Walmart accused of dodging US taxes by storing $76bn in assets abroad

A new report accuses Walmart of stiffing the US government out of $3.5 billion in corporate income taxes by hiding more than $76 billion in assets in a web of subsidiaries in international tax havens where the company does not own any retail stores.

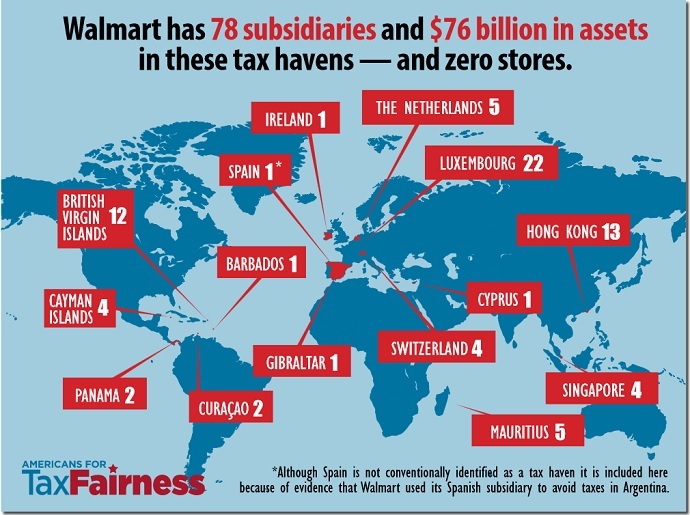

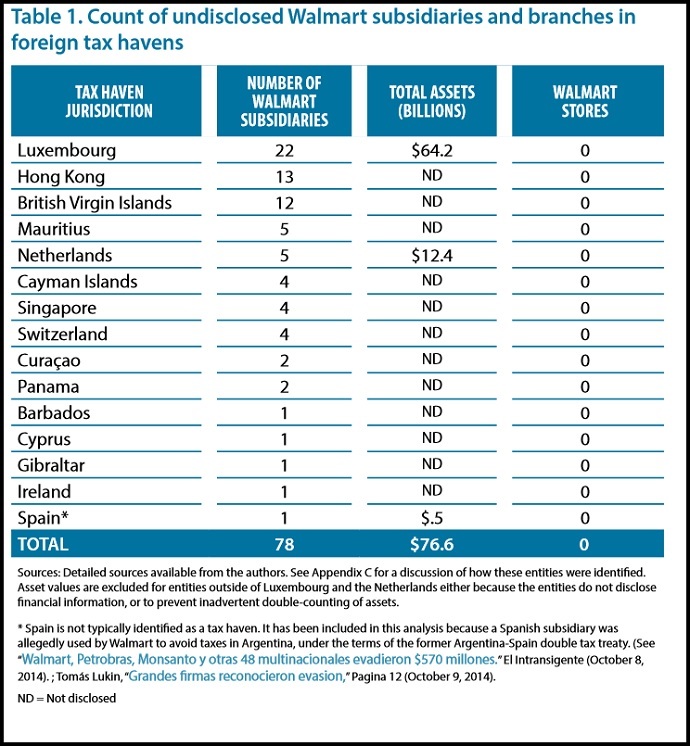

According to a report by Americans for Tax Fairness, Walmart has at least 78 offshore subsidiaries and branches ‒ more than 30 of which have been created since 2009 ‒ where it has stashed more than $76 billion in assets. Over 90 percent of the company’s international assets are owned by subsidiaries in Luxembourg and the Netherlands. The remainder are stored in 13 other countries, none of which have been publicly reported to the US Securities and Exchange Commission, the report said.

Walmart’s annual reportsto the SEC show that the company shaved more than $3.5 billion from its income tax bills in the past six years, according to Bloomberg Business.

Despite having no stores in Luxembourg, Walmart companies reported $1.3 billion in profits there between 2010 and 2013. It paid a tax rate of less than 1 percent on that $1.3 billion.

