A whistleblower of HSBC fraud has denounced the bank’s chairman, Douglas Flint, as “an extraordinary hypocrite” following the financier’s suggestion that those who expose crime in Britain’s financial services sector should be rewarded and celebrated.

Flint made the comment at the launch of Britain’s Chartered Institute for Securities & Investment’s (CISI) “Speak Up” initiative launched on Tuesday. The program was set up to encourage financial services firms to adopt a policy that assists staff in reporting legislative, regulatory and company policy violations.

Calling on UK financial firms to take a more proactive approach to tackling misconduct in the workplace, Flint said firms should “encourag[e] the calling out of both good and bad behaviour” and reward and praise “those who escalate their concerns even if they are sometimes wrong”.

He welcomed the CISI’s newly launched initiative, and paid tribute to the body’s prioritisation of the term “Speak Up” over the phrase “whistleblowing”, which he suggested “has a much narrower and more sinister connotation in many people's minds”.

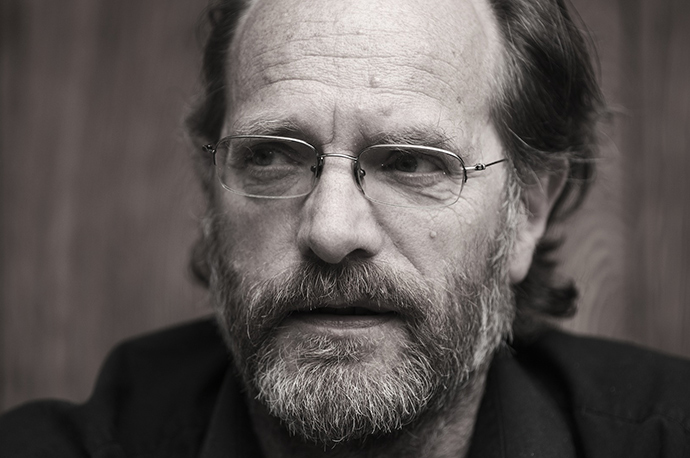

But HSBC whistleblower and financial campaigner Nicholas Wilson condemned Flint’s comments, insisting they were disingenuous. In an exclusive interview, Wilson told RT he had attempted to expose fraud in HSBC for years, yet Flint had turned a blind eye.

"Flint is an extraordinary hypocrite and his comments are just lip service because that is what he thinks he should say. I have been blowing the whistle on HSBC illegal practices for years and Flint has ignored me, because to acknowledge my revelations would entail the bank in massive compensation payments. He was finance director for 15 years before he became chair; he is well aware of the practices I am highlighting," Wilson said.

HSBC fraud allegations

The British-born whistleblower, who is currently preparing a private prosecution against HSBC for its alleged role in widespread fraud, claims the bank added “illegal charges” to “delinquent” UK accounts for years, irrespective of whether such legal proceedings actually occurred.

Because the Office of Fair Trading had laid out “no contractual provision” for these charges at the time, Wilson insists they were in violation of UK law. The whistleblower estimates this fraudulent activity amounted to a startling £1 billion.

While Wilson didn’t work directly for HSBC, he worked for a legal firm acting on behalf of the bank. Having uncovered evidence of what he claims was widespread fraud, Wilson says he informed HSBC’s solicitor in 2003 that the legal charges were in breach of UK law, yet the bank “carried on regardless until 2010 when the Office of Fair Trading told them to stop.”

“I went through all the proper channels, reported the fraud to the Solicitors Regulation Authority which upheld my complaint, but still the bank carried on,” he said, adding that the illegal activity was allowed to persist because “regulators such as the FCA” assisted HSBC in “covering up the fraud.”

A HSBC spokeswoman told RT on Thursday that the bank was aware of Wilson’s allegations, but would not comment on them. She also refused to respond to Wilson's assertion that Flint ignored the whistleblower's attempts to expose HSBC fraud while he held the position of the bank's finance director.

Wilson's criticism of Flint follows a recent, high-profile scandal, which severely compromised HSBC’s reputation around the world. The bank was forced to pay American authorities £1.2 billion ($1.9 billion) in a settlement in December 2012, following allegations that it facilitated the laundering of illicit funds emanating from Mexican drugs cartels and several states that were under US sanctions.

Speak Up campaign an ‘empty gesture’

At the launch of the Speak Up program, the CISI suggested a special “financial hardship fund” be introduced to provide monetary support to prospective whistleblowers. The body believes such financial assistance would complement its Speak Up program – helping to foster an enhanced culture of transparency and ethics in Britain’s financial sector.

Wilson holds little hope for the scheme, however, suggesting it is little but a “PR initiative.”“If an employee were to break a few rules that will earn him or her huge bonuses, there is no likelihood that one will rock the boat. Banks are not charities. There will be no exposure of wrongdoing by insiders until the whole culture is changed and properly regulated,” he added.

Britain’s entire financial edifice is corrupt and “empty gestures” such as Speak Up will have little effect until there is a comprehensive clean-up of the industry, Wilson emphasizes. He argues UK regulatory authorities’ failure to fully grasp “exotic financial instruments” common to Britain’s risk-based financial culture have compounded the situation.

Wilson doesn’t believe staff should be financially incentivised for highlighting misconduct in the workplace, as is currently common in the US. But he argues whistleblowers should be compensated, stressing his decision to expose HSBC fraud ultimately cost him his health and his livelihood.

In an effort to legally challenge HSBC, Wilson filed an application to launch legal proceedings on May 7. The City of London Magistrates Court responded in June, requesting he tender a sworn statement with all the evidence. Wilson believes the court is making his efforts to pursue the proceedings “as difficult as possible”. Nevertheless, he hopes to secure pro bono legal support to persevere with his case against HSBC.