Get Real: Petrodollars, not corruption is the reason for Brazilian coup

Dilma Rousseff’s impeachment was motivated by her efforts to circumvent US dollar dominance through trade with Iran, rather than the ongoing allegations of corruption, hypothesizes independent analyst Haneul Na’avi.

In ancient times, communities would place their sins on the body of an al-Azazel, or scapegoat, and cast it into the desert to die. This was done every year in order to garner favoritism in the eyes of God and ensure a bountiful harvest. In the same ritualistic fashion, Brazil’s acting government has chosen to honor this tradition at the expense of the consent of the governed.

Ousted President and Worker’s Party (PT) leader Dilma Rousseff awaits a fabricated impeachment trial despite the chagrin of the Chamber of Deputies Speaker Waldir Maranhao who ordered an annulment. A defiant Congress has hurled its entire weight at the gates of Brasilia’s Superior Courts with burnt offerings of her political career; with the hope her sacrifice will birth a neocolonial Dark Age. Hands clasped, they await the blessings of Chevron, Royal Dutch Shell, and the US State Department to affirm their convictions.

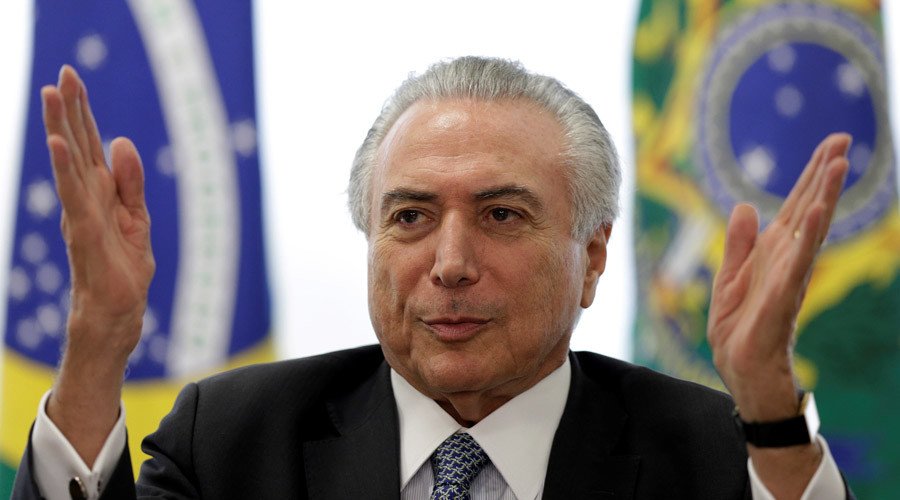

Brazilian Democratic Movement Party (PMDB) leader, coup initiator and interim president Michel Temer has longed to sell out Rousseff for his 30 pieces of silver, according to WikiLeaks, and despite the endless sins permeating Brazil’s legislative branch, the mainstream media has equated her financial mistakes to treason, completely obscuring the bigger picture. “Dilma Rousseff has not been accused of any financial impropriety. However, 318 members of the Brazilian Congress, including many who backed her impeachment, are under investigation or face charges,” Democracy Now highlights.

The undercurrents of the coup flow directly from Petrobras, Brazil’s state-owned oil enterprise, currently under fire after Operation Car Wash unearthed several massive corruption scandals in 2014, and multi-partisan thievery saw Rousseff inherit the company’s $130 billion debt. Fortunately, to protect the country’s national currency, the Brazilian real, Petrobras cleverly retained its debt in US dollars for easy convertibility into bonds, while maintaining revenue in reals. “[…] 80 percent of the company’s debts are dollar-denominated, but much of its revenue comes from domestic fuel sales in reals”, an Energy Fuse article stated.

Unfortunately, last year the dollar strengthened and fluctuated, which inflamed the nation’s debt burden. “Inflated by a stronger dollar, Petrobras' gross debt swelled to 799.25 billion reals [$223 billion] at the end of 2015 […] even as the company slashed investment spending and spent the last six months of the year trying - with limited success - to sell off assets,” MarketWatch states. A combination of weakening exchange rates, high global oil supply, and falling domestic demand, did little to stop Petrobras’s hemorrhaging revenues amidst the corruption scandal.

The swell in global supply was attributed to failed OPEC negotiations with Saudi Arabia, the cartel’s undisputed leader, after it childishly responded to North America’s “shale oil revolution” with a textbook oil glut that needlessly shrank global revenues to historic lows and threatened Petrobras’s limited 2.7 bpd upstream rates. With dwindling funds, the company was forced to sell assets to avert the onset of reverse Dutch disease. "If oil prices stay low, I'm not very hopeful,” Fabio Fuzette of Antares Capital mentioned.

With rising debt in US dollars and tanking profits in reals, Petrobras found itself at the mercy of the petrodollar. The company’s Q4 report reflected staggering losses, where market prices had “decreased 49.6 percent from the year earlier to $33.50 per barrel,” Zack’s Research highlighted. This had been aggravated by a previous Moody’s downgrade to “junk” status, which “rocked the country’s equities and currency, with […] the real tumbling 1.3 percent.” the group also discovered.

Another Energy Fuse article also revealed increasing bouts of in-fighting between the government and private investors after the 2007 discovery of pre-salt extraction reserves. “A 2010 reform under former President Luiz Inacio Lula da Silva requires Petrobras to be the sole operator in all pre-salt fields with a minimum 30 percent stake, severely limiting private investment in those areas.” To protect them from corporate exploitation, the Worker’s Party leadership mandated this to safeguard current and future welfare programs, but still required borrowing from the Central Bank of Brazil. Borrowing also heavily subsidized petrol costs to domestic consumers using the state bank. “Petrobras was not allowed by the government to pass on higher input costs to its end consumers and the company had to sell gasoline, diesel, and other refined petroleum products in Brazil at a sharp discount to international prices,” a Seeking Alpha article illustrated.

