Trump tax plan slashes taxes for ‘some’ businesses and wealthy estates

The White House is proposing comprehensive tax reforms which are said to simplify the federal tax code by cutting rates and eliminating deductions. The plan fell short on how the measures would be paid for with critics saying it will primarily benefit the wealthiest Americans.

“This is going to be the biggest tax cut and largest tax reform in the history of our country, and we are committed to seeing this through,” US Treasury secretary, Steve Mnuchin, said announcing the tax reforms with scant details at the White House on Wednesday.

Mnuchin Nearly Loses His Cool During Unveiling of Trump's Tax Reforms https://t.co/qUOqfEQmbM via @the_real_flypic.twitter.com/YVbMgvjkGA

— iBankCoin (@iBankCoin4tw) April 26, 2017

The plan calls for slashing the federal income tax from 35 to 15 percent for corporations, small businesses, and partnerships of all sizes. That would represent a major tax cut for many businesses from mom-and-pop grocers to hedge funds – including Trump’s own business empire.

Reducing rates for “pass-through” businesses will be tough to justify https://t.co/Kc27CdOQ1s

— The Economist (@TheEconomist) April 26, 2017

Under current law, companies pass their earnings and deductions through to their owners, who are then taxed at their individual income tax rates.

There are already critics of the 15 percent tax rate.

“Unsurprisingly, the president is proposing straightforward tax cuts for the rich, which will need to be temporary because they will increase the federal budget deficit,” wrote Josh Bivens and Hutner Blair at the Economic Policy Institute.

“[A] 15 percent rate on pass-through business is nothing but a loophole. Reducing the pass-through rate will not help the majority of genuine “small business.” Instead, it will help private equity managers and people like President Trump, wealthy people who will now be able to reconfigure their taxes by reclassifying themselves as independent contractors.”

“The Trump proposal is a very big step in the wrong direction… and show they intend tax reform to simply mean tax cuts for the rich,” Bivens and Blair added.

Former Democratic presidential candidate Senator Bernie Sanders (I, Vermont) said the plan would favor large businesses and the wealthy.

"We have a rigged economy designed to benefit the wealthiest Americans and large corporations," Sanders tweeted. "Trump’s tax plan would make that system worse."

We have a rigged economy designed to benefit the wealthiest Americans and large corporations. Trump’s tax plan would make that system worse.

— Bernie Sanders (@SenSanders) April 26, 2017

The reforms include a one-time tax on about $2.6 trillion in earnings that US companies have parked overseas, and would end the taxation of corporations’ offshore income by moving to a territorial system, in which most foreign profits would be exempt from US taxes. Currently, the US taxes business income no matter where it’s earned.

“We are determined to move as fast as we can and get this done this year,” Mnuchin said.

US stocks gained in midday trading today after the Trump administration outlined its tax reform plan.

Mnuchin said the proposal would stimulate enough economic growth to cover the costs of the tax cuts, although economists have called that proposition into question, according to Bloomberg.

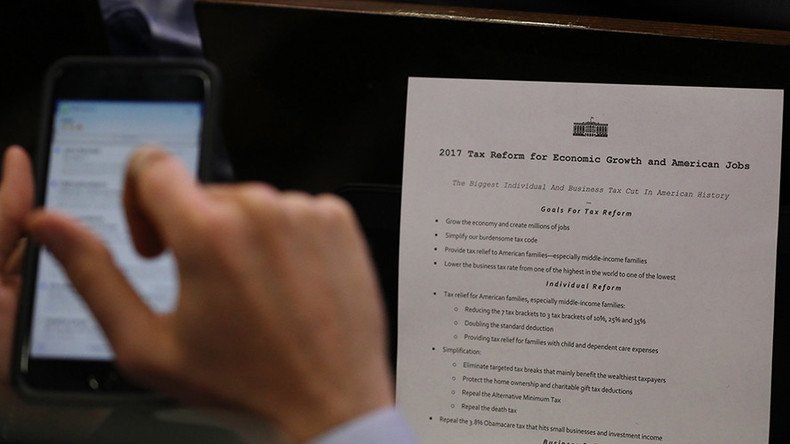

Simplification: White House hands out one-page tax reform outline. pic.twitter.com/fwY3tqyjd0

— Martin Walsh (@mrwalsh8) April 26, 2017

For individuals, the reforms propose condensing the existing seven income-tax brackets to just three, cutting the individual rate to 35 percent from 39.6 percent and doubling the standard deduction for married taxpayers to $24,000.

House Minority Leader Nancy Pelosi called the plan a "wish list for billionaires."

"The same Trickle Down Economics that undermined the middle class are alive and well in the President’s tax plan," she said in a statement. "True to form, President Trump’s tax plan is short on details and long on giveaways to big corporations and billionaires."

The only itemized deductions that would be preserved under the plan would be for home mortgage interest and charitable contributions.

“Tax reform is long overdue,” National Economic Council Director Gary Cohn told reporters at the White House. "We have a once-in-a-generation opportunity to do something really big."

Cohn said Trump’s proposal is to immediately phase out death taxes on estates.

Commonly known as the estate tax, it taxes an estate’s value that exceeds roughly $5.5 million per person. Cutting death taxes only benefits the wealthiest 0.2 percent.

Eliminating the tax would generate a windfall, averaging $3 million apiece while benefiting wealthy heirs. The elimination does nothing for small farms and business and the repeal would cost $269 billion over ten years, according to the Center on Budget and Policy Priorities.

Senator Ron Wyden, (D, Oregon) the ranking member on the Senate Finance Committee, took to Twitter to go after the president's plan.

"Light on details for people who work for a living, yet very detailed for the elite," Wyden tweeted. "No estate tax, cut in capital gains and cut in top rate? All an #EliteGiveway. And yet the Trump team couldn't tell you what the tax plan means for the typical American family. Self-serving & elitist."

Secretary Mnuchin said the tax reform plan will pay for itself through growth and reduction of deductions, closing loopholes.

The White House plan is a set of principles with few details, but it’s designed to be the starting point of a major push to urge Congress to pass a major tax reform package this year. It is similar to the House Republican ‘Better Way’ tax plan.

The White House is set to release the broad outlines of Trump's proposed overhaul later in the day.