Emerging crisis: India's rupee punished amid investors' 'flight to safety'

The rupee has touched an all-time low of 68.75 against the dollar Wednesday on fears India’s cheap food plan would increase the budget deficit. Surging oil prices and tapering Fed stimulus could push the rupee and other emerging market currencies down.

"This is [rupee’s fall] unprecedented and we are in

unchartered territory for the rupee," BBC quotes Vishnu

Varathan, an economist with Mizuho, who added that he expects the

rupee to fall to the 70 mark against the US dollar.

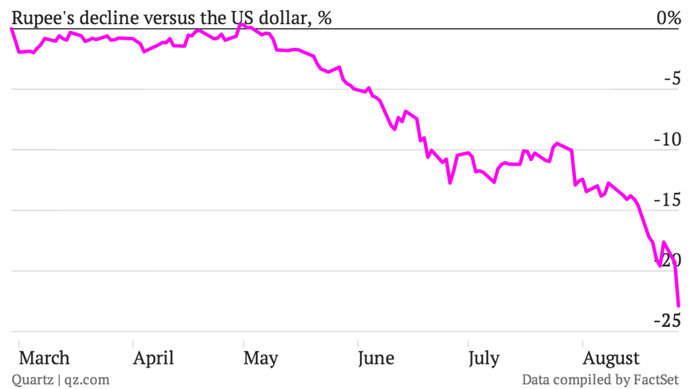

The Indian currency is one of the world's worst-performing

currencies this year, as it has lost over 20 percent of its

value.

India’s rupee

nosedived, after the country’s lower house of Parliament okayed a

$20 billion plan to provide cheap grain to the poor. This raised

concern that India’s sky-high fiscal deficit will rise even

further.

On Wednesday BNP Paribas cut its growth forecast for India for

this fiscal year to 3.7 percent from 5.2 percent - the slowest

pace since 1992.

A jump in oil prices amid fears of military action against Syria

has also knocked Asian Markets. An 8.9 percent jump in Brent

crude in August is set to boost costs for India, which imports

almost 80 percent of its oil, Bloomberg reports. This may fuel

the country’s inflation and worsen India's deficit.

International investors have withdrawn nearly $12bn from India's

markets since the beginning of June, according to the BBC.

Investor confidence was mainly hurt by the expectation the Fed

will begin to cut its $85 billion a month bond purchase

stimulus. As developed economies are sending more signals

they are getting closer to a recovery track, emerging economies are starting to feel increasing pressure. In

the past three months emerging markets have seen an exodus

of cash, with their 20 most-traded currencies falling more than 5

percent.

Investors are now hastening to buy dollars before the US caps its

monetary stimulus, Natalya Orlova, Alfa Bank’s chief economist,

told Business RT. “They are buying up greenbacks now, giving

emerging economies their domestic currencies back,” she said.

“It’s all part of a general flight-to-safety trade --

investors are liquidating positions in riskier assets,”

Bloomberg quotes a currency strategist at Bank of

Tokyo-Mitsubishi Lee Hardman.

Barclays investment bank is bearish on Turkish Lira, Indonesian

Rupiah, South African Rand and the Indian Rupee.

The bank’s report notes that domestic inflation pressures have

driven some emerging market central banks, including Brazil's,

into action and more central bank measures could follow, but adds

that "India's decision to tinker with capital controls only

brought renewed funding pressures, setting an example for the

rest the EM space."

The Russian rouble has been weakening throughout the summer,

sharing the emerging market currencies trend. The Russian

currency lost 8% against the dollar over the last six months, but

Brazil’s currency fell by 21%, the Indian rupee by 19%, the South

African rand by 15%, Indonesian rupiah by 12%, and the Turkish

lira by 12%.

Russia has one of the lowest national debt-to-GDP ratios in the

G20, which helped keep the currency market fairly stable.

“The currencies of other emerging markets with imbalanced

government finances fell deeper than the Russian rouble”,

Voice of Russia radio quotes Senior Economist at Sberbank Anton

Stroutchenevski.