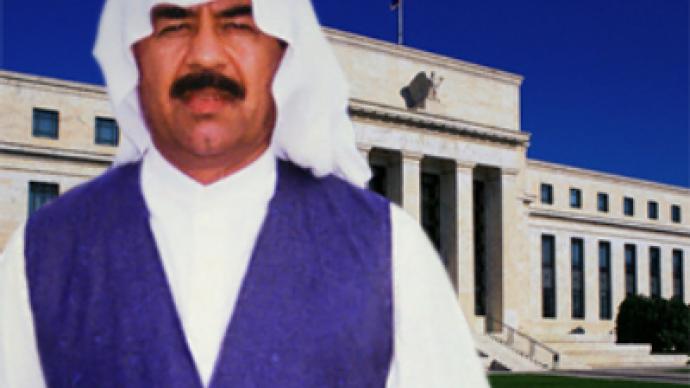

Did the US Federal Reserve finance Saddam Hussein’s weapon purchases?

As Congress debates legislation to make the US Federal Reserve less secretive, Republican Ron Paul said the Bank loaned Iraq billions of dollars to buy US weapons in the 1980s.

Ever since the bottom fell out of the US economy in 2007, triggering an economic crisis of titanic proportions, the US Federal Reserve has found itself on the defensive as lawmakers are demanding more supervision over the tight-lipped money-printing outfit.

The man who is leading the fight against “the Fed” is Texas Congressman Ron Paul, 74, an outspoken critic of US foreign and monetary policy. And given the present economic and social conditions inside of the United States, which are quickly converging to form the perfect political storm, Paul may be successful in passing his Federal Reserve Transparency Act that will give lawmakers the authority to audit the Federal Reserve – a power that it presently does not enjoy.

On the rocky road to that elusive goal, Paul appeared this week alongside fellow lawmakers on Capitol Hill where they had the pleasure of putting Chairman of the Federal Reserve Ben Bernanke in the hot seat for a painful Q&A session. Bernanke, incidentally, is the guy who ran the money-printing machines at full speed to bail out the American economy, if not the entire globalization project itself, following the Collapse of 2007.

Paul, who regularly provides the fireworks to otherwise drab Congressional hearings due to his profound knowledge of the issues, slammed the “cozy relationship” that now exists between lawmakers and the Federal Reserve Bank, which creates what the congressman from Texas has labeled the “inflationary tax.”

“There has been a political cozy relationship between Congress and the Federal Reserve,” said Paul, addressing his comments at Bernanke. “The Congress has been derelict in its duties to provide oversight…Congress can keep spending and getting reelected. They don’t have to raise taxes, so the Fed can act as a taxing authority: you print the money, [which] dilutes the value of the money, prices go up, and price inflation is a tax and when people pay a lot more for their medical care than they used to they ought to think about the inflationary tax.”

Paul then discussed the lack of transparency in the Federal Reserve, and how this may have contributed to more than one under-the-table transaction that worked to disrupt US foreign policy.

“I would like to get to more specifics on the ‘transparency bill’ because it has been reported in the past that during the 1980s the Fed actually facilitated a $5.5 billion dollar loan to Saddam Hussein, and then he bought weapons from our military industrial complex,” Paul said, adding that was also the time when the Iraqi dictator invested in a nuclear reactor.

There is a famous photo of Donald Rumsfeld, then special envoy of former US president Ronald Reagan, shaking hands with Saddam Hussein in Baghdad on December 20, 1983 during the height of the Iran-Iraq War (1980-1988). According to the National Security Archive (NSA), “Rumsfeld met with Saddam, and the two discussed regional issues of mutual interest, shared enmity toward Iran and Syria, and the U.S.'s efforts to find alternative routes to transport Iraq's oil; its facilities in the Persian Gulf had been shut down by Iran, and Iran's ally, Syria, had cut off a pipeline that transported Iraqi oil through its territory.”

The NSA goes on to say that “although official U.S. policy still barred the export of U.S. military equipment to Iraq, some was evidently provided on a “don't ask – don't tell” basis."

Paul then fast forwarded to a less benevolent period in American-Iranian relations, in 2003, shortly after US forces occupied Baghdad and taken control of the country.

Who is Ben Bernanke?

Critics tend to paint Bernanke as either a hero (he won Time magazine person of the year in 2009, despite or because of his handling of the worst downturn since the Depression), or an accomplice to the crime of the century, if not the millennium.

Bernanke, 56, attended Harvard University, and graduated with a B.A. in economics summa cum laude in 1975. His doctoral thesis was entitled “Long-term commitments, dynamic optimization, and the business cycle," with special attention on the Depression. His thesis adviser was Stanley Fischer, present Governor of the Bank of Israel.

