6 useful things you need to know about the rapid descent of the Russian ruble

The Russian ruble has lost more than 20 percent against the US dollar since the beginning of the year, but what does that really mean, for Russia, its people, and economy? RT talks to Ben Aris, Editor-in-Chief of Business New Europe, to find out.

READ MORE: Putin says no capital controls in Russia, as currency hits record lows

1. Russia has decided on no capital controls. What’s your take on it?

“Russia, out of all the emerging markets, is the only one that has a total open current account you can transfer money in and out without any restriction from day to day. And this is very important for investors; because if they make money they have to be sure that they take it home.”

2. The last time Russia introduced capital controls was in the aftermath of the 1998 ruble crisis. Is this a repeat scenario?

“If they were to introduce capital controls, it’s usually a measure of last resort when your hard currencies reserves are running out to nothing and you’re desperate for every dollar to pay for imports. Russia is far away from that position and has $450 billion - the third largest reserves in currency in the world - so there is no need for capital controls.”

3. At what stage would Russia need to enforce capital controls?

“A full-blown financial meltdown is the point you start reaching those kinds of mechanisms in order to keep the whole show going. You can point to Ukraine as an example, Ukraine is in a financial crisis and the economy is expected to contract by at least 8 percent his year and they introduced capital controls about 6 months ago."

"Russia has a huge cushion of cash, and doesn’t need to do that.”

4. Would moving towards a free floating currency help Russia?

“It does. Because it also acts as a cushion. If there are shocks or economic pain then the ruble will devalue as it has been- it’s lost 20 percent of its value this year.”

5. Who benefits from a weak ruble?

“What it does is it makes Russian products cheaper, makes it easier to export, you can add more revenue- the oil companies in particular benefit do extremely well because their costs are in rubles, but revenue in dollars.”

6. How does Russia balance high inflation and slow economic growth?

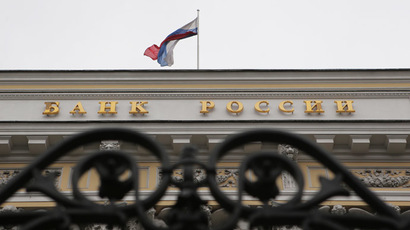

“Inflation is being driven by non-monetary factors. That is to say, usual things you do to bring inflation down is to attach to monetary policy, how many rubles you print, and none of these things are actually pushing inflation up, it’s things like food prices, which are outside of the central bank. So she [Central Bank Chief Nabiullina, Ed] has a very hard job of trying to manage inflation- because she doesn’t actually have any tools to deal with it. So this is a wider problem of structural reform, lifting the sanctions and ending sanctions on European food, investing into agricultural. But these things will really only start to kick in and make a difference a couple year down the road. In the meantime, they will have to muddle through the best they can.”