‘Blatant profiteering’: Radical measures required to tackle PFI debt traps, says report

Private Finance Initiatives (PFIs) created to fund public services in Britain have enabled flagrant profiteering and crippled public bodies with unsustainable debt, social justice campaigners have warned.

Debt justice campaign The People vs Barts PFI says a radical solution is required to stop banks and investment funds from profiteering from Britain’s public assets. In a policy paper titled ‘The Private Finance Initiative,’ the group argues the UK’s PFI model must be challenged.

Our new video exposing the problems of #PFI in our #NHS featuring @ElGingihy and @BluGreenMonster. https://t.co/U5Q6ziRjnz cc @OurNHS_oD

— The People vs PFI (@PPLvsPFI) November 30, 2015

Authored by Senior Lecturer in Economics at Greenwich University Dr Helen Mercer, the report outlines radical measures for resolving Britain’s PFI crisis. It has attracted the interest of academics, economists, debt justice campaigners and politicians since its release.

Unsustainable debt

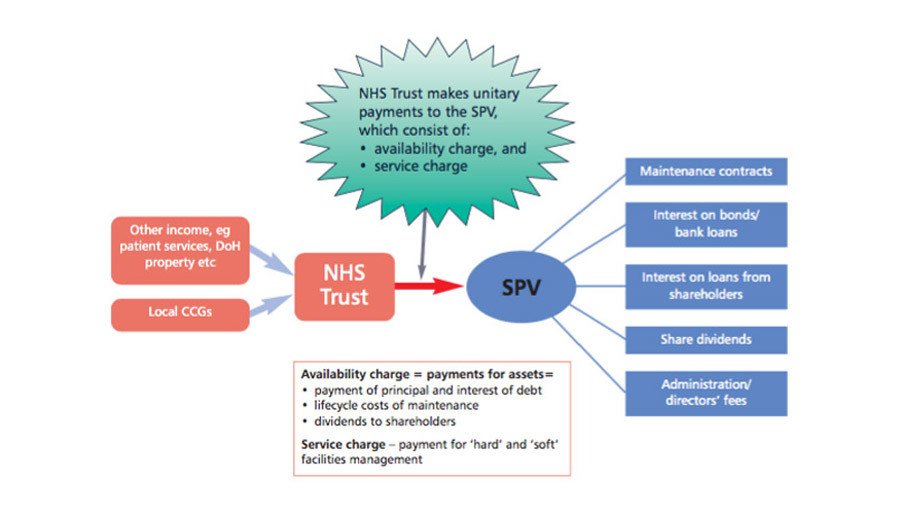

PFIs operate through firms known as Special Purpose Vehicles (SPVs), and use private capital to fund public infrastructural development. They have been adopted in many states worldwide as part of a broader program of privatization and financialization.

The costly and clandestine nature of these contracts has been denounced by activists, academics and MPs across the UK. In particular, concerns have been raised that PFI deals enable service contractors, construction firms and offshore companies to profit as Britain’s public hospitals and schools crumble under the weight of unsustainable debt.

British taxpayers were estimated to owe roughly £222 billion ($337 billion) to banks and private firms under 720 PFI contracts in 2015.

Local authorities in Britain carry the greatest burden of PFI debt, despite the fact many of their projects are focused on social care and housing.

By 2050, the UK’s total PFI bill could amount to £310 billion ($470 billion) or four times the UK’s deficit. Critics warn that these contracts are overpriced, shrouded in secrecy and – in certain instances – dependent on criminally rigged Libor rates.

Radical reforms required

Mercer’s report calls for the nationalization of SPVs that sustain PFI contracts. It argues that many widely-discussed options for rescuing Britain’s public services from PFI debt traps are flawed because they focus on liabilities rather than assets.

Such proposals include renegotiating PFI contracts, centralizing NHS debt and strategic sell-offs of PFI liabilities.

British law and financial corporations have made a fortune privatising Europe through #austerityhttps://t.co/M7nIlkFgjk

— Nick Dearden (@nickdearden75) February 17, 2016

Mercer argues these policy proposals are doomed to fail. While the redrafting of onerous contracts is commonplace in the private sector if debtors are facing bankruptcy, no drive to renegotiate such deals in the public sector exists because the government has guaranteed all debt payments will be met, she argues.

Mercer suggests that nationalizing the SPVs would eradicate many of the legal pitfalls linked to redrafting PFI contracts and restructuring PFI debts.

Renegotiation and centralization of such debt leaves public assets in the hands of private sector actors, while history tells us that buyouts are unlikely to offer any savings for the public purse, she says.

Petition: pay off all the NHS PFI debt. without reducing the current NHS budget https://t.co/BiRjht3OE5

— Paul Dunbar (@para1559paul) February 28, 2016

While Mercer acknowledges tougher regulation of SPVs could be helpful, she says regulators often act behind a gauze of secrecy and are inevitably vulnerable to being captured. Her report concludes that nationalizing the SPVs is the most viable antidote to crumbling public services in the face of mounting PFI debts.

'Dissolve the contracts'

Speaking to RT on Wednesday, Mercer said an Act of Parliament would be required to nationalize SPVs.

“After nationalisation, the state would be the owners of the SPV and would dissolve the contracts with public bodies by mutual consent,” she said.

“The contracts with service providers would remain in force in the immediate term. The state would be able to renegotiate or terminate these contracts and take service in-house as and when required.”

Before raising taxes, councils should look at auditing their astonishing debt repayments: https://t.co/inuxZyIVjPpic.twitter.com/nep61qlVbO

— openDemocracy (@openDemocracy) March 2, 2016

Mercer said SPVs will most likely have to be nationalised for two reasons: PFIs are “bad value and driving public bodies into bankruptcy,” and “the PFI system is unsustainable.”

“This looming crisis in essential [public] services means that the status quo cannot be maintained,” she said.

“Nationalising the SPVs that hold PFI contracts is the simplest and most effective way out of this crisis. As health campaigners we have been confronted by the problems caused by PFIs for many years. This has forced us to examine the issue in detail and explore all possible solutions.”

British doctor Alyson Pollock says Britain’s PFIs are drivers of “service closure and privatization” due to the high cost of servicing related debts.

A leading critical voice on PFI, Pollock argues a full public inquiry is necessary to address Britain’s PFI crisis. She says the Treasury, National Audit Office (NAO) and Public Accounts Committee (PAC) must work together to ensure the UK’s PFI deals advance the public interest.