Rising dollar major threat to global economy - study

The durability of the dollar isn’t a given, and pressure in the $12.3 trillion US Treasury market is causing alarm. A study by the Bank for International Settlements (BIS) suggests dollar dominance could spell disaster for emerging markets.

The spectacular recovery by the US dollar could ruin emerging market economies that have large dollar-denominated debts, which in turn could trigger chaos in the global financial markets, the Swiss-based global watchdog said.

“Should the US dollar - the dominant international currency - continue its ascent, this could expose currency and funding mismatches, by raising debt burdens,” Claudio Borio, Head of the Monetary and Economic Department at the BIS, said in the Quarterly Review published December 7.

The Bank for International Settlements, dubbed the bank for central bankers, warns of the imbalance between dollar debt and dollar output, and said it could have a “profound impact on the global economy.”

Cross-border dollar transactions have tripled to $9 trillion in the last decade, $7 trillion of which is outside of the US, according to the BIS. Companies in emerging markets have amassed $2.6 trillion in dollar-denominated debt.

Over the past few years, non-bank capital flows to EMEs have surged via three main channels - http://t.co/eTIppWMq4Cpic.twitter.com/LsaP0DGmn5

— Bank for Intl Settl. (@BIS_org) December 8, 2014

“A long-standing puzzle in international finance is the durability of the dollar's share of foreign exchange reserves - which remains above 60 percent, while the weight of the US economy in global output has fallen to less than a quarter,” the report says.

This means that America’s trillion dollar debt problem isn’t isolated to the US, but includes the countries that also hold US debt- including China, Japan, Russia, the UK, and hundreds of others.

A tightened monetary policy by the US Federal Reserve, paired with the strong dollar, could exacerbate debt problems in emerging markets.

A strong dollar, as pointed out by Borio, can raise debt burdens for countries with weaker currencies, as a strong dollar has historically triggered turmoil in emerging markets, such as in Latin America in the 1980s, and Asia in the 1990s.

In response to these crises, governments have tried to move away from the dollar, cut back on foreign borrowing, and have buffed up central bank reserves to protect from a repetition.

READ MORE: ‘BRICS system’ – healthy alternative to ‘defunct dollar system’

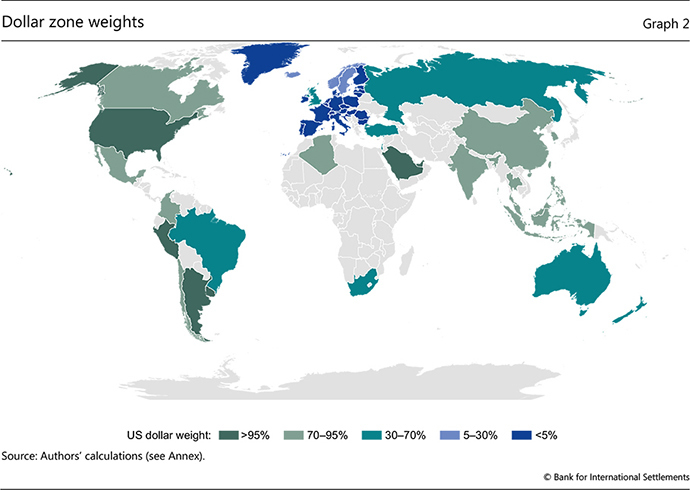

The report authors established each country’s relative stability to dollar exchange rates, concluding that if a currency varies less against the dollar than other major currencies, then dollar reserves pose less of a risk when returns are measured in the domestic currency.

Outdated

The dollar emerged as the predominant foreign currency reserve after World War I and again with the Bretton Woods agreement and then in the early 1970s, when the gold standard was officially abolished.

However, even though the dollar has decreased 18 percent in value against other major currencies like the euro and the yen, its foreign currency reserves remain little changed. In 1978 global dollar reserves stood at 66 percent, and 36 years later, at 61 percent.

“If one takes the size of the US economy to explain the dollar's share, then one might infer that this share would decline only slowly unless and until another economy surpasses the US economy in size,” the report says.

READ MORE: China surpasses US as world's largest economy based on key measure

Dollar dominance relative to GDP is “at first puzzling” given the euro’s expanded influence as well as Asia’s fast growth, but the authors explain hot Asian growth has actually acted against the spread of euro influence, which accounts for the strong dollar peg in many Asian currencies.

Most vulnerable

The study finds that the amount of dollar reserves a country decides to keep is directly correlated to the currency’s dollar weight, which they dub as the “dollar zone weight.”

“We find that the higher the co-movement of a given currency with the dollar, the higher the economy's dollar share of official reserves. Two thirds of the variation in the dollar share of foreign exchange reserves is related to the respective currency's dollar zone weight,” it says.

Among the biggest holders of reserves are emerging economies such as Brazil, South Korea, Hong Kong, Russia, Turkey, China, Saudi Arabia, Singapore, Mexico, Algeria, Thailand, and Taiwan.

Dollars remain heavily weighted in the Americas, especially in highly-dollarized Peru and Uruguay. In Europe, most central banks hold fewer dollars, whereas countries like Russia, Turkey, the UK, Australia, and New Zealand fall in between.

The Russian economy has particularly suffered at the expense of the rising dollar, and its currency has lost more than 40 percent against the greenback this year. Russia has $715 billion in debt, mostly held in dollars.

READ MORE: Cheaper oil takes Russian ruble to new lows; officials say no reason to worry

Most economies outside the United States, the euro area, and Japan are intermediate cases, with dollar zone weights of less than 95 percent and above 5 percent.