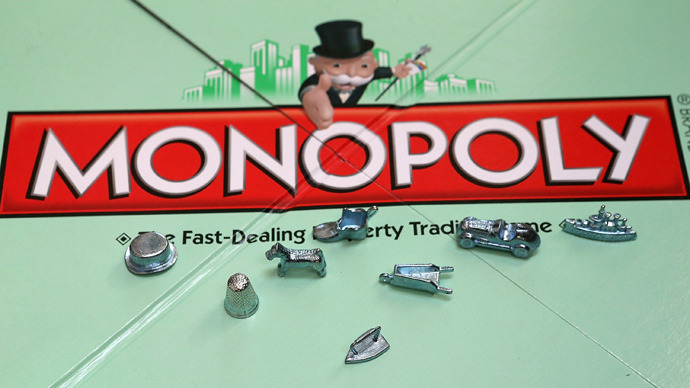

In global Monopoly game there can be only one winner

The unconventional monetary policies of global central banks makes the current economy resemble the game of Monopoly, but the players must remember that in this board game there can be only one winner, with all the rest going bankrupt.

In the game of Monopoly, when you pass ‘Go’ you collect $200.

This keeps the game going by adding liquidity into the system. The

bank in the game is increasing the money supply and this keeps

people rolling the dice; buying up property and paying taxes.

Eventually, due to the luck of the dice, the player who is able to

land on the most expensive properties on the board ends up being

able to extract crippling amounts of rent from the other players

until everyone goes bust except for the lone Monopolist who is

declared the winner. Notice that in the Monopoly economy nobody

works. The only activities are rolling dice and shopping for real

estate, houses, and hotels.

In today’s global game of Monopoly we have Quantitative Easing to

replace the free money give away that occurs when players pass

‘Go.’ But instead of the token $200, players (those who work in the

FIRE economy of Finance, Insurance and Real Estate) get $85 billion

a month from the Federal Reserve Bank in America and similar gifts

of cash from the central banks in Japan, Britain, and most of the

G20.

The asset prices of the houses and hotels keep going up as the free

money given away by the bank: whether in the game of Monopoly or

the game of the Fed is pumped into the economy. Again, nobody who

has wealth in these economies works for a living. They speculate by

rolling the dice and buying up assets knowing that the infusion of

cash will guarantee asset price inflation.

If you play Monopoly you know that eventually the player who chanced on the opportunity to buy the most expensive real estate on the board eventually wins as the rent-seeking that comes with that real estate bankrupts the rest of the players who keep collecting their free $200 each time they pass ‘Go,’ money that works its way to the Monopolist with the most powerful monopoly.

Similarly in the global economy we have a situation where none of the sizeable wealth of the players was garnered through work. A list of the wealthiest in the world shows virtually all the players having gained their riches by engaging in monopoly rent-seeking through real estate speculation, gaming the banking system, manipulating stock prices, exploiting an extremely pernicious copyright monopoly or promoting and financing war: a particular monopoly of the state.

We are headed to a similar ending. With most of the world’s population already bankrupt and over half of Americans now officially straddling the poverty line we see the wealth being gobbled up the lucky dice throwers sitting on the most exploitive rent-seeking properties.

Just like in the game of Monopoly, there will be only 1 (or a handful) of winners at the end of the game but unlike the game, it won’t be so easy to start a new one. You don’t expect a full scale riot of a revolution staged from the losers of your average Monopoly game at home but typically this is what happens when a few at the top bankrupt the 99% at the bottom if we use history as a guide.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.