cause of the ‘perfect storm’ was partly driven by technology: fracking & shale have completely amended the supply dynamics (QV ‘peak oil’ - a beloved doomster term appears more distant than ever).

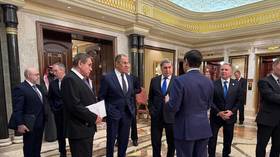

Kremlin orders stress tests with $25, $35 and $45 oil https://t.co/Q0YSX2gYTNpic.twitter.com/EZtIIJJ3UV

— RT (@RT_com) January 13, 2016Unfortunately, OPEC buried its head in the sand. The once dominant cartel hadn’t noticed their declining influence. It has been downhill ever since the 1970’s as alternative supplies emerged from Brent to Bakken, Athabaska, et al. The Saudis deployed the typewritten glam-rock-era OPEC playbook, intending to flood the oil market, thereby bankrupting the frackers.

But while Saudi Arabia has generated a glut, the pesky frackers have deployed their ingenuity to consistently lower their production costs. True, the number of US rigs is down (13 percent roughly year on year) but overall US production has pretty much doubled since 2010. Meanwhile Iraq, in a patch of quasi-normality, has doubled output. The Saudis stubborn determination to maintain market share is driving OPEC’s suicide strategy.

The only certain result is more volatility. In fact, $10 a barrel is now a possibility, but so is $500!

As all systems become chaotic, very big ramifications tend to occur. Thus the oil combustion now happening is likely to vastly exceed merely networking a cargo of barrels to a stick of dynamite. The Saudis, doubling down in pursuit of the lesser spotted American fracker, have pushed all their chips onto the table. Talk of an Aramco IPO, the (black gold) energy jewel in the Saudi crown is perhaps the closest to a direct threat to - or at least a shot across the bows of - Russia.

A publicly quoted Aramco could enable the Saudis to continue financing their regime longer than, arguably, Russia can survive. That said, Russia’s relatively nimble-footedness (150 million people across a vast landscape by definition makes ‘nimble’ tricky) means hardship, but perhaps not bankruptcy - so long as Russian stoicism remains. Meanwhile, Saudi Arabia is itself endangered by its gamble. The Eastern province is restive (hence the execution of Shia cleric Sheikh Nimr al-Nimr); a breakaway would render the House of Saud a government without a viable state.

Most acutely challenged by an Aramco IPO and the Saudi drill at all costs strategy, is Iran, already angered by the Al-Nimr execution. Should relations spiral out of control (not beyond the bounds of possibility), any form of Saudi-Iranian conflict inverts the oil equation once more - hence suggestions of $500 oil. Black gold, indeed...

Game of oil: Russia ready for fight with Saudi-dominated OPEC cartel – Energy Minister https://t.co/yQxUiYg7Alpic.twitter.com/jWe7udr5dl

— RT (@RT_com) October 24, 2015At that level many overstretched oil rich governments would return to surplus - Iran, amongst them - but the world economy would be crushed underfoot. Ceteris paribus, energy demand remains soggy. The US endures a weak rebound, strangled by President Obama’s destructive interventionism. The failed EU superstate remains incapable of growing without a reversal of its corporate socialism strangling progress. Given relative western stasis, China is catching a cold, reducing energy demand as its export markets remain soggy.

Low oil prices will break states. The already pallid Venezuela must abandon its Socialist shambles or risk feudalism. Even if Saudi Arabia scales production back, it is already politically exposed to significant internal dissent, levels last seen in the immediate aftermath of September 11, 2001. Brazil is stuttering while the Qatari government has shuttered the US Al Jazeera channel driven by budgetary restraint as gas prices tumble.

Northern Winter chills may be alleviated by the energy price collapse, but the realpolitik of the oil supply crisis is super-heating political instability.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.