'A lot of talk about inequality in Davos, but very little action'

There's not much to be expected from Davos in solving the issue of inequality, while studies show that the rich and powerful use their money to dominate political processes all over the world, Max Lawson, head of advocacy at Oxfam GB, told RT.

On January 20 a report entitled “Working for the Few” was released by Oxfam, an international organization searching for solutions against poverty and injustice. According to this report the world’s 85 wealthiest people have as much money as the 3.5 billion poorest people on the planet – half the Earth’s population. This signifies an extreme economic inequality, which is a serious and warring trend.

Max Lawson doesn’t think we should expect any moves to be made in Davos about it.

“We think there will be a lot of talk about inequality in Davos but very little action. We don’t expect them to do much at all,” Lawson told RT.

What the report has also concluded is that big money often opens political doors for the rich.

“Often those powerful rich people use that money to capture the political process. Our paper has case studies of that happening in countries all over the world, whether it’s Pakistan, whether it’s Tanzania. You see politicians buying politics,” Lawson says.

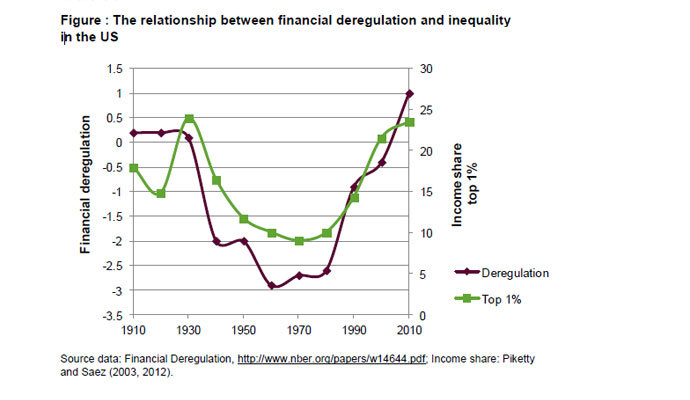

“The paper shows that it’s definitely a case in the rich OECD countries that politics is being increasingly influenced by rich people. We use the example of the financial deregulation and very low tax rates, where you can see these furious lobbies of the politicians by the richest people in the United States, in Europe, to push for lower taxes, which in turn increases greater inequality because if rich people are not paying tax, then it means inequality goes up,” Lawson added.

‘Tax avoidance is human rights abuse’

Lawson speaks about billionaires like Warren Buffett and Bill Gates who agreed to give away their fortunes as an example of people who are really doing an amazing job to fight global poverty. One of the main tactics, he says, should be support for progressive taxation and fighting tax dodging.

“Warren Buffett has spoken out on this issue of tax dodging and on the fact that rich people pay very low tax rates. I think some of the billionaires in Davos are definitely saying the right thing. We need to see a lot more of them agreeing to a lot more tax so that we are not having a situation that we’ve got. People have more money that they can spend in ten thousand life times, when you are have a billion people living on less than a dollar a day,” Lawson told RT.

There is a lot that can be done on the international level to tackle the issue of the growing inequality, particularly around the issue of tax, tax havens and tax avoidance, Lawson believes.

“So you are seeing hundreds of billions of dollars being hidden away in tax havens. This is money that is owned by the richest corporations, the richest people, and that should be taxed. If it was taxed fairly then that money would be spent on health, on education, on decent jobs for ordinary people. So if we saw a crackdown on tax evasion that would make a major difference to inequality.”

According to Lawson, tax dodging is not just a problem in Western countries, it’s a huge problem in Africa. Many of the mining companies, the big investors in Africa, make enormous use of tax havens, he says.

“Africa loses something like $60 billion a year in lost taxes. It’s a major problem for the poorest countries, so it’s not just about Starbucks or Google and Apple, which is important too, but it’s also about all these mining companies, companies operating in Africa that are all avoiding taxes. And every dollar in tax they avoid, that’s a dollar that could be helping put a child in school, could be building a clinic, or hospital or paying for a nurse. We think this tax avoidance is human rights abuse and it needs to stop,” Lawson concluded.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.