‘Tough choices’ required: Real US debt over $65 trillion, former GAO chief says

Economists understate the real extent of the US government’s financial commitments, which in reality exceed $65 trillion, the US government’s former top accountant told RT. A debt fix would need to tackle the tax code, debt ceiling, and Pentagon spending.

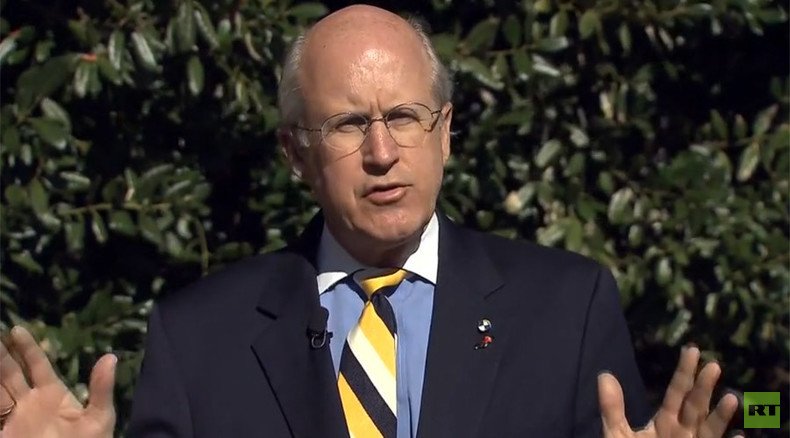

“You have to consider not just the public debt, you have to consider the debt we owe to the Social Security and Medicare trust funds, as well as the huge unfunded obligations for our social insurance programs,” former US Comptroller General David Walker told RT. “When you add all those numbers up, the number is over 65 trillion, rather than the lower numbers a lot of the economists want to talk about.”

Officially, the US public debt currently stands at $18 trillion.

U.S. Debt Is Triple The Oft-Cited Figure Of $18 Trillion: Ex-GAO Head https://t.co/XtzVaP1IENpic.twitter.com/WG4iony81X

— ValueWalk (@valuewalk) November 9, 2015“The US is not trying to hide anything” and is actually a lot more transparent about its finances that most countries, said the former head of the Government Accountability Office (GAO).

“The problem is that the economists only want to consider current public debt, and they don’t want to end up looking at the huge promises that we’ve made, that we have not set aside adequate resources to meet,” he added. “Ultimately, we’re going to have to confront that gap.”

Walker served as comptroller general between 1998 and 2008, serving under Presidents Bill Clinton and George W. Bush. The name change of GAO, from General Accounting Office to Government Accountability Office, happened during his tenure. He has championed fiscal responsibility for years, most recently making the case for debt reform in the wake of a budget deal between the Obama administration and GOP-controlled Congress.

The agreement raised the “debt ceiling” – the maximum amount the US government is allowed to have in public debt – to $20 trillion, which economists estimate will be reached by the time President Barack Obama leaves the White House in January 2017.

Walker advocates abolishing the debt ceiling altogether, noting the US is the only major country in the world with such a restriction. The way forward, he says, is to set limits on the debt in terms of the percentage of the economy, “with automatic targets, automatic triggers – and automatic enforcement mechanisms if those are violated.”

A combination of lower revenues due to the 2008-2009 recession and an increase in government spending, especially on major military operations, has driven the public debt up under President Obama. Walker says that high debt-to-gross-domestic-product (GDP) ratio is a drag on the economy, and has slowed down the recovery. Reforms could make it possible to reduce US debt to 60 percent or so of the GDP by 2030 or 2035.

The good news is that the US does not need to pay off the debt entirely, only ensure that it can continue to service the debt. The bad news? The required reforms would have to tackle the three sacred cows of US politics – the arcane tax code, social services, and the Pentagon’s budget.

“We have to reform our tax system, we have to restructure our social insurance programs, and we’ve got to rationalize our defense spending over time,” Walker said.

“We have the largest economy on Earth, we’re a very powerful nation, we can solve this problem,” he added. “But it’s going to require tough choices, and we need to start sooner rather than later.”