Argentina not negotiating multimillion debt, say holdout creditors

A key holdout creditor in dispute with Argentina over a massive, decade-old sovereign debt dispute said the country is not committed to negotiating following five hours of meetings in New York.

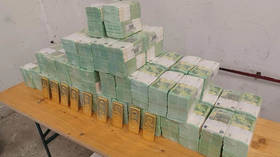

The Latin American nation defaulted on some US$100 billion worth of sovereign debt in 2002 – an event which triggered what most economists would consider a worst case scenario, with a run on banks, GDP contraction for years, and political turbulence which saw the country’s president, Fernando de la Rua, ousted from power.

Twelve years after that historic default, one holdout creditor

firm, Elliott Management Corp, has continued a legal fight to

compel Argentina's government to substantially improve its payout

to investors. The terms offered to the bulk of investors for

repayment are considered the worst in recent history, according

to Reuters. Those investors received between 25 cents and 29

cents on the dollar.

Argentina was able to offer large-scale debt swaps by 2005,

thanks to a surprising economic recovery, reducing bonds in

default to 76 percent, and by 93 percent in 2010. The terms of

those debt exchanges were not accepted by all bondholders,

however, including hedge funds Elliott Management Corp and

Aurelius Capital Management.

Creditors which rejected the country’s debt restructuring became

known as holdouts, or as “vulture funds,” as their bonds were

purchased on the secondary market rather than directly from

Argentina for cents on the dollar following the 2002 sovereign

default. Both Elliott and Aurelius specialize in acquiring

discounted or distressed debt, and later negotiating favorable

settlements through courts.

Holdout creditors have won a judgement of $1.33 billion, plus

accrued interest. Those investors met with Argentine government

officials on Friday – not in the same room, but rather separately

through a court-appointed mediator. Apparently the sides failed

to make up any ground.

“No resolution has been reached. It is my hope that there will be

future dialogue," Daniel Pollack, the court’s special master

and mediator, said in a statement.

The stakes for the country could scarcely be higher, as the

third-largest Latin American economy faces another default amid

an economic recession, one of the world’s highest inflation

rates, and tight foreign reserves. Argentina has insisted that US

District Judge Thomas Griesa, who has overseen the proceedings in

New York, reinstate a suspension on his judgements before

negotiations continue. The holdout creditors have countered that

the country refuses to negotiate without preconditions.

"Argentina is still refusing to negotiate with its creditors,

either directly or indirectly, about any aspect of this dispute,

and we have not heard that it has any plans to change

course," according to Jay Newman, portfolio manager at

Elliott Management Corp's NML Capital Ltd.

"Simply put, we have not seen any indication that Argentina

is serious about even beginning a negotiation," Newman said.

If Argentina seems to be dragging its heels on negotiations, that

is because the country has been compelled to either pay holdout

debt holders at the same time it repays those who have already

agreed to the debt restructuring, or not pay at all.

A new stay would allow Argentina more breathing room beyond a

July 30 deadline for a $539 payment currently in limbo with Bank

of New York Mellon, which cannot be disbursed to bondholders

following Griesa’s order. The situation has left Mellon in the

unusual situation of asking the court what, precisely, it should

do with Argentina’s deposit.

The latest legal wranglings are a result of the US Supreme Court

declining to take up the case on June 16, setting into motion the

current impasse.

Holdout creditors have indicated that they would be willing to

discuss allowing Buenos Aires to repay bondholders who previously

agreed to the debt restructuring if progress is made prior to the

July deadline, suggesting that the ongoing negotiations may yet

produce a settlement that avoids another default by Argentina.