Living or surviving? Britain’s poorest eking a living, richest splash out on leisure

Britain’s poorest households spend almost 50 percent of their income on the bare necessities of food and housing. On average, the richest spend more than four times as much on recreation, new research shows.

Although spending has grown across the board for the second year running, indicating the economy is showing signs of recovery, the Office for National Statistics (ONS) figures point to a stark disparity between the spending habits of the rich and poor.

How much do households spend per week? Explore the data behind #FamilySpendinghttps://t.co/1GWX1jJtuMpic.twitter.com/MwTvpRJfvA

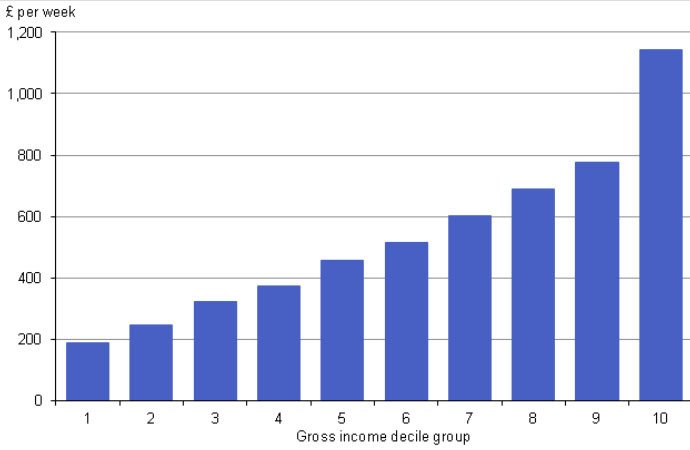

— ONS (@ONS) December 8, 2015The bottom 10 percent of households had just £188.50 to spend per week, while the top 10 percent shelled out £1,433.40. The UK’s richest spent a proportionately greater amount on recreation, cars and holidays.

Resolution Foundation chief economist Matthew Whittaker explained: “This reflects the unavoidable and sizeable costs associated with housing and food that all households face.

“As a result, poorer households spend a much higher share of their income overall and allocate far more of their spending to these essentials.”

“Disproportionate increases in the costs of many essentials over the last decade or so have meant lower-income households facing higher inflation levels than the headline rate, compounding the squeeze on their incomes.”

Overall, household spending reached an average of £531 per week, which when adjusted for inflation is still less than the £554 peak of 2004-2005, but a marked improvement from 2012’s £507 average.

Trade Union Congress (TUC) General Secretary Frances O’Grady said borrowing was fueling the spending hike.

“While it is good that consumer confidence is up, let’s not pretend that everything is rosy,” she said. “We need a wages-led recovery, not a re-run of the events that led to the last financial crash.”

Economists predict the Bank of England will hike interest rates in the second half of 2016, after years of cheap borrowing costs, which may potentially curb household spending.