London's inflated rental prices double those in rest of UK

London rental prices are double those throughout the UK for the first time in modern history, according to newly published research.

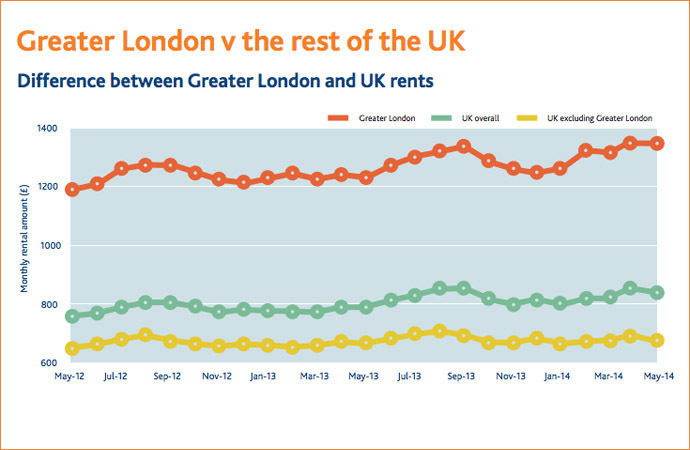

Average rents across the nation increased by 6.3 percent over the past year, and are currently peaking at £862 (US$1,464) per month, according to the HomeLet Rental Index. HomeLet, a specialist insurer and tenancy referencing firm, provides comprehensive and current data on new tenancies throughout the UK.

According to the company’s report, London-based tenants face rental prices of £1, 412 ($2,398) per month on average, in contrast to a much more affordable £694 ($1,178) outside the capital.

Londoners have seen rental prices soar in the past year by approximately 11.2 percent, the index reveals. This stark rise eclipses what is considered affordable by experts, compounding widespread fear of a London-centered cost of living crisis.

The UK’s North East and Scotland were the only UK regions to experience moderate decreases in rental prices – demonstrating yearly declines of 2.4 percent and 3.8 percent respectively.

Monthly rental prices in Scotland average at £578 ($981), while the North East's tenants pay approximately £507 per calender month ($861).

Martin Totty, the chief executive of HomeLet's parent company, emphasized that Britain’s private rental market continues to demonstrate “strong growth,” and is characterized by a state-wide trend of increased rental costs with very little exceptions.

But while average incomes in the UK are rising, affordability with respect to private renting is becoming a problem for some, he admits.

"As a rule of thumb, for a rental property to be affordable, a tenant's gross income must be at least two-and-a-half times his or her annual rent,” according to Totty. HomeLet’s “data shows that rents in London have pushed beyond that boundary, with the South East and South West of England close behind,” he cautioned.

But the minister of state for housing and planning, Brandon Lewis, dismissed HomeLet’s research, claiming the firm’s data is misleading.

"Contrary to this limited survey, figures from the Office for National Statistics clearly show private rents falling in real terms – while inflation currently stands at 1.9 per cent, nationally rents have risen by just 1 percent,” he argued.

On the subject of tackling an over-inflated rental market in the UK, Lewis suggested “building more rented housing.” He added that “excessive red tape” will only drive rental costs upwards while reducing choice for prospective tenants.

For this reason, the government is currently “investing £1 billion ($1.6 billion)” in a “Build to Rent fund, which is on track to have work started on 10,000 newly built homes specifically for private rent,” according to Lewis.

Lewis announced an array of other planned measures designed to address the over-heated rental market in Britain. Among the proposed policies is a newly published, government-backed 'How to Rent' guide, which breaks down the complex realm of tenancy rights for those who wish to rent privately in the UK.

Crazy cost of London living: you pay TWICE as much #property rent as rest of UK http://t.co/aHVmtROpXd

— LondonLovesBusiness (@LondonLovesBiz) July 28, 2014

But whether such policy prescriptions can adequately address the starkly inflated rental prices in Britain’s capital remains to be seen.

Broadly accepted poverty indicators suggest that a household’s net income should be two-and-a-half times the figure allocated to housing costs. Yet according to HomeLet’s research, most tenants across Greater London channel over half their earnings into rent alone.