US Shale oil production may have maxed out - EIA

The shale oil boom may be over, judging from the latest report from the US Energy Information Administration, which said oil output from America’s seven most productive shale formations will decrease for the first time in four years.

The report has had an effect on the oil market with Brent, the benchmark for more than half of the world’s oil, trading above $58.25 per barrel, a 0.55 percent increase, and WTI, the North American blend, advancing one percent to $52.44 at the time of publication.

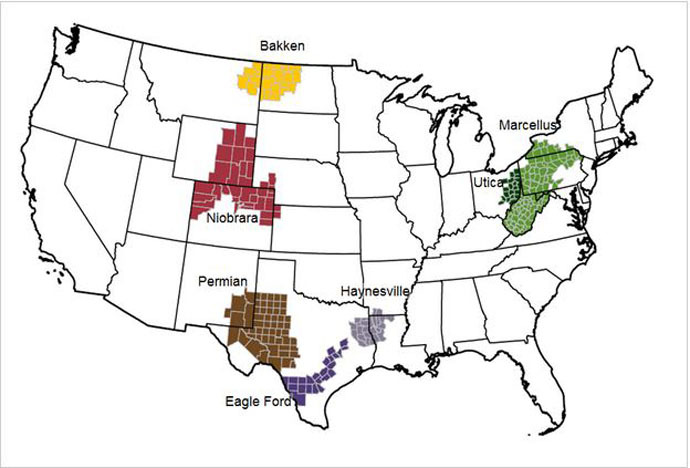

Production from Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian and Utica will only product 5.56 million barrels of crude oil per day in the next month, compared to 5.62 million barrels per day (bpd) in April, the organization said in its monthly Drilling Productivity report, published Monday.

The imminent decrease marks a sharp turnaround from 2014, when crude oil production in the US hit a 100-year high.

The decline is directly correlated to the number of active oil rigs, which at 802, is at its lowest number since March 4, 2011, according to Baker Hughes.

“We’re going off an inevitable cliff,” because of the shrinking rig counts, Carl Larry, head of oil and gas for Frost & Sullivan LP, told Bloomberg News. “The question is how fast the decline is going to go. If it’s fast, if it’s steep, there could be a big jump in the market.”

The so-called cliff so far only looks like a slightly rounded plateau for April, which the agency only believes will lose 2,098 barrel per day in production. However, in May, this drop will intensify, as the EIA predicts a loss of 56,673 barrels per day. To compare, output increased by more than 100,000 bpd in November and February.

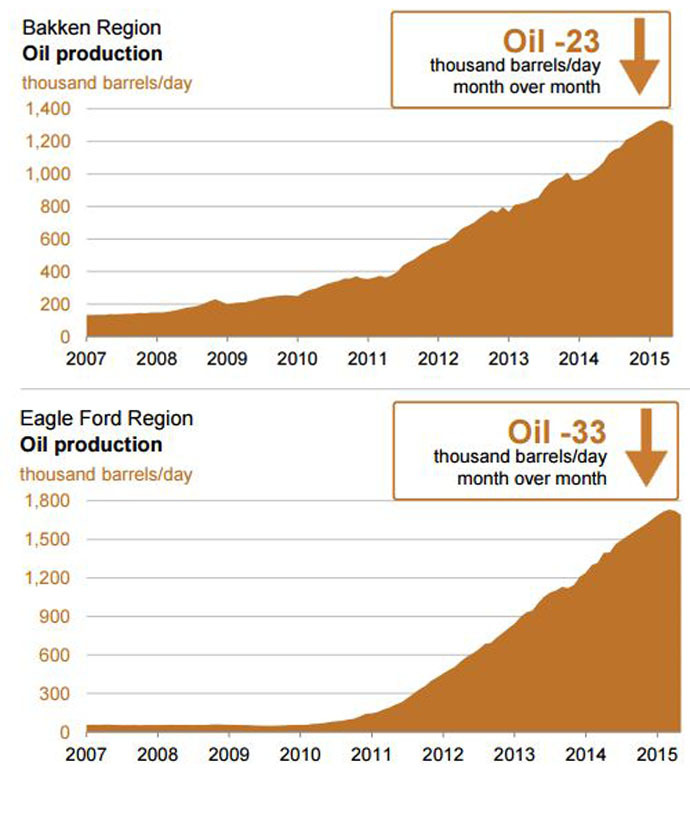

The graphs below shows how much production will be hit in the nation’s two biggest producers. The Bakken shale formation in North Dakota, believed to contain the most recoverable crude oil, will see output decline by 23,000 barrels per day and production from Eagle Ford in Texas, the second-largest oil field in the US, is expected to fall 33,000 barrels per day.

Perhaps oil prices did succeed in squeezing out the more

expensive to produce North American shale. In November, the OPEC

oil cartel decided to keep production high and provide no relief

to the supply glut, a move that was seen as analysts as a way to

hamper American shale competition.