Western economies: A tale of thieves and tapers

2013 was the year where the threat of removing the QE punchbowl provoked market panic, while the EU was instrumental in sinister programs of theft above and beyond even the rapacious 'Central Bankers’ party'...

We began 2013 with the euro crisis yet to be cured, and indeed as we end the year it remains the fiscal elephant in the room. A volcano apparently dormant but clearly still active beneath the crater. Quite when it will next erupt nobody knows, but even Christine Lagarde of the IMF was keen during December to remind us that the crisis was far from resolved.

However, 2013 was the year where certain governments continued to be immolated on a symbolic funeral pyre as euro authorities sought to keep the flawed single currency alive at any price. Bank customers in Cyprus, ranging from Russian companies, through a significant quantity of the companies quoted on the Warsaw Stock Exchange and many individuals across the world found their assets appropriated. Rather than burn bondholders and others holding risk capital (Germany protected its bankers as they did in Ireland and elsewhere), the depositors found their deposits being stolen. The theft axis was one which carried on throughout the year. In an audacious deployment of arcane EU accounting rules previously exploited by Hungary, the Polish government de facto confiscated over half the nation’s private pension funds in an attempt to make up for their inadequate fiscal management.

Ultimately, most global citizens ended the year with their pockets having been picked in some way by rapacious governments, albeit through stealthy means... The daft policy of Quantitative Easing continued apace. In the vanguard remained the Federal Reserve handing bankers a cool 85 billion dollars every month to perpetuate the largely bankrupt system. During 2013, the US alone every month spent twice the annual GDP of Serbia in a balance sheet shuffle which a non-economist might prosaically term a confidence trick.

Even some traditional congressional spendthrifts have realised they can’t maintain this suicidal ‘rob Peter to pay bankers’ policy. Thus the second half of 2013 was spent obsessing about the ultimate financial terror (aside from the bankers’ previous hegemony). Outgoing Fed Chairman Ben Bernanke plotted a way out of the ‘crazynomics’ created by the ill-considered QE policy knee jerk after the credit crunch.

At first mention of a taper, markets panicked and, just like 2008, politicians lost their nerve. The taper was hastily postponed while the Fed endeavoured to counsel the markets to avoid what remains a case of Stockholm syndrome between banks and government. Ben Bernanke’s parting retirement gesture has been to taper by a rather derisory 10 billion dollars per month in the New Year.

For those lost in the arcane minutiae of quantitative easing (who isn’t?), it remains true that government oversaw a crazy party during the last decade where politicians maintained a delusion that they could inflate property markets with impunity. Banks joined the party and the result was chaos when inevitably the boom cycle led to bust. Sadly the party has long ended in the real economy but the bankers are being lubricated by a central banker punchbowl which the Fed is trying to gradually siphon out of the bar.

However, the damage has already been done and hence the terror of theft mentioned earlier will likely soon become post taper terror. Western politicians of left and right have successfully created a dangerous whirlpool of QE debt which has fed massive asset inflation - from fine art to classic cars through all manner of investment markets.

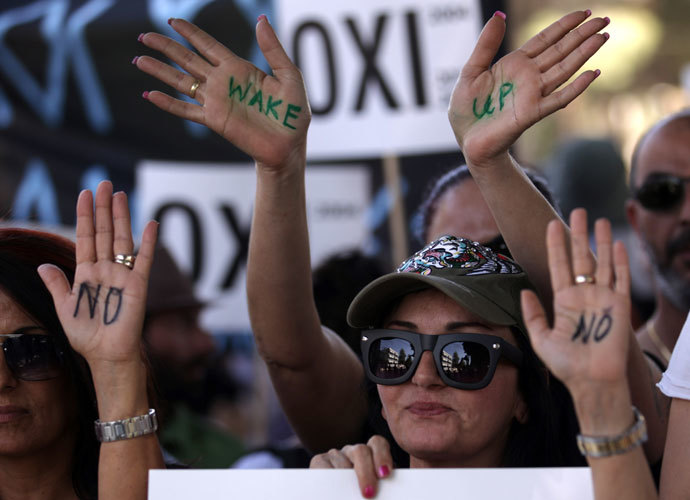

A day of QE reckoning is coming and the mood on the streets is understandably angry as normal business has been left behind in the bizarre escalation of a central bank spending spree which has only proven the ultimate impotence of government to create tangible wealth. Ironically it is the very banking elite the G20 pledged to curtail (Pittsburgh 2009) which have profited as everybody else has felt their wealth reduced through higher taxes, lower savings rates and the colossal failure of this unprecedented government interventionist phase to actually deliver any benefits to the economy at large. At least one could argue that some governments have finally succeeded with redistribution of wealth - problem is the people have paid to keep bankers and the absolute richest on their pedestals.

Sooner or later the taper will give way to terror and an incredible rebalancing will begin. However 2013 was dominated by what amounts to tawdry theft.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.