Thousands of Britons unlawfully charged with bedroom tax amid bureaucratic mess

More than 16,000 people have been unlawfully charged as a result of a UK government mistake in the implementation of its bedroom tax. Meanwhile, two thirds of households affected by the controversial tax are in rent arrears, a survey has shown.

The number of people who have wrongly had their housing benefit

cut is already three times as high as the government claimed,

according to a Freedom of Information Request (FOI) submitted by

the UK Labour Party to local authorities.

Iain Duncan Smith, the Work and Pensions Secretary, said last

month that between 3,000 and 4,000 people would be affected by

the error, but the final figure could reach as many as 40,000.

Some 16,460 people have been identified as affected by the

mistake. The FOI request was made to all 346 local authorities

but so far only 140 have replied.

The error involves a loophole in the law, which means that

tenants who have lived in the same property since 1996 should not

have been forced to pay the bedroom tax – otherwise known by its

official names as the “spare room subsidy” or the

“under-occupation penalty”.

A spokeswoman for the Department of Work and Pensions, which is

responsible for the bedroom tax, earlier insisted that only a few

people would be affected.

“We expect very few people to be affected by this – around

5,000 – and we are working with councils to ensure affected

claimants are kept informed,” she said.

But Labour’s spokesman on work and pensions Chris Bryant said

that Duncan Smith was apparently picking figures out of thin air.

“With just a third of councils responding to our Freedom of

Information requests, we already know that over 16,000 people are

affected. At this rate the total will be nearly 50,000

households, each of them overcharged by an average of £640.

That’s £3,072,000 that will have to be repaid,” he said.

Overall the tax affects 660,000 housing benefit claimants who

have more bedrooms than they need, who have to pay on average

between £14 and £22 out of the rest of their benefits.

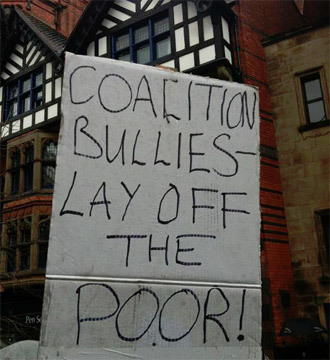

On Wednesday Labour tried to force a Commons vote to repeal the

bedroom tax saying that no claimant should be penalized for the

number of bedrooms in their home, but Conservative and Liberal

Democrat MPs voted down the bill.

One in seven households face eviction

Meanwhile, a survey by the National Housing Federation (NHF)

published Wednesday revealed that two thirds of people affected

by the bedroom tax have fallen into arrears with their rent while

one in seven families have received notices of eviction and risk

losing their homes.

The report concluded that the tax was “heaping misery and

hardship” onto families already struggling and who are

unable to find anywhere else to live because of a lack of smaller

homes in the UK.

A separate study, also published on Wednesday, by the Papworth

Trust, a disability charity, said that a third of disabled people

affected by the spare room subsidy have been refused emergency

financial help, despite official government guidance that

disabled tenants should be assisted with housing payment funding.

It called on ministers to exempt people living in specially

adapted homes for their disability from the tax.

The Labour MP who tried to bring in Wednesday’s bill to abolish

the tax, Ian Lavery, said that the tax is cruel and mean.

“I have seen with my own eyes the absolutely astounding

impact the bedroom tax has on disabled and sick people. I’m not

sure the government is aware of the hardship and misery it has

caused,” he said. Labour has promised to abolish the tax if

it wins the next general election in 2015.