Colorado lawmakers approve regulation and tax bills for legal marijuana

The Colorado state legislature passed two historic bills this week that could officially regulate the sale of marijuana.

If signed by the governor, these bills will take major steps toward completing the legalization process within Colorado. In November, voters there passed an amendment to the state constitution that essentially legalized the personal use of marijuana, making it one of the first states in the nation to do so.

"The adoption of these bills is a truly historic milestone and brings Colorado one step closer to establishing the world's first legal, regulated and taxed marijuana market for adults," Mason Tvert, director of communications for the Marijuana Policy Project, told Huffington Post.

One measure, the House Bill 1317, proposes the regulatory framework for legal marijuana. This would provide the first retail sales licenses to private dispensaries that have so far distributed marijuana for medical reasons. It would also set a marijuana blood content driving limit, allowing drivers to be stoned with no more than 5 nanograms of active THC per milliliter of blood. HB-1317 also requires stores to keep the drug behind the counter,and bans cities from operating pot shops that operate tax-free or against the new regulatory laws.

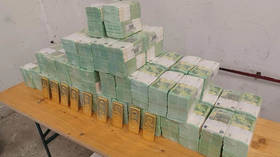

The other measure, House Bill 1318, establishes a tax on the commercial sale of marijuana for recreational use. The legislation would impose a 15 percent excise tax and a 10 percent statewide sales tax on retail marijuana purchases – a high rate that some Coloradoans have starkly opposed, but which nevertheless takes a major step in the implementation of legalization.

Both bills have passed the State House and Senate, and will now land on Gov. John Hickenlooper’s desk for approval. But before HB-1318 is signed into law, Coloradoans will need to vote on the tax increases.

If voters reject the hefty excise and sales taxes, the state will likely be stuck with the regulatory framework for marijuana sales but not the funds to pay for it.

Some lawmakers have expressed concern that the 25 percent tax rate could turn some marijuana proponents against the measure, but Amendment 64 mandates that the first $40 million raised from the excise tax would go to the state’s construction of schools. In a recent survey, Public Policy Polling found that 77 percent of Colorado voters who support marijuana legalization also support the tax, while only 18 percent oppose it.

If Hickenlooper signs the tax bill, it will be subject to a ballot referendum and voted upon later this year.

Under Colorado’s marijuana law, Amendment 64, people over the age of 21 are legally allowed to possess up to one ounce of marijuana and cultivate up to six plants.

Lawmakers passed the two comprehensive marijuana bills on Wednesday – the final day of the legislative session — thereby making Colorado the first US state to take such extensive steps toward implementing the legal sale, regulation and tax of marijuana for recreational use.

"Facilitating the shift from failed policy of prohibition to a more sensible system of regulation has been a huge undertaking and we applaud the many task force members, legislators, and others who have helped effect this change,” Tvert said. “We are confident that this legislation will allow state and local officials to implement a comprehensive, robust and sufficiently funded regulatory system that will effectively control marijuana in Colorado."