If you think the world of banking will become utterly transparent – that’s false

Under pressure from Western governments, Switzerland has revoked some of its outdated banking secrecy laws, but it won't make the world of banking utterly transparent, Patrick Young, Executive Director of DV Advisors, told RT.

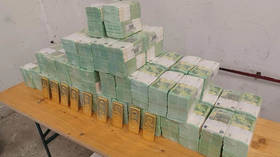

We spoke to Patrick Young after Switzerland, the world’s largest

offshore wealth center, worth an estimated $2.2 trillion in

assets, on Wednesday signed an agreement to share financial

information with nearly 60 countries.

RT:How would you assess this step? Will it have any

impact on tax evaders?

Patrick Young: It's a very interesting move from a general sense

of natural justice; it seems entirely logical. Why should certain

people be allowed to open bank accounts in somewhere like

Switzerland, avoid paying any tax on the money, take it out of

the country in which they were earned it and so on?

RT:Therefore there's a strong logic in that sense. At

the same time we have to have an eye on history, why do the Swiss

have such strong privacy laws and private banking laws?

PY: Actually, they were developed in 1944 as a reaction to

the Nazis in Germany. They were in attempt to try and help

fleeing refugees stop having their money being confiscated by

Adolf Hitler.

Of course at the same in the modern era people are very

concerned. Governments dosn't have enough money to function, it's

becoming increasingly difficult to raise more money whether you

are in the US or Western Europe. And therefore there's been this

big move toward some degree of transparency and forcing

Switzerland to open up.

And frankly large Swiss banks had this coming to them. You had

people like UBS and CreditSwiss opening massive branches in US

cities such as New York.

In the middle of Manhattan there was a complete city block

effectively devoted to UBS's private banking division. It was

ludicrous to think that in some shape or form the IRS, the

American tax authority, wasn't going to get interested in what

was going on in that particular building. There were of course

scandals, people smuggling in, rather James Bond-style, diamonds

in toothpaste tubes that were brought in by private bankers from

Switzerland to the US.

RT: How does Switzerland stand to benefit from this?

Could it lose investors?

PY: Switzerland essentially stands to lose a great deal,

because of course it has massive banking operations. The banking

industry in Switzerland is way larger – way, way larger than even

the size of the banking industry in London, the major financial

capital of Europe. Therefore there could be obviously massive

amounts of funds that would suddenly disappear from all of the

cantons and Geneva, and that would obviously harm the Swiss

economy.

RT:Financial hubs such as Luxemburg and Singapore

joined the convention on international sharing of bank data in

May. Has anything changed for them since then?

PY: I think there is a big difference with a hub such as

Singapore – they were significantly sized to begin with, they did

not have the same critical cash mass as Switzerland had,

therefore their banking business has not been hugely harmed.

It's important to understand that if you look at the world of

banking per se, what's happened now is that the names of private

bank accounts will be shared. If I should happen to be so lucky

and have a private Swiss bank account, that information could not

be transmitted to tax authorities around the world. However,

corporate bank accounts will still be subject to a large degree

of secrecy, because they have bearer shareholders, because they

have some form of a trust structure involved. So the idea that

suddenly the lights will go on in the world of banking and

everything will become utterly transparent is false.

RT:Could this improve the situation in the eurozone in

terms of governments recovering lost tax?

PY: The situation in the Eurozone, much like in the USA,

is that the government is actually alcoholic – it drinks too much

vodka, it wants ever more vodka and no matter what happens it

seems to consume endless amounts of vodka. In other words, it's

the government spending. Governments are spending too much

throughout Western Europe and in the US they simply cannot afford

to go on with that sort of spending.

Therefore we have this ludicrous nirvana approach, with the

belief that ending the anonymous private banking in Switzerland

is suddenly going to see us have a huge wall of money appear to

pay for the government. The truth is that even if all of that

money is repatriated, it would not be enough to save the

governments from having to go through more austerity and cutting

back their spending.

The overall reality is that no matter what you do in these

circumstances money would tend to leave the countries that tax it

too highly. And therefore Western Europe has a huge crisis,

because it would be much easier for us all to go and live in

Moscow and pay only the 13 per cent flat rate tax, compared to

the swinging rates that are being charged in Western Europe at

the moment.

In that sense, there’s clearly an issue here that simply evolving

the banking system as we have done removes certain wrinkles, but

will it cure the ongoing eurozone problem? Of course not. The

eurozone needs to cure it itself, not look for outside panacea.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.