Obama forces Soros to return money

If you have a million dollars to throw towards marijuana legalization, you probably are doing pretty well off.

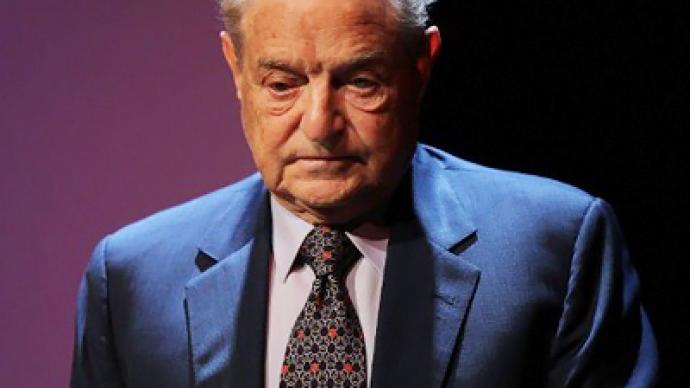

It shouldn’t come to a surprise then that, after practically bankrupting the UK and earning billions of dollars without flinching, George Soros is throwing in the towel in regards to the investment circuit.Apparently Soros has had enough of the regulations that are making the money-making game not quite as fun anymore. Now he’s giving money back to investors.Hedge fund magnate, philanthropist and old rich guy George Soros announced today that, from now on, he will only be managing money for his family and himself. The unexpected announcement marks the end of a nearly four decade career in investing that allows him to currently sit on around $25 billion.In a letter from sons Jonathan and Robert Soros, both deputy chairmen of Soros Fund Management LLC, the brothers write that “An unfortunate consequence of these new circumstances is that we will no longer be able to manage assets for anyone other than a family client as defined under the regulations.”The Soros family adds, “We wish to express our gratitude to those who chose to invest their capital with Soros Fund Management LLC over the last nearly 40 years. We trust that you have felt well rewarded for your decision over time.”The Soros Fund currently holds onto around $1 billion from outside investors but will be returning it before 2012.One billion might seem like a lot, but is only a fraction of what Soros is worth. In 1992 he bet against the British pound and made that much just through short selling sterling. He’s also contributed another $8 billion to various charities and organizations during the last 30 years. In 2010 he gave one million towards support of California's Proposition 19, aiming to legalize marijuana. Under new regulations, hedge funds worth more than $150 million will have to report more information to the Securities and Exchange Commission and be subject to periodic inspections. The Soros sons respond to this by noting that, until now, they had relied “on other exemptions from registration which allowed outside shareholders whose interests aligned with those of the family investors to remain invested in Quantum,” referencing its trademark Quantum Endowment Fund. “As those other exemptions are no longer available under the new regulations, Soros Fund Management will now complete the transition to a family office that it began eleven years ago.”