SEC brings charges as first-ever Bitcoin Ponzi scheme unravels

Bitcoin, the virtual currency that has been gaining momentum in recent years, now seems to have reached the dubious milestone of its first Ponzi scheme, following charges filed by the US Securities and Exchange Commission in Texas.

On Tuesday the SEC announced it was charging Trendon Shavers of

McKinney, Texas for allegedly defrauding investors he had lured

into the Bitcoin market with promises of up to 7% interest per

week.

Shavers was able to raise over 700,000 bitcoins in the period

between September 2011 and September 2012, a sum worth some $4.6

million based on the digital currency’s value at the time.

According to the SEC complaint, Shavers was actually using funds

from new investors to pay out promised returns to those already

lured into what became a classic Ponzi scheme.

SEC spokesman Andrew Calamari said the charges mark the first

time the US agency has handled a case that involves Bitcoin.

"Fraudsters are not beyond the

reach of the SEC just because they use Bitcoin or another virtual

currency to mislead investors and violate the federal securities

laws," Calamari, director of the SEC's New York office,

said in a statement.

“Shavers preyed on investors in

an online forum by claiming his investments carried no risk and

huge profits for them while his true intentions were rooted in

nothing more than personal greed,” he added.

In addition to failing to invest funds as promised, Shavers is

also accused of retaining $147,000 worth of Bitcoin to cover his

own personal expenses, which included rent, food and gambling.

The agency said in its complaint that Shavers, using the online

name 'pirateat40,' began advertising his Bitcoin Savings and

Trust via online forums in 2011.

The biggest irony of the unprecedented case is that had investors simply bought Bitcoin directly during the same period as the Ponzi scheme they would have seen significant returns.

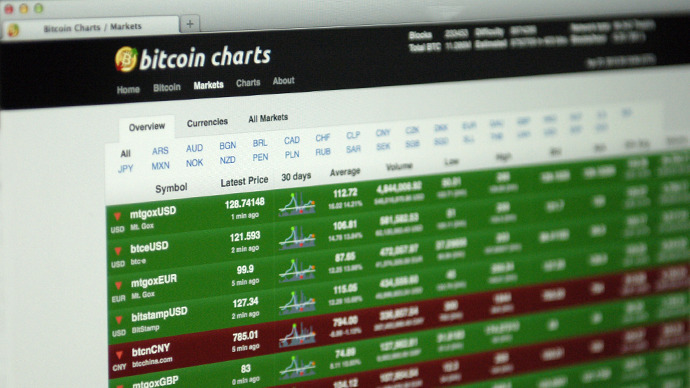

As CNNMoney points out, one bitcoin was valued at about $6.56 on

average between September 2011 and September 2012, and the value

has since then skyrocketed to $95.30 each as of Tuesday. Today,

the value of the 700,000 bitcoins Shavers is alleged to have

swindled exceeds $60 million, according to the SEC.

In announcing the Ponzi allegations the SEC also took the

opportunity to remind the public that all securities investments

within the US fall under its jurisdiction, regardless of whether

these are made using US dollars or virtual currency.

Along with a public announcement of the SEC’s charges against

Shavers, the agency also issued an investor alert, warning that

investors should "be wary of so-called investment

opportunities that promise high rates of return with little or no

risk, especially when dealing with unregistered, Internet-based

investments sold by unlicensed promoters.”

Bitcoin, the anonymous online currency launched by computer

programmers in 2009, owes most of its popularity to investors’

distrust of traditional or fiat money in light of high-profile

financial crises, such as the massive financial bailout of Cyprus

following its government’s raid on bank deposits in excess of

100,000 euro.

Along with alternative investment options, such as gold, Bitcoin

has emerged as another option for those distrustful of

government-issued currencies and securities.

The online currency’s anonymity has also garnered it a faithful

following from online consumers that are wary of creating

easily-traced paper trails for their currencies, giving Bitcoin

something of a reputation as the currency of choice for

underground transactions.

In June the US Drug Enforcement Administration (DEA) raided a

user of the “deep web”

Silk Road online market, which can be accessed only through the

anonymous Tor network. According to the DEA, a user named Eric

Daniels Hughes, aka Casey Jones, was charged with intent to

distribute drugs purchased from Silk Road using Bitcoin, which is

often the only currency accepted for transactions on the deep

web.

Also in June, Bitcoin’s largest currency exchange, Mt. Gox, was

forced to halt withdrawals in US dollars after federal agents

seized its account with Wells Fargo in May. The loss of relations

with payment processors meant that only wire transfers were

available to transfer US dollars into and out of the exchange,

which meant a steep increase in fees.

Since then, Mt Gox has opted to register as a money services

business with the US Treasury Department, which means that the

exchange handling over 60% of all Bitcoin trading volume

worldwide must now follow stricter accounting procedures and log

transactions in excess of $10,000.