Debt doomsayer: Treasury forecasts ‘back to 2008 recession or worse’ if US defaults

The US government default caused by the ongoing budget standoff in the Congress could have a "catastrophic” effect on the country’s economy, which would be felt for decades, the Treasury Department said in report.

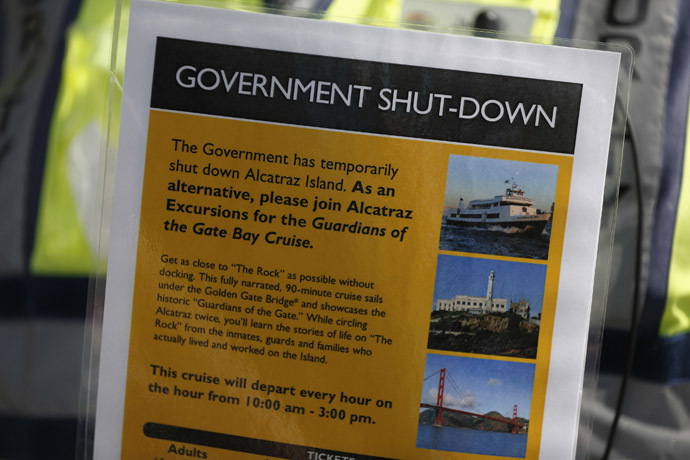

The US government went on partial shutdown this Monday after the

Democratic-led Senate turned down repeated efforts by the

Republicans to pass a budget, constraining the implementation of

‘Obamacare’ – a healthcare law, which the president considers a

centerpiece of his political legacy.

If the Congress fails to raise the $16.7 trillion federal

borrowing limit by October 17, the government could begin running

out of money to pay its bills, which would result in an

unprecedented US debt default.

“In the event that a debt limit impasse were to lead to a

default, it could have a catastrophic effect on not just

financial markets, but also on job creation, consumer spending

and economic growth — with many private-sector analysts believing

that it would lead to events of the magnitude of late 2008 or

worse, and the result then was a recession more severe than any

seen since the Great Depression,” the Treasury said in a

report on Thursday.

The consequences of the default, which include high interest

rates, reduced investment, higher debt payments, and slow

economic growth, would also be sustainable and “could last for

more than a generation,” the department warned.

The Treasury said the “we may be starting to see some

tentative signs that the current debate is affecting financial

markets,” with the crisis already shaking the Wall Street

where the Dow Jones Industrial Average dropped 136.66 points

(0.90 per cent) to 14,996.48 on Thursday.

The Treasury also noted that the negative spillovers from an

“unprecedented” US default would “reverberate around the world”

as “credit markets could freeze, the value of the dollar could

plummet, US interest rates could skyrocket.”

The International Monetary Fund has also sounded the alarm over

the American debt crisis, which is putting the world economy

under threat.

IMF chief Christine Lagarde stressed that it is "mission

critical" to urgently find the way out of the stalemate – as

she arrived in Washington for the next week’s IMF and World Bank

meetings.

“The ongoing political uncertainty over the budget, over the

debt ceiling doesn’t help. The government shutdown is bad enough,

but failure to raise the debt ceiling would be far worse and

could very seriously damage not only the US economy, but also the

entire global economy,” she said.

According to Lagarde, the economic growth in the US has already

been hurt by excessive fiscal consolidation, and will be below 2

percent this year before rising by about 1 percentage point in

2014.

Congressional action remains the only way to avoid the US

default, an unnamed Treasury official told the reporters.

He stressed that the Treasury Department has no plans of using

the Constitution’s 14th Amendment, which says that the validity

of the US public debt “shall not be questioned,” to get

around the debt limit.

But there are no signs that the budget dispute will be solved

before being dragged into a second week, with all of the

government’s non-essential workers sent home due to the

shutdown.

Obama has refused to negotiate on raising the debt ceiling with

the Republicans, saying that offering concessions would set a

poor precedent for future heads of the White House.

"If we screw up, everybody gets screwed up. The whole world

will have problems," he said in his emotional speech on

Thursday, adding that the debt default would throw the US economy

back into a recession.

The president stressed that Republican House Speaker John Boehner

could bring the government back to work “in just five

minutes” by passing a temporary operating budget, but he’s

not doing it because “he doesn't want to anger the extremists

in his party.”

"Take a vote, stop this farce and end this shutdown right

now," he urged the Republicans.

Meanwhile, the Congress may pass a measure on Friday, which will

see federal workers receive back pay for the period when they’ve

been out of the office due to government shutdown.

Members of the House of Representatives and Senate have filed

bills that would ensure all federal employees receive retroactive

pay for the duration they’ve been off work.

‘Default will be avoided, but it’ll still hurt’

The US government is going to avoid debt default after all, but

the after-effect of the budget standoff in Congress may be

equally painful for the economy, Kenneth Levin, professor of

economics at City University of New York, told RT.

“I think there’s going to be a threat of default,” he

said. “I think they will let the October 17 deadline pass. I

think the Obama administration will find a way to get some extra

funding to avoid a default on the Treasury bonds,” he said. “But

at the same time, you know a write down or some sort of

devaluation of your investment is almost the same as a default.

There are different forms of default. If we have higher interest

rates, if we have a runaway inflation, if we have higher taxes,

if the value of the dollar falls – all of those are different

forms of default, but you don’t call it a default.”

In order to get the affordable health care act, the Obama

administration would have to make more concessions on the debt

ceiling if it wants the crisis to end, the professor stressed.

According to Levin, the real problem isn’t Obamacare or debt

ceiling, but the fact that “the American economy isn’t growing

fast enough to sustain all the demands on it, especially the

debt.”

“Just remember that the national debt has grown at the same rate

as household debt. So, there’s no tax pays or post-tax pays that

is a salary base for people to continue to pay all the household

debt and cover the national debt,” he said.

The US economy requires “significant restructuring” to

provide the necessary growth, but the professor isn’t sure the

issue will ever be addressed by the government.

Levin also mentioned that it isn’t the first time that the US

Congress hasn’t been able to pass the budget by October 1.

“It’s the 12th consecutive year that they failed to have met

[sic] the deadline,” he said. “The only reason there

hasn’t been a shutdown for the last 12 years, there’s always been

these temporary resolutions – that is a bill for six-week

temporary resolution that [Republican] speaker of the house, John

Boehner, is refusing to put before the Congress for vote right

now.”

With law providing no mechanisms to persuade the Republicans to

move on with the budget, the professor suggested that the current

situation in the Congress indicates “some sort of constitutional

crisis.”