The Sword of Damocles hangs over Cyprus

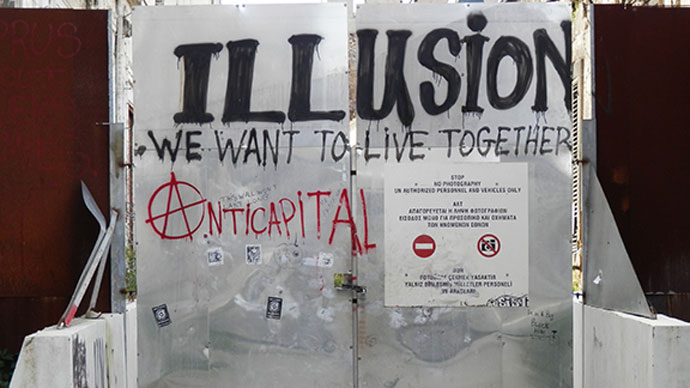

While bureaucrats and technocrats in Nicosia have been busy trying agree on an even more horrible haircut than each of the previous Troika proposals, the EU’s deadly pathogen has begun to spread to the far corners of the country.

Among others, it hit the southern seaside tourist town of

Paphos.

Cyprus managed to avoid the initial danger of an all out bank

run and the potential for mass rioting this week, which is probably

down to the fact that no Cypriot wants to see their country become

a lawless banana republic in the Mediterranean.

But that calm will not last for long if banking oligarchs continue to pressurize this economy.

Capital controls and frozen bank deposits mean thousands of

businesses are now being strangled of operating funds. It’s a very

bad scene. One successful Pathos bar owner, named Nicolas, is being

hit particularly hard, and told us that his story is the same as

every local trader he knows.

He explained, “Our credit card merchant account was with Laiki Bank and we cannot access it anymore, so we cannot take cards. People aren’t spending money. All my suppliers are demanding cash for deliveries, and we just haven’t got enough. They’ve got our cheques in the bank but we don’t have the funds to cover them. Staff need to be paid in cash daily now. My emergency funds are frozen in another bank account and cannot be accessed for 45 days. On top of that, tourism is down, and there’s no foreign money coming in anymore. We’ll be lucky if we’re still here in 4 or 6 months time.

“The only thing which might remedy the situation is if the government impose austerity cuts on government spending”.

In other words, things are likely to get much worse, as the Sword of Damocles is now hanging over the head of every Cypriot.

The story of Damocles is rather poignant in more ways than one. The Damocles fable can be applied two ways here. Everyone we spoke to here on Cyprus is aware that this sword is hanging over them, suspended by threads. That is obvious to the thousands of small to medium size businesses who are all hanging in there, and barely holding on in the face of capital controls and an acute liquidity shortage. If they didn’t have sufficient cash reserves before this crisis hit, then it’s doubtful that they will be able to weather the storm indefinitely.

The deeper aspect of Damocles here, is that before joining the

EU and opting into the euro single currency, Cyprus was a closed

economy and could more easily manage its domestic and incoming

cash. It’s currency, the Cypriot Pound, was one of the strongest in

the world. It filled a gap in the international market by offering

a secure and profitable offshore destination for capital

investment. Why worry when everyone seemed to be doing well? Then

came the Russian money, and then the housing bubble, and the euro –

which turned this small island of 800,000 into a speculative

free-for-all, where incoming cheap money corrupted nearly every

level of Cypriot society. This period of speculative gambling based

in Nicosia was transposed on top of an already existing, pre-euro

layer of backhanders and fat brown envelopes.

It was a perfect storm for our Damocles. All the while, shrewd

shylocks in New York, London, Berlin and their court administrators

in Brussels, where watching closely, and simply waiting for someone

to spring the trap. Arguably, that someone was a Dubai-backed,

high-flying Greek tycoon, Andreas Vgenopoulos, who took control of

Cyprus’s Laiki Bank and proceeded to attach the Cyprus banks to a

sinking Greek financial system.

You can blame Vgenopoulos, or Laiki management, or you can blame the money laundering, or the Troika. You can even blame the corrupt politicians, but in the end, all anyone could do in the end is stand and watch its balance sheet go up in flames. and watch it sink to the bottom. Corruption in Nicosia left the Troika mafia in control of the entire country of Cyprus. Like Damocles, some older Cypriots are now longing for their old farming lives, where living off the land was part and parcel of living here.

As is always the case these days, the elite financial wars and

ponzi schemes end in disaster for the average saver, and even worse

for the above average saver. The people are asked to pay for the

collective losses of the elite.

A local restaurant owner in Larnaca, Mr Petreu, told us a story which made my heart sink, and one which illustrates the Greek tragedy unfolding before our eyes here. His business is already being ravaged by an EU funded motorway project which is running along the beach front and will cut off most of his trade as a result. Contractors are moving at a snails pace and is expected to take two years to complete. Eurocrats and the firms profiting from the work have offered no compensation, and some suspect that this EU road works project was lobbied for in Brussels and done by design, in order to crush already struggling long-term resident businesses, in order to redevelop the area with modern multimillion dollar properties and casinos in Larnaca in a bid to attract Gulf state billions and wealthy Northern European money there. Now the banking crisis has hit as a left-hook, knockout punch.

