$3.8bn in UK aid for developing states 'routed through tax havens'

Over two-thirds of investments by the private-sector wing of the UK's foreign aid program were funneled through tax havens in 2013, a report reveals. Since 2000, the UK government routed in excess of $3.8bn worth of aid through such jurisdictions.

The study, “Going Offshore: How development finance institutions support companies using the world’s most secretive financial centers,” was conducted by the European Network on Debt and Development (Eurodad).

The network is comprised of 48 NGOs from 18 different EU states that campaign on development, tax justice, and other financial issues.

The research reveals how billions of euros, supposedly intended for projects in developing states, are being channeled through tax havens that are “shrouded in secrecy.”

The research specifically examines financial support offered to private sector firms by Europe’s most prolific Development Finance Institutions and the World Bank’s lending division – the International Finance Corporation (IFC).

Eurodad argues Britain’s CDC, previously known as the Commonwealth Development Corporation, makes regular use of such opaque offshore jurisdictions. The CDC is wholly owned and controlled by Britain’s Department for International Development (DfID).

In 2013, the CDC invested in nine separate funds, six of which deployed offshore tax havens in Mauritius, Singapore, Guernsey and Luxembourg. The six funds received a total of $553 million (£441 million).

“CDC’s portfolio as of 31 December 2013 shows that both its direct and its indirect investment model rely heavily on secrecy jurisdictions,” the Eurodad report says.

“A massive 118 out of a total of 157 fund investments go through secrecy jurisdictions. Between 2000 and 2013, these funds received a total of $3.8bn in CDC commitments.”

Financing for whose development? How official Development Finance Institutions support tax havens http://t.co/5Mmm8tuiDj via @fp2p

— Eurodad (@eurodad) November 4, 2014

Sixty-nine of the funds in question are registered in Mauritius, and 26 are registered in the notoriously secretive Cayman Islands.

The CDC is allegedly designed to engage in “pioneering” investment models constructed to supposedly benefit developing nations. The sum of its investments are counted as official aid, and contribute towards the meeting of UK commitments to allocate 0.7 percent of gross national income as international aid.

While virtually all of CDC’s cash is channeled through investment funds, which subsequently invest in business in developing countries, these investment funds are embroiled in aggressive tax avoidance strategies.

The report’s author, Mathieu Vervynckt, a policy analyst at Eurodad, warns that developing states lose “hundreds of billions of euros” annually through firms’ tax avoidance and evasion strategies.

Vervynckt argues that Development Finance Institutions (DFIs), supposedly created to “promote development and end poverty,” are in fact financially supporting and legitimizing the very offshore industry that sustains such tax dodging.

By routing funds through “secretive financial centers” that directly result in the loss of billions each year for developing countries, the Eurodad Policy analyst suggests bilateral and multilateral DFIs are not acting in the interest of these states.

New @eurodad report: Billions for projects in developing countries routed through #taxhavens by #DFIs. http://t.co/RPn3AolspK via @guardian

— Eurodad (@eurodad) November 4, 2014

The study calls for DFIs in Britain and Europe to improve their transparency by investing only in firms that are prepared to “publicly disclose beneficial ownership information and report back to the DFI their financial accounts on a country-by-country basis.”

Eurodad suggests related investment funds should be registered in the state of operation, and take full accountability not just for their own activity but that of their clients.

The debt justice and ethical finance network is also calling for a specially designed cross-border tax body to be founded by the UN to offer developing states equal leverage in the international reform of current tax regulations.

On the question of the UK government’s management of the CDC’s investment funds, a spokesperson for the body said: “CDC investments are helping create the jobs and growth needed to lift people out of poverty. Businesses we support employ over one million people in developing countries and last year paid over £2.3bn in local taxes.”

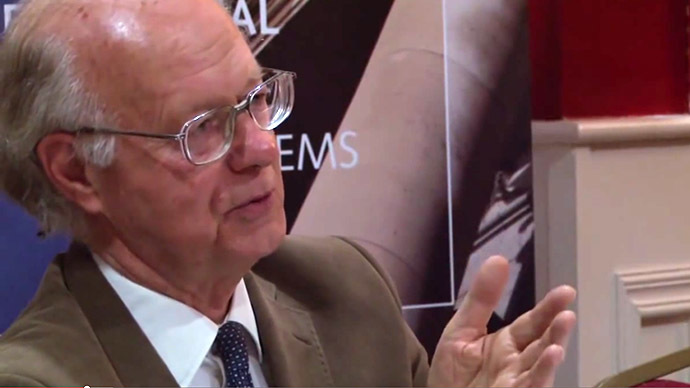

But Lawrence Cockroft, a UK development economist and co-founder of anti-corruption think tank Transparency International, warns secrecy jurisdictions are a haven for illicit capital flows, originating in multiple forms of corruption. Cockroft estimated in 2012 such covert financial flows amount to $1 trillion a year.

In his book, “Global Corruption: Money Power and Ethics in the Modern World”, Cockcroft warns corruption plays a key role in compounding global poverty and inequality, and is often directly responsible for creating “failed states.”