AIG shareholders sue government claiming their $182 bn bailout wasn’t favorable enough

Maurice Greenberg, former head of the American International Group (AIG), recruited prominent Wall Street players to contribute several million dollars to a lawsuit that alleges the US government bailout of AIG in 2008 was unfair to company shareholders.

Greenberg, who still owns a large stake in AIG, filed the suit on behalf of his fellow shareholders. They will argue when the trial begins in Washington next week that though AIG needed the $182 billion rescue to avoid bankruptcy amid an unprecedented financial crisis, the government’s actions were unduly harsh.

Three prominent investors agreed to finance around 15 percent of the case’s legal costs, which have reached tens of millions of dollars, sources told The New York Times. The investors are entitled to a cut of any damages Greenberg and shareholders collect from the US.

In a new chapter for so-called litigation financing - a burgeoning cause for hedge funds and specialty firms - Greenberg reportedly targeted investors that have a beef with the government. Kenneth Langone, former director of the New York Stock Exchange, and Christopher Flowers, a private equity executive, are two of the three investors. The third’s identity was not available, the Times reported.

Greenberg also pitched the idea to hedge-fund figure Steven A. Cohen and Peter G. Peterson, founder of private equity firm the Blackstone Group, the Times said.

The lawsuit, which seeks more than $40 billion from the US government, challenges the manner in which AIG was rescued. In a unique move among other Wall Street bailouts, the government took an eventual 92 percent stake in AIG, diluting the value of the company, shareholders argue; attached a steep 14-percent interest rate on rescue funds; and allowed AIG’s trading partners to make off with billions of dollars. AIG shareholders argue that the moves violated their Fifth Amendment rights, in that their private property was taken for “public use, without just compensation.”

Greenberg, who resigned as AIG chief in 2005 amid accounting investigations, also says the Federal Reserve lacked legal authority to take a stake in insurer.

After the dismissal of an earlier suit against the government that was filed in Manhattan, Greenberg’s legal team now believes arguing the case in front of a friendlier United States Court of Federal Claims in Washington will boost claims that AIG was subject to the most punitive of bailouts.

The government - after saving Wall Street, including AIG, with generous taxpayer-funded support - argues that AIG had one other choice in the matter: to go bankrupt. Government officials also warn that a positive verdict for Greenberg’s team could set a precedent wherein Wall Street firms are legally encouraged to set the terms of their own bailout.

The government, which collected a $22.7 billion profit on the AIG bailout, says Greenberg and company benefited from the AIG-bailout terms in the long run, and that “the common shareholders’ 20.1 percent equity stake in AIG. after the rescue was worth more than their 100 percent equity stake before the rescue.”

“Neither the Constitution nor the Federal Reserve Act required American taxpayers to rescue AIG and cushion the fall of its shareholders, much less to do so on terms even more favorable to Starr,” the government said in court filings, referring to Starr International, a company owned by Greenberg that was the largest AIG investor at the time of the bailout.

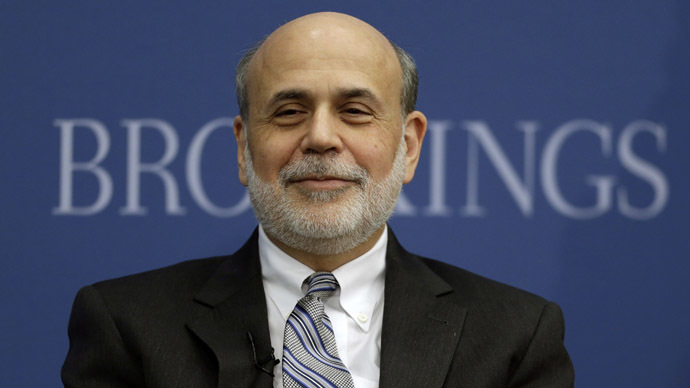

Former Federal Reserve Chairman Ben Bernanke and former US Treasury Department Secretary Timothy Geithner are expected to offer crucial testimony in the trial.

For its part, AIG, now on solid financial footing, does not support the lawsuit, as it dredges up the excessive risks taken by Wall Street that triggered a painful economic recession that lingers on today.