He explains, “For 29 years, I have always paid my rent on

time, but this week I had to call my landlord to tell her to reduce

my rent or I cannot afford to pay it. So I gave her that choice –

reduce the rent or take me to court because either way, I can no

longer afford it.”

The next call could be to his daughter at university, saying he

cannot afford to help finance her higher education any

longer.

These are the stories which people like Christine Lagarde and Angela Merkel will never hear, even though they have the power to rectify the situation. If you still think they really care, then you are probably still in denial.

Agent provocateur

Now that the danger of an immediate run on the banks has subsided, former President Demetris Christofias has become one such focus of the people’s anger.

Lucious Petrou, a retired local farmer says, ”Imagine the

timing of Christofias resigning only five weeks ago, and then our

banks closing their doors three weeks later?”

“Our Communist President came into power with a 1 billion euro surplus and left with what will be a 17.5 billion euro debt to the international bankers. Where is he now?”

Most residents are confident that Christofias will be dragged into the dock during the upcoming judicial inquiry into the banking collapse.

Of course, that’s the big question on everyone’s minds: why Cyprus? Why now? Social Democrat and avowed communist Demetris Christofias came to power in 2008 through a coalition government, after campaigning on the populist platform of the “reunification of Cyprus”, bringing the Greek and Turkish sides together in a bi-zonal federal state. The people liked the idea, but instead they got an economic meltdown.

Other shadowy players in this story mentioned in the cafes of

Nicosia include the USA, who with the help of Henry Kissinger, were

the architects of the Turkish invasion in 1974 and masters of the

IMF today. Like the British, the US also have a military presence

on the island to go with their 300 plus other bases and

installations scattered throughout Turkey. Many Cypriots believe

that the US have been using their multi-lateral institutions like

the IMF to kick Russian influence – and money out of Cyprus, and

thus, out of Europe. There are an estimated 50,000 Russians living

in Cyprus, concentrated around the city of Limassol, along with

many off-shore corporations, and hundreds of thousands more coming

to visit year-round. If the US, or the EU wanted to lean on Russia

– particularly in Syria, then this would be the first place to

start.

We also discovered that there are an estimated 20,000 plus Chinese who have established a burgeoning European beachhead in and around Pathos, and one would expect that there were at least a few hundred Chinese millionaires, or billionaires, who took a sizable haircut too this week – but you won’t find that one in the mainstream media.

One other name kept coming up again, and again, as we combed the

back streets of the old town in Nicosia. His name is Andreas

Vgenopoulos, the Greek tycoon and chairman of the controversial

Marfin Investment Group, and the man who inflated the now failed

Laiki Bank’s financial balloon – which was doomed to pop three

weeks ago, taking the whole of the Cyprus economy down with

it.

The story behind his inflated success and failure is a bizarre

Ménage à trois between Dubai, Athens and Nicosia. It appears that

Mr Vgenopoulos steered a massive ponzi scheme which attracted the

usual suspect crowd of high-flying financiers, naive and corrupt

politicians and overpaid government bureaucrats, who flocked to his

over-cooked honey pot of accessible capital backed by the same junk

bonds and overvalued paper which brought down Cyprus’s EU neighbor

Greece only 2 years earlier. By the time Cypriots knew what was

going on, the bottom had already fallen out of their balance sheet

– forcing Nicosia to go cap in hand to the ECB, and later to the

IMF.

Vgenopoulos, it seems, was the Troika’s agent provocateur in this story – he lit the match, left the building with all the loot and watch it burn from across the sea.

Last but not least, people seemed very suspect, and somewhat offended, by the Germans, who magically opened-up their bond market, promoting investment into everything from solar energy to “secure investment” – at the very same time the Cyprus economy was flushed down the Euro- toilet by the Troika.

What’s worse, however, is that the elite Troika (Brussels, Berlin and the IMF) had known about this contagion and also that Cyprus would collapse well in advance of this month’s bank holiday – but they just stood back and watched as the moussaka to hit the fan, to swoop in with more crisis loans which has ultimately given them complete financial control over the economic destiny of the island. It’s like the heroin dealer trying to help a recovering addict by giving them a kilo of smack. What will happen if the European and Cyprus banks re-hypothecate all this new debt-based issued money from the Troika? And what about the bankers’ using these latest loans to parlay a piece of Cyprus’s untapped gas and oil reserves? We’ll find out in a year, until then, it’s watch and wait.

Even worse, imagine the heroin dealer, after giving the recovering addict a final kilo smack, proceeds to steal the addict’s furniture, sell-off his house and cut the wages and pensions of everyone living in the house.

One winner so far, is the private security company G4S, who have been contracted to provide extra guards throughout Cyprus in case the people lose their patience with the government and their Troika masters in Europe. It’s been a relatively easy gig for them so far in Cyprus. If it happened anywhere else, there would have been riots in the streets. If the Troika tries to steal depositor’s money in Spain, G4S probably won’t cut it, and the Spanish government would probably give the security contract to someone like Blackwater - as was done already in Greece.

When the dust settles, it doesn’t take a genius to figure out

that every Cypriot will know who robbed them, and how it was done.

Now, in their deceptive laid back fashion it seems, the people are

deciding how best to even the score.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.