When $2.8 trn is not enough: US govt rakes in record tax revenue, but still overspends

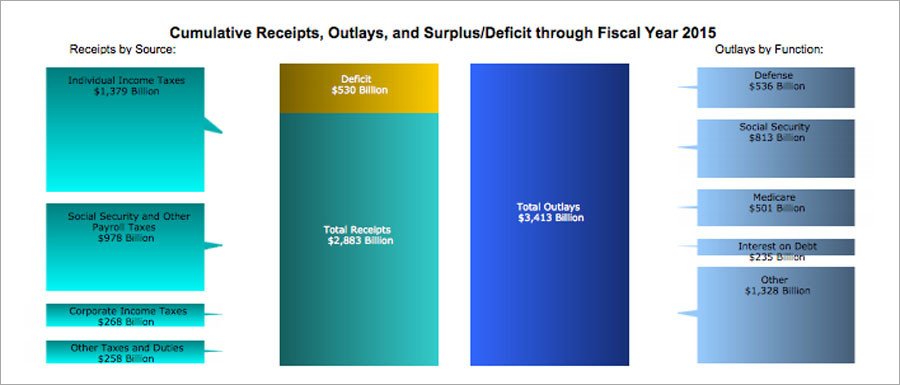

The federal government has collected $2.8 trillion in taxes over the 11 months of the fiscal year 2015, almost $200 billion than the year before. This means $19,346 for every working American. Yet Washington has overspent by $530 billion.

Most of the money – $1.379 trillion – came into the Treasury from individual income taxes. Payroll taxes for Social Security, Medicare and other entitlements accounted for $977.5 billion, while corporate taxes accounted for $268.4 billion, according to the monthly statement released Monday by the Department of Treasury. The US fiscal year begins and ends in October.

Federal Taxes Hit Record: $19,346 Per Worker - http://t.co/H285504MEQpic.twitter.com/tqHtLJQWO7

— InvestmentWatch (@InvestWatchBlog) September 14, 2015Given that the Bureau of Labor Statistics logged 149 million Americans with either part-time or full-time jobs in August, the total taxation would work out to $19,346 for every US worker.

In 2015 dollars, the US government took in $198.4 billion more than in the first 11 months of the fiscal year 2014. This time last year, the government’s revenue was at $2.684 trillion. However, in 2015 the government has spent $3.413 trillion so far, racking up a $529.9 billion deficit.

Most of the government spending goes to Social Security ($812 billion) and Medicare ($501 billion). Another $235 billion is dedicated to paying the interest on government debt. The second-biggest outlay is military spending, with the Pentagon receiving $536 billion.

In 2012, the Obama administration raised the top income tax rate from 35 percent to 39.6 percent, increased the top tax rate on dividends and capital gains to 20 percent, and eliminated many exemptions and deductions for those who earned $250,000 or more in annual income.

Another 3.8 percent tax on dividends, interest, capital gains and royalties went into effect in 2013, embedded in the Affordable Care Act, commonly known as Obamacare.