Eastern Attraction: Australia to buy $2.1bn in Chinese bonds

The Reserve Bank of Australia announced it will transfer 5% of its foreign currency reserves ($2.1 billion) into Chinese bonds, deepening ties with its Pacific neighbor and biggest trade partner, and reflecting a global shift to the yuan.

RBA Deputy Governor Phillip Lowe went public with the People’s Bank of China approval in front of a business audience in Shanghai on Wednesday.

"Our current intention is to hold around 5% of Australia's foreign currency assets in China," Mr. Lowe said, and hinted the switch would be completed by the end of the year.

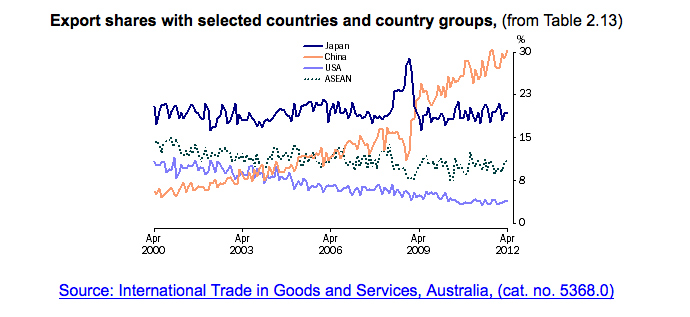

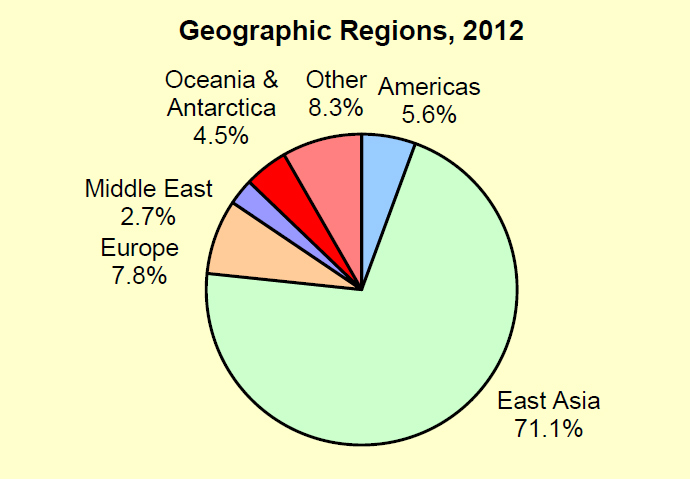

According to the Australian Department of Foreign Affairs, in 2012 71.1% of exports went to Asia, about 30% to China, only 7.8% to Europe and 5.6% to the US. A switch to the yen is a tactical business move for Australia, since their business fulcrum is in the east.

The RBA currently allocates 45% of its foreign reserves to the US, 45% to Europe, 5% to Japan, and 5% to Canada.

The move is an “important milestone in deepening our financial and economic linkages with China,” Australia’s Treasurer Wayne Swan said in an emailed statement to Bloomberg.

The RBA’s announcement comes shortly after their agreement with China to make the Australian dollar and yuan directly convertible.

The convertibility and the bond reserves will encourage more Australian-Chinese business, as Australian businesses will no longer have to change foreign currency earnings into dollars first. Conducting business in yuan will give import/export industries a competitive advantage.

Australia is the fifth largest importer of Chinese goods. Between 2011-2012 it imported $15.1 AU ($15.4 million) of telecom equipment, computers, clothing, and furniture from the world’s second largest economy.

According to its website, as of March, the RBA holds currency assets of $39.2 billion.

Australia’s top exports in 2012 were iron ore (26%), coal (17%), and gas (6%).

Dollar in decline

On Monday, China’s currency hit a record high against the US dollar, which confirmed currency analysts’ speculation of a dominance shift from the West to the East.

Treasurer Swan, in his email to Bloomberg, confirmed Australia’s currency allegiance.

“Strong financial linkages between our economies will ensure that Australia is even better positioned to benefit from the shift in global economic growth towards Asia,” said Swan.

The Wall Street Journal published an article in April entitled, “Why the Dollar’s Reign Is Near An End,” by a University of California, Berkeley economics professor.

Barry Eichengreen wrote, abolishing the US dollar as the world’s reserve currency will open up opportunities for European and Asian companies.

“The same will be true of companies in other countries that do most of their business with China or Europe,” wrote Eichengreen. “It will be a considerable convenience—and competitive advantage—for them to be able to do that business in yuan or euros rather than having to go through the dollar,” Eichengreen wrote.

However, it’s not necessarily an end-sum game - just because China prospers doesn’t mean the US must suffer. Our financial system is far too mature for such rationale, and the diversification in reserve funds is a reflection of this maturity.