Putin allows Russian banks to share tax data with US

Russian President Vladimir Putin has signed a law allowing Russian banks to share the tax data of American clients with US tax authorities, but participation isn't obligatory.

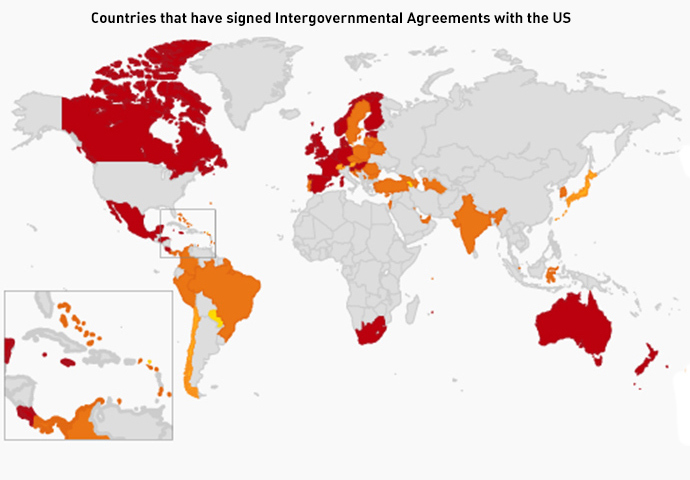

Russia, unlike other countries, hasn't signed an Intergovernmental Agreement with the US, after the US Treasury Department suspended negotiations with Russia in March 2014.

Under Russian law it is illegal for banks to disclose confidential information to foreign governments, but the new amended legislation will allow Russian banks to provide the US International Revenue Service (IRS) with taxpayer information on American clients.

Red:Model 1 of IGAs signed: Australia, Belgium, Canada, Cayman Islands, Costa Rica, Denmark, Estonia, Finland, France, Germany, Gibraltar, Guernsey, Hungary, Honduras, Ireland, Isle of Man, Italy, Jamaica, Jersey, Liechtenstein, Luxembourg, Malta, Mauritius, Mexico, Netherlands, New Zealand, Norway, Slovenia, Spain, South Africa, United Kingdom.

Orange:Model 1 agreed in substance: Antigua and Barbuda, Azerbaijan, Bahamas, Barbados, Belarus, Brazil, British Virgin Islands, Bulgaria, Colombia, Croatia, Curacao, Cyprus, Czech Republic, Georgia, India, Indonesia, Israel, Kosovo, Kuwait, Latvia, Lithuania, Panama, Peru, Poland, Portugal, Qatar, Romania, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Seychelles, Singapore, Slovak Republic, South Korea, Sweden, Turkey, Turkmenistan, Turks and Caicos Islands, United Arab Emirates.

Light Orange:Model 2 IGA signed: Austria, Bermuda, Chile, Japan, and Switzerland.

Yellow:Model 2 agreed in substance: Armenia, Hong Kong, Paraguay.

Before client information is sent to America, it will pass through the Central Bank of Russia and other local financial or government agencies, which still have the right to keep the information private.

Customers will have to give the bank permission, however banks can stop servicing clients who refuse to share their information.

The law simply gives Russian banks the ability to work with FATCA, but does not deem it obligatory. In Russia, only 10 percent of capital in the financial system is owned by foreigners or foreign entities. Participating Russian banks had to register by May 5, 2014.

“We already have Russian banks that have registered and implemented procedures, now it’s up to banks to have a pragmatic approach,” Alexander Sinitsyn, Director of Banks and Financial Services at Deloitte, told RT.

Russia’s Ministry of Finance is working on providing a framework to cooperate with FATCA.

The law will only apply to American individuals and entities.

Some Russian banks have decided to cut out American clients, to avoid the headache of paperwork and bureaucracy. VTB, Russia's second-largest lender, announced in early June it wouldn't prolong existing contracts or take on new American clients.

According to the US Treasury Department 77,000 banks from over 80 countries have registered to comply with FATCA.

France, Italy, Germany, the UK, and Spain were the first countries to sign up for the information swap, and Japan and Switzerland followed.

Cooperation with FATCA will in theory prevent banks from fines related to tax evasion, but many countries still view it as intrusive and not mutually beneficial.