Fun Fact: He was also an All-State saxophonist, playing in the school's marching band.

Who is Ron Paul?

Born in Pittsburgh, Pennsylvania in 1935, Paul has endeavored for much of his political career to limit the size and scope of the federal government, which he argues is the true meaning of the conservative philosophy.

Ron Paul has made a run for the American presidency on two occasions: the first attempt was in 1988 as the nominee of the Libertarian Party and again in 2008 as a candidate for the Republican Party.

The mainstream media made every effort to silence Paul (despite millions of supporters Paul was excluded from a Fox News debate in New Hampshire, just days before the primary, due to “limited space”), which motivated him to create the Tea Party movement to reduce government. In the 2010 CPAC straw poll, Paul stunned analysts by decisively winning with 31%, followed distantly by Mitt Romney and Sarah Palin.

The title of his just-released book sums up much of his lifelong work: End the Fed.

Fun Fact: In his junior year in high school, Paul set a state record for the 220-yard dash.

“A lot of cash was passed through, and a lot of people supposed it was passed through the Federal Reserve when there was a provisional government after 2003,” Paul said, in reference to the moments after the Ba’athist regime of Saddam Hussein was toppled during the American-led military operation.

“That money was not appropriated by the Congress as the Constitution says,” the congressman from Texas charged.

For unbiased observers, the possibility that the United States profited off Iraq twice –first in the 1980s when it loaned Saddam Hussein the cash to purchase American-made weapons, and then again two decades later following the demise of Saddam Hussein and the “reconstruction” of the country, is a textbook example of how the Federal Reserve may be seriously overstepping its boundaries as far as US foreign policy is concerned.

If the US really is bankrolling foreign countries for a variety of “good causes,” then it is the duty of Congress, Paul charges, to make the public aware of such transactions. Presently, at least according to the firebrand congressman from Texas, that is not the case.

But the accusations against the Fed did not stop there. Paul then went on to suggest that the money involved in the Watergate scandal was funneled onto the scene courtesy of the Bank.

From Watergate to Athens

“There have been reports that the cash used in the Watergate scandal [Watergate was the name of a political scandal in the United States in the 1970s after a break-in at the headquarters of the Democratic National Committee in Washington. The sensational trial led to the resignation of Republican President Richard Nixon] came through the Federal Reserve,” Paul said.

Incredibly, the real problem concerning these accusations, whether true or not, is that the government authorities at the time were prevented from carrying out a thorough investigation of the Federal Reserve due to the latter’s intense level of secrecy.

“When investigators back in those years tried to find out, they were always stonewalled and we couldn’t get the information.”

Finally, Paul moved the timeline of possible “shenanigans,” as he labeled the Fed’s past behavior, to the present, suggesting that “you’re working to bail out Greece now, for all we know.” [Greece is presently struggling with a debt crisis, and may need billions of dollars in aid to become solvent once again; at the same time, financial regulators suspect that outside financial institutions, like Goldman Sachs, may have concealed the real extent of Greece’s debt problems].

Bizarre allegations?

Bernanke responded to Paul’s allegations as “absolutely bizarre,” while giving his word that the Fed has no plans for bailing out Greece. Yet the possibility that such international financial transactions could occur without congressional oversight is what really rankles Ron Paul.

“These specific allegations that you’ve made, I think, are absolutely bizarre,” Bernanke responded. “And I have absolutely no knowledge of anything like you just described.”

He then told Paul that “after 5 years we produce complete transcripts of every word said in the FMOC (Federal Open market Committee) meeting, so you have every word in front of you.”

Paul refuted those claims, saying that such foreign lending practices on the part of the Federal Reserve are “easily covered up.”

“When this came out in the early years, they did have an effort [to investigate], and the Federal Reserve never participated in this, and it’s easily covered up,” Paul said. “Eventually though, because this system is not viable, and that it is this cozy relationship that we will get to the point when something will have to be done about this financial system.”

“It is in the interest of the Federal Reserve to make sure that the people don’t know,” Paul concluded.

Ben Bernanke, who just got the nod from the US Senate to serve another four years in his position as Fed chief, will probably face more "interrogations" in the near future as the United States begins to rethink the powers that it handed over to the Federal Reserve System in 1913 with the passage of the Federal Reserve Act.

For starters, critics observe, the Federal Reserve Act, pushed through Congress when many lawmakers were away on Christmas vacation, is unconstitutional.

As Ron Paul explains it: "The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy."

If the current mood of Main Street, U.S.A. is any indication, especially with the Tea Party movement in full swing, it should be no surprise that Ron Paul is finding a very receptive audience for his "revolutionary" views.