Walmart is one of more than 340 international companies that use Luxembourg to slash their tax bills. Officially, Luxembourg has an income tax rate of 29 percent, but companies use the tiny European nation as a tax conduit because they can can send money in and out almost tax free.

“Companies use tax havens to dodge taxes. It appears that’s the secret game Walmart is playing,” Frank Clemente, executive director of Americans for Tax Fairness, said in a statement. “We are calling on Congress, federal agencies and international organizations to determine if Walmart is skirting the law when it comes to reporting its use of tax havens, using various schemes to dodge taxes, and getting a sweetheart deal from Luxembourg that is the equivalent of illegal state aid.”

READ MORE: Walmart employees deliver chairman $7.8 bn 'tax bill' for company's tax breaks

The subsidiaries in tax havens provided Walmart’s US affiliates with $2.4 billion in foreign earnings through “earnings stripping,” or low-interest, short-term loans, the report found. Walmart subsidiaries generated about $1.5 billion worth of tax deductions in Luxembourg by making “phantom interest payments” to their parent company in the US. This so-called “hybrid loan” made the income disappear for tax purposes in both the United States and in Luxembourg.

“This takes Wal-Mart’s irresponsibility to a new level. Walmart’s tax havens are making one of the richest families in the world even richer while Walmart workers and their families continue to struggle to get by on poverty-level wages,” Making Change at Walmart ‒ a coalition of Walmart associates, union members, small business owners, religious leaders, community organizations, women’s advocacy groups, multi-ethnic coalitions, elected officials and ordinary citizens ‒ said in an emailed statement.

The group called on Walmart to “do the right thing” by “immediately committing to pay their fair share of American taxes.”

The report, which was researched by the United Food & Commercial Workers International Union, found that Walmart is using subsidiaries in tax haven countries to minimize foreign taxes in countries where it has retail operations and to avoid US taxes on those foreign earnings. At least 25 out of 27 of Walmart’s foreign operating companies ‒ in places like the United Kingdom, Brazil, Japan and China ‒ are owned by subsidiaries in tax havens.

“Walmart is another example of a multinational corporation engaging in deceptive tax practices, in this case hiding from investors and the public for years the existence of an extensive network of 78 tax haven subsidiaries by dubbing them ‘not significant’ and omitting them from its public filings,” former U.S. Senator Carl Levin (D-Michigan) said in the Americans for Tax Fairness statement.

“Walmart’s undisclosed subsidiaries in 15 different tax havens hurts its credibility on tax matters and raises questions about whether it is using hidden offshore tax dodges,” Levin continued. “Walmart is a perfect example of why multinationals should be required to provide publicly-available country-by-country reports on their revenues and tax payments ‒ disclosures that would help stop profitable multinationals from engaging in offshore tax schemes to avoid paying tax.”

Walmart spokesman Randy Hargrove said the report "includes incomplete, erroneous information designed to mislead readers," CBS News reported.

"Walmart has processes in place to comply with applicable SEC and IRS rules, as well as the tax laws of each country where we operate and we maintain transparency with the IRS via real-time disclosure of our business transactions and corporate structure," the company said in a statement, noting it paid $6.2 billion in US federal corporate income taxes for 2014, or about 2 percent of all corporate income tax that the US Treasury collected last year.

President Barack Obama’s proposed budget for fiscal year 2015 would include two separate tax hikes aimed at US-based businesses. The first would be a one-time fee that would place a 14 percent tax on US companies’ past foreign earnings, while the second would implement a forward-looking 19 percent tax rate on the future foreign-held profits of US-owned businesses.

“It’s estimated that there are maybe $20 trillion of assets put in these tax havens around the world” from world billionaires and large, international corporations, Jeffrey Sachs, head of Columbia University’s Earth Institute, told RT on the sidelines of the fifth annual Gaidar Forum in Moscow in 2014. “It’s an abuse of the public trust.”