This explains the rampant embezzlement and the central bank’s egregious freeze of Selic benchmark rates at 14.25 percent. Recently, Temer replaced the bank’s leadership with IMF/ World Bank crony Ilan Goldfein to limit borrowing to all state-funded programs and impose austerity regulations.

Heads also began to roll at Pemex, Mexico’s Petrobras equivalent to which Brazil joined forces via Latin America’s largest trade agreement, dealing a heavy blow to the continent’s energy reform plans. “Emilio Lozoya (Pemex's CEO) lost his job back in February, after failing to stop a production decline despite heavy leverage.” As a result, Rousseff was forced to continue selling off Petrobras assets, but continued to subsidize oil costs with borrowed money. This was a mistake, but not a crime.

To prepare a motive, the overthrow was preplanned in a businesslike manner. A Folha de Sao Paolo report containing leaked recordings confirmed the pivotal moment in which Temer’s allies moved into position weeks before the coup. In it, Planning Minister Romero Juca and former Transperto President Sergio Machado commented that they wanted to “stop the bleeding” in Petrobras’s finances; a casus belli to form a national pact with Temer as the acting president. “I think we need to articulate a political action,” mentioned Juca to Machado. Juca has since stepped down in response to the leak.

However, it was her new methodology to reduce company debt that was the final straw. Reuters saliently reported that, following her January lifting of sanctions against Iran, the two countries met on the sidelines prior to the April 17th OPEC summit in Doha to discuss lucrative trading opportunities and bilateral agreements. “[Trade Minister Armando] Monteiro said Brazil aims to triple trade with Iran to $5 billion by 2019” and that “Rousseff lifted UN-imposed sanctions against the OPEC nation last week after meeting with the Iranian ambassador, […] despite tensions with the West,” Reuters continued. This trade was to occur in “euros and other currencies”, not dollars, and fit seamlessly with Petrobras’s 2015-2019 Business and Management Plan. Additionally, Brazil’s recent row with UNASUR and OPEC member Venezuela further encouraged Rousseff to seek new partnerships.

Rousseff impeachment efforts a bid to stop oil corruption probe – leaked tapeshttps://t.co/525wUzgViE

— RT (@RT_com) May 24, 2016

With increasing fallout between Saudi Arabia and the US over the 9/11 bill, coupled with embarrassing results from the Doha summit, Rousseff’s plan became an extra headache for the administration. Amidst all the hostile finger-pointing, she was in fact taking genuine steps to correct the company’s mismanagement using the P5+1 talks as a springboard for cooperation. “Relations between Brazil and Iran […] experienced new momentum in the context of implementation of the Joint Comprehensive Plan of Action (JCPoA) last January and of the lifting of international sanctions against Iran,” Brazil’s Ministry of Foreign Affairs quoted.

This is precisely what prompted the desperate political coup, which occurred the day after (April 12th) Brazil’s meeting with Iran—Congress voted during the OPEC summit after Iran’s absence confirmed this. Washington panicked at the thought of endangering petrodollar dominance and losing control of Iran’s post-sanction partnerships. Even Reuters perceived this threat by voicing “…although it is not clear whether any attempt to circumvent the U.S. financial system could raise tensions with Washington, Brazil's leftist government in the past has annoyed the United States by drawing closer to Tehran.”

Apparently, it did, and Brazil’s plans for reform eventually ran diametrically opposed to Washington’s future Iran ambitions, activating the CIA assets in the Brazilian Congress to overthrow Rousseff. With her impeachment underway, speculators were practically speaking in tongues at the possibility of raking in profits to the private sector. “Brazil's currency climbed by 1.7 percent to 3.6262 per dollar earlier today on heightened speculation that President Dilma Rousseff is nearing impeachment,” TheStreet rejoiced.

Unrelentingly, Temer has opted for massive budget and department cuts, rather than continuing with Rousseff’s socialist trajectory, threatening Brazil’s long-term autonomy with nearsighted profits and further dollar dependency. Additionally, appointing new FM Jose Serra also poses a serious threat to the BRICS alliance by moving away from a clear and holistic strategy. “Relations with new partners in Asia, especially China […] and India, will be a priority,” expressed Serra, insinuating that, armed with new pre-salt field reserves, it may not honor ties to Russia.

Furthermore, Temer has also replaced Petrobras CEO Aldemir Bendine with Pedro Parente, another favorite of the US financial elite, who was “formerly the top executive at the Brazilian unit of US agribusiness giant Bunge Ltd. and currently chairman of stock-market operator BM&FBovespa SA,” MarketWatch explained.

It is important to recognize that Brazil’s current ‘leadership’ benefits both the American empire and Brazilian capitalists. On the US side, Brazilian debt continues under the US dollar, and US President Barack Obama can maintain the CIA tradition of supporting the “moderate opposition” around the world in order to stifle democracy and plunder foreign markets. While Brazil’s terrorists aren’t chopping heads, they are slashing budgets; bleeding Brazil’s fragile democracy dry, and over the next 180 days, this will reflect in the will of the people as they take to the streets to fight their puppet government. Temer couldn’t have picked a better time, as the Olympics will see him and his enablers persistently humiliated through by a rapturous organization of the masses; from the grassroots to the Most High, until President Dilma Rousseff’s miraculous resurrection.

Haneul Na’avi, independent analyst for RT

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.