Crude falls below $35 a barrel for first time since 2009

Oil prices on Monday plunged to their lowest level since 2009 as OPEC continues high volume production and Iran plans to boost exports. Brent crude was down below $37 a barrel while the US benchmark WTI fell below $35 per barrel.

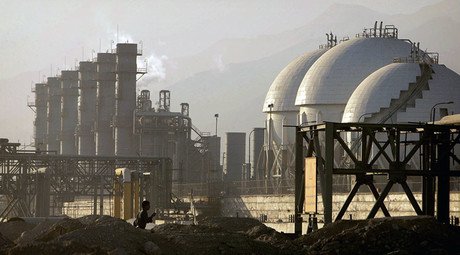

There’s “absolutely no chance” Iran will delay its plan to increase shipments even as prices decline, Bloomberg cited Amir Hossein Zamaninia, Iran’s deputy oil minister as saying. Tehran which expects international sanctions over its nuclear program to be lifted early in January, aims to double crude exports. The country currently exports 1.1 million barrels per day.

Oil prices could slump to $30 per barrel in 2016 and could stay low throughout the year, said Russian Finance Minister Anton Siluanov, warning of tough times ahead.

Deputy Finance Minister Maxim Oreshkin said Russia is drawing up plans based on the price fluctuating between $40 and $60 until at least 2022.

That scenario would have devastating implications for OPEC, according to Oreshkin. It would also spell disaster for North Sea producers, Brazil’s off-shore projects, and heavily indebted Western producers. “We will live in a different reality,” he added.

According to the head of Russia's Central Bank the average crude price for next year would be $35 per barrel. Elvira Nabiullina said that at that price Russian GDP would fall by two to three percent along with investment and real wages.

The International Energy Agency’s report last week added to the concerns as it warned the global oil glut would persist at least until late 2016 with oversupply and slowing demand.

According to the Telegraph's Liam Halligan, the slump in oil prices reflects supply patterns driven almost entirely by geopolitics that could quickly shift. Just as fast as crude prices have fallen over the past year or so, they “could easily spring back again,” Halligan writes.

"Then there’s Russia, outside OPEC and constantly vying with the desert kingdom to be the world’s biggest oil producer. An OPEC production cut, the increasingly paranoid Saudis’ fear, would make yet more room for Russian crude,” Halligan added. Moscow is “less bothered about cheap oil than Riyadh – given that, in ruble terms, prices have not fallen so far," he said.

Russia continues record oil production – energy ministry https://t.co/jhDlyQW6FLpic.twitter.com/UBr7qV0CxH

— RT (@RT_com) December 2, 2015

Halligan’s analysis echoes experts who say the low oil price may have had no impact on Russian output, which is currently hovering at post-Soviet record levels. Russian crude production reached 10.77 million barrels per day (bpd) in October with 5.32 million bpd destined for export.