Who will threatened sanctions hit most? US-EU-Russia trade in numbers

US lawmakers are already threatening Russia with economic sanctions over the crisis in Ukraine. Trade, business, investment, and G8 membership closely link the Russian, American and European economies.

While the West is considering going down the 'sanction road', here's a look at what's at stake for the markets.

Unified view by G8 & more that they will not engage with #Russia as business as normal. Russia inviting trade isolation. @meetthepress

— John Kerry (@JohnKerry) March 2, 2014

Trade

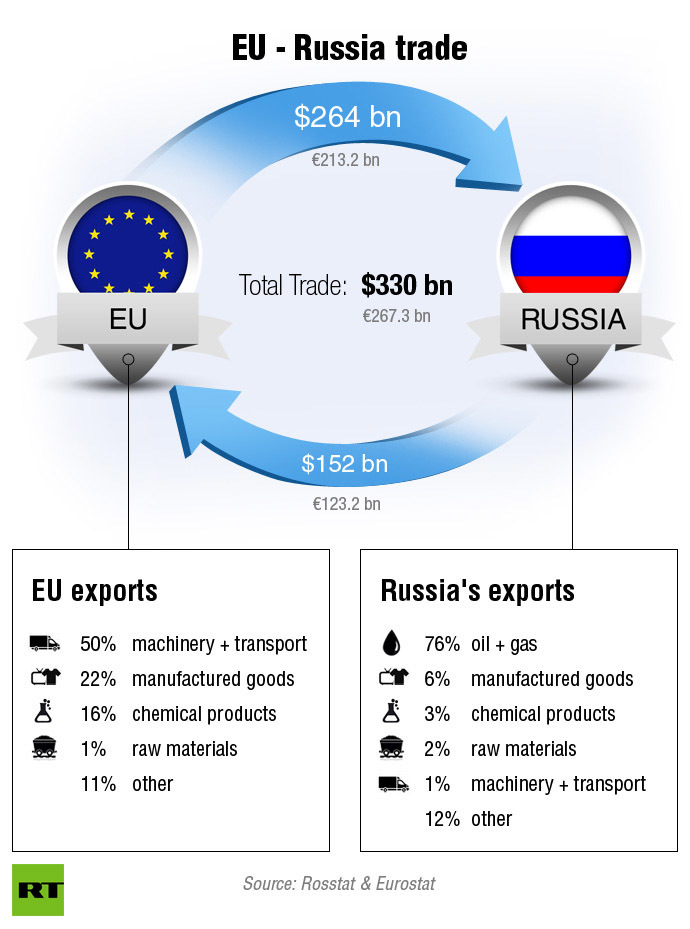

In terms of billions of dollars, trade is higher between Russia and the EU, but the US remains Europe’s biggest export market.

Net trade between Russia and the US was $38.1 billion in 2013, according to US Chamber of Commerce data. The US exported $11.26 billion to Russia, and imported $26.96 billion worth of goods.

Russia exports more than $19 billion of oil and petroleum products to the United States, as well as $1 billion in fertilizer products, according to Chamber of Commerce data.

"Is Russia going to be cut off from the world? That is very unlikely given what Russia provides to the world, which are oil, gas, raw materials," Alexis Rodzianko, president of the American Chamber of Commerce in Russia told Reuters.

Russia is very dependent on trade with the EU, as member states account for about 50 percent of total Russian imports and exports. In 2012, trade between the two neighbors reached €267.3 billion.

One of Russia’s most valuable exports to Europe is something factories and households run on every day: natural gas. Europe imports one-third of its natural gas from Russia, with Germany being the biggest client importing nearly 30 billion euro annually. In 2012, 75 percent of all European imports from Russia were energy.

Many countries in Europe have strategic partnerships with Russia’s state-owned gas giants, Rosneft and Gazprom.

According to Eurostat data, Russia accounts for 7 percent of total imports and 12 percent of total exports in the 28 European Union bloc, making it the regions third most important trading partner, behind the USA and China.

US companies with big Russia presence

Several of America’ biggest companies- Boeing, Cargill, Ford, General Motors, ExxonMobil, to name a few- all have a huge presence in the Russian market.

Boeing’s investment in Russia is deep, as the aerospace carrier sources a considerable amount of steel, titanium, and aircraft parts from Russian companies. Boeing receives about 35 percent of its titanium from state-owned, Rostec. In 2013, Boeing’s deliveries to Russian carriers were valued at $2.1 billion, and the company plans to spend $27 billion in Russia, Bloomberg reports.

“We are watching developments closely to determine what impact, if any, there may be to our ongoing business and partnerships in the region,” Doug Alder, a spokesman for Chicago-based Boeing, told Bloomberg by email.

Last year, Russia was a $11.2 billion market for the US, with heavy trade in automobiles and aircrafts, according to Commerce Department data.

US automakers have a high exposure to Russian markets, so are closely watching US economic actions against Russia. Ford has sold over 1 million automobiles in Russia, and in 2013, sold 105,000 cars. GM, which has a 9 percent market share, sold 258,000. Both companies have shifted production plants from Europe to Russia, which is set to become Europe’s biggest car market by 2016.

ExxonMobil has partnered with Rosneft in exploring the Bazhenov oil field in Western Siberia, a deal that could be worth up to $500 billion. ExxonMobil is planning to build a $15 billion LNG terminal project in the Bazhenov field, and also has joint venture projects set up to explore Black Sea reserves.

Senator Chris Murphy, chairman of the Senate’s subcommittee on Europe, said the sanctions could be extended to Russia’s banks. Russia’s two largest state banks are Sberbank, Europe’s third largest, and VTB. Both banks have a strong industry presence in London, which has indicated it isn’t moving towards the sanctions. A leaked document from Downing Street shows that the UK government doesn’t plan to follow America-led asset freezes or trade restrictions, but are mulling over visa restrictions and travel bans on key Russian politicians.