'Panama Papers’ company set up 1000+ businesses in USA

Mossack Fonseca, the Panamanian company at the heart of the leaked documents scandal, has set up over 1,000 businesses inside the US since 2001, highlighting the emergence of the US as an international tax haven.

Dubbed the “Panama Papers,” the leaked papers have pointed to several former and current government leaders across the world. Iceland’s Prime Minister Sigmundur Gunnlaugsson was pressured to resign over his role in the scandal, while the offshore fund run by the late father of UK Prime Minister David Cameron has been named as a client as well.

However, Mossack Fonseca has also operated in the United States, registering almost 1,100 businesses over the past 15 years. Its Nevada operation, which USA Today describes as “a one-employee company based out of a low-slung tile-roofed office building 20 miles from the Las Vegas strip,” is responsible for 1,026 registrations. Another business registration operation was set up in Wyoming the same year.

The Wyoming office is actually operated from Las Vegas, according to a testimony given in a Nevada court case in 2014 by Mossack Fonseca’s Patricia Amunategui, USA Today reported.

Panama Papers: 'Biggest leak in history' on corruption https://t.co/jpM8MJdG8zpic.twitter.com/fCNQF2dPN9

— RT (@RT_com) April 4, 2016

Among the corporations created by the Nevada subsidiary of Mossack Fonseca are 123 firms named in the corruption probe involving the current and former presidents of Argentina, and another entity implicated in the corruption scandal within FIFA, the international soccer association, according to USA Today.

On Monday, as the “Panama Papers” revelations captivated the headlines, US President Barack Obama announced new rules aimed to prevent US corporations from using legal tricks such as “inversion” to avoid taxes.

The move is yet another step in the ongoing US crackdown on offshore tax havens, launched with the 2010 Foreign Account Tax Compliance Act (FATCA). The law requires financial firms to disclose accounts held by US citizens and report them to the Internal Revenue Service (IRS) or face penalties.

Yet when the Organization for Economic Cooperation and Development (OECD) sought to apply FATCA standards internationally, the US was among the handful of countries that refused to sign on – along with Bahrain, and the Pacific island nations of Nauru and Vanuatu, according to a Bloomberg report from January.

In fact, as Washington has blasted foreign tax havens, many transnational financial organizations have been setting up shop in the US, using the low taxes and confidentiality provisions in state laws in places like Nevada, Wyoming, South Dakota and Delaware.

Calling those states "the new Switzerlands of this world," journalist and author Ernst Wolff told RT, "The United States have been professing to be fighting tax evasion all over the world, but at the same time, they've opened up some tax havens in their own country."

"What's the American government doing? It's pursuing a policy of destablization all over the world, and this also serves the purpose of destabilization," Wolff added. "The US is preparing for a big, super-big financial crisis, and they want all that money in their own vaults and not the vaults of other countries."

Andrew Penney, managing director at the Rothschild Wealth Management & Trust, even went so far as to describe the US as “effectively the biggest tax haven in the world,” according to Bloomberg – though he ultimately decided to omit that description from a presentation given to clients in San Francisco, California last September.

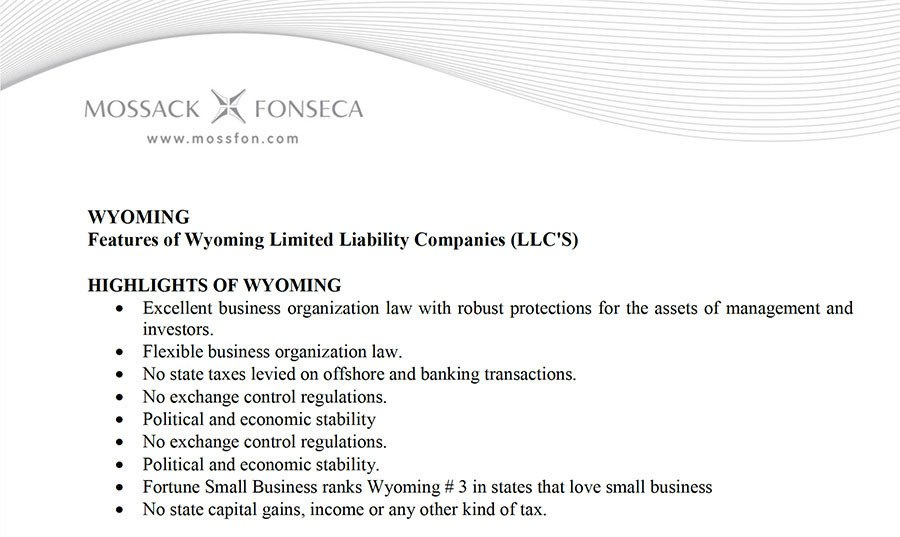

Mossack Fonseca’s marketing materials have pointed out that Wyoming has no state taxes, low corporate taxes, and “robust protections for the assets of management and investors.” Likewise, limited liability companies “may be formed with a single member which can help avoid US federal income tax reporting requirements,” while ownership is “confidential and under state law may only be obtained by court order.”

The “Panama Papers” were initially leaked to the German newspaper Süddeutsche Zeitung (SZ) a year ago by an unknown hacker. The paper then forwarded them to the International Consortium of Investigative Journalists (ICIJ).

The ICIJ is “funded and organized entirely by the USA’s Center for Public Integrity,” former UK diplomat Craig Murray pointed out, noting that the CPI is backed by the US government’s international development agency (USAID), and foundations such as George Soros’s Open Society Fund, the Carnegie Endowment and the Rockefeller Family Fund.

While the ICIJ has denied targeting Russia, much of the coverage of the “Panama Papers” in the US and the UK has focused on Russian President Vladimir Putin, whose name does not appear anywhere in the documents.