Digital currency exchange accused of biggest money laundering scheme ever

The United States government has shut down a digital currency website and jailed its executives for allegedly operating the largest money laundering scheme ever, considered by some to be “PayPal for criminals.”

Costa Rica-based Liberty Reserve has been seized by authorities

in the US following the unsealing of a federal grand jury

indictment Tuesday that charged the website and its

administrators with conspiracy to commit money laundering and

conspiracy to operate an unlicensed money transmitting business

by providing a means of channeling a currency without registering

in the US. Law enforcement agencies in 17 countries assisted with

the investigation.

In the complaint, Manhattan Attorney Preet Bharara said Liberty

Reserve was structured “as a criminal business venture, one

designed to help criminals conduct illegal transactions and

launder the proceeds of their crimes.”

“Its existence was based on a criminal business model,”

Bharara added at a Tuesday press conference.

Since 2006, Liberty Reserve has served as a portal for Internet

customers to make anonymous financial transitions on the Web, but

investigators say that service thrived on and encouraged illegal

activity. Under the guise of a currency transferring site,

authorities allege the executives of Liberty Reserve laundered

billions of dollars and “facilitated global criminal

conduct.”

“This was really PayPal for criminals,” a senior law

enforcement official told the New York Times, equating Liberty

Reserve as “a shadow banking system for criminal conduct” that

was “able to facilitate all sorts of criminal conduct that would

not otherwise happen.”

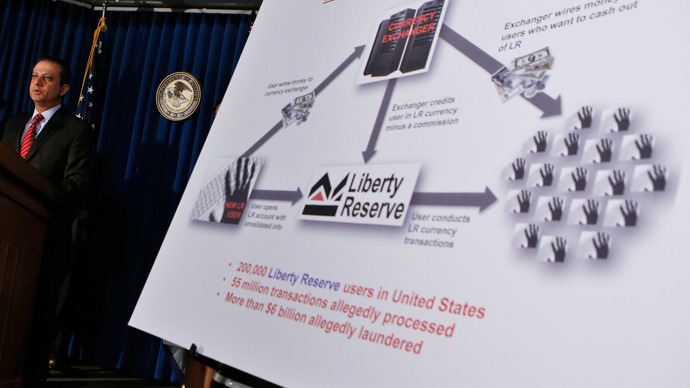

Liberty Reserve allowed users to pay for goods and services using

a digital currency that could not be traced back to a consumer

such as with a credit card by allowing customers to create

accounts using only a name, email address and date of birthday.

Because the company did not verify the identity of its users,

accounts could be created in any name. In exchange, the company

took one percent for each transaction and for an additional 75

cents offered to hide a user’s account number.

This, allege investigators, allowed Liberty Reserve to become in

a matter of just a few years the international "financial

hub" for identity theft, credit-card fraud, hacking, child

pornography and narcotics trafficking.

"The defendants deliberately attracted and maintained a

customer base of criminals by making financial activity on

Liberty Reserve anonymous and untraceable," the indictment

said.

An estimate one million users around the world have used the site

for 51 million illicit transactions at a rate of more than 12

million transactions each year, authorities claim. In all, the

site is accused of laundering over $6 billion.

Liberty Reserve’s website went offline last Thursday and its main

homepage was replaced with a Department of Justice notice that

the United States Global Illicit Financial Team, a previously

unknown association compromised of the US Secret Service, the

Treasury and the Department of Homeland Security, had seized the

site.

“Liberty Reserve’s virtual currency has become a preferred

method of payment on websites dedicated to the promotion and

facilitation of illicit web-based activity, including identity

fraud, credit-card theft, online scams and dissemination of

computer malware,” the Treasury said in the statement that

followed.

Arthur Budovsky, Liberty Reserve’s founder, was arrested Friday

in Spain on suspicion of money laundering. Four days later the

indictment was unsealed and Bharara then made his remarks about

the investigation.

Budovsky had previously operated a similar exchange site,

GoldAge, but had that operation shut down in 2006 after being

charged by American officials with operating an illegal financial

services business. He then fled to Costa Rica while serving

probation for his felony conviction, renounced his US citizenship

and registered Liberty Reserve. When word of an investigation

surfaced in 2011, Budovsky told authorities he shut-down

Liberty’s

Costa Rican operations. According to the indictment, though, the

company actually continued to function and funds were cycled

through a number of shell companies across the globe.

Security researcher Brian Krebs wrote on his blog Tuesday that

the indictment has the potential to cause a “major

upheaval” in the cybercrime economy. The charges against

Liberty Reserve come just days after Mt. Gox, the biggest name in

the Bitcoin cryptocurrency, had its assets seized by the federal

government. The US Department of Homeland Security intervened in

Mt. Gox’s operations after a federal judge signed a warrant for

the website on May 14 on suspicion of it being an unlicensed

money transfer business, also because they failed to register in

the US. Liberty Reserve did not use Bitcoin in its transactions,

instead relying on its own digital currency, the LR.

Authorities add Liberty Reserve co-founder, Vladimir Kats, was

arrested in Brooklyn, New York as part of the complaint. At least

three others have been arrested at this time, including one other

man in Brooklyn and another in Costa Rica.