‘Web of financial secrecy’: Britain, satellites dominate tax haven rating

The UK is “by far the most important” player on the global financial secrecy market. While only ranked 21 on the Tax Justice Network index, the aggregated web of jurisdictions around the world makes Britain the top router of global financial secrets.

“Our index reveals that Britain plays a key role in the global

market for financial secrecy,” John Christensen, director of

the Tax Justice Network said in a statement.

This, despite David Cameron’s recent G20 drive to crack down on

tax avoidance and promoting tax transparency.

“The City of London uses a web of satellite secrecy

jurisdictions based on British crown dependencies and overseas

territories to channel huge illicit flows which feeds London’s

mad property boom,” Christensen added.

The findings by the non-aligned network of researchers and

activists were presented to Britain’s monarch Queen

Elizabeth II before the index was released.

“Britain, taken together with its Overseas Territories and Crown

Dependencies, is by far the most important part of the global

offshore system of tax havens or secrecy jurisdictions,” the

letter read.

The note to the Queen also mentioned that the Prime Minister of

the country, David Cameron, is doing little to deliver on his

pledge to provide more transparency.

“Our findings show that these jurisdictions still fall

woefully short of acceptable standards of transparency, having

made only modest reforms since 2009, when the G20 led by your

government committed itself ‘to take action against

non-cooperative jurisdictions, including tax haven,’” the

message to the Queen read.

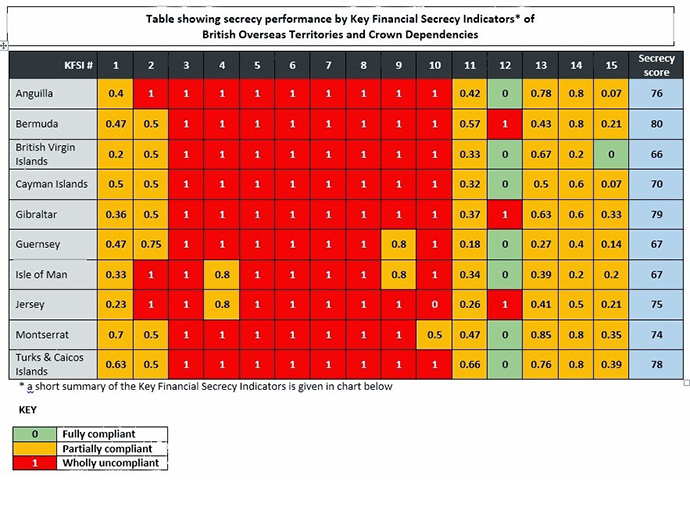

To show the extent of the divide between the political ambitions

and actions on-the-ground of British tax havens, the research

group has published an illustrated table on their website along

with the statement that once again criticized UK’s leadership.

“The crown dependencies and overseas territories have long been considered among the worst offenders of world tax havens", Salman Shaheen, editor for International Tax Review magazine told RT.

“What is surprising is that the British government is not

doing very much about it. I mean it has introduced certain

legislation to clean up its own companies onshore but it really

needs to get its work on tax havens offshore in order,”

Shaheen said.

Overall Tax Justice Network ranked 82 global financial jurisdictions, 10

of which are directly connected to UK, whose head of state is the

British queen. They include places like the fourth-ranked Cayman

Islands, fourteenth-ranked Bermuda and the British Virgin Islands

ranked 20th.

According to the financial secrecy watchdog, up to US$32 trillion

is sitting in offshore zones where it is either untaxed or

slightly taxed.

“Rolling back the secrecy that shrouds up to $32 trillion in

offshore financial assets remains one of the great challenges of

the 21st century,” Christensen said in a statement

The report believes that offshore zones have cost African

countries over $1 trillion since the 1970s of which $640 billion

came from 16 Commonwealth countries.

“These losses dwarf the external debts of ‘just’ $190 billion for

the 33 countries, meaning that Africa is a major net creditor to

the world, contrary to what is widely believed,” the letter

said.

“The yawning gap between fact and fiction in the fight over

global financial transparency is only just starting to shrink.

Important shifts – such as the European Union’s decision to curb

one important aspect of banking secrecy from 2015 – mask waning

momentum for other urgent changes elsewhere,” Markus Meinzer,

lead researcher for the Financial Secrecy Index said.

The ranking was calculated by combining a secrecy weighting

scale, that factors in components such as banking secrecy and

anti-money laundering regulation, with the jurisdiction’s share

of services of the world’s total.

The three highest ranking countries on 2012 financial secrecy

index are Switzerland, Luxembourg and Hong Kong.

Switzerland, the “grandfather of the world’s tax

havens”, accounts for just fewer than 5 percent of the

global market share of offshore financial services.

Last year the country managed about a quarter of the world’s

total assets or approximately $2.8 trillion, according to

the Swiss Bankers’ Association.

“Switzerland has also been playing the spoiler, striving to block

or derail emerging international transparency

initiatives,” the watchdog said on its website.

Luxemburg, a tiny EU nation, has also been accused of undermining

transparency efforts, when it was placed second on the

index.

“Outside what might traditionally be regarded as the financial

sector, it also runs a lucrative line in hosting holding

companies of transnational corporations, principally to help them

avoid (and evade) tax. It is also strenuously seeking to build up

an industry based on Islamic finance, and in October 2012

achieved a further fillip when a group of major Chinese banks

said they were departing the (very lightly regulated) London

markets in favor of the even less regulated

Luxembourg,” the country profile reads.

Hong Kong has been ranked third for the rapid growth of offshore

industries in Asia that expanded with the overall economic growth

on the continent. One of two Chinese Special Administrative

Regions, the island accounts for over 4 percent of the global

market share for offshore financial services and is

the “fastest growing secrecy jurisdictions or tax havens

today.”

“Our Index shows that too many jurisdictions still help tax

evaders hide their identities and assets behind shells and

smokescreens,” Moran Harari, researcher for the

Financial Secrecy Index said.

“Without public disclosure of the beneficial owners of these

assets, and the automatic exchange of information between

jurisdictions to provide the information that law

enforcement and tax authorities need, it will be impossible to

tackle some of the world’s most pressing